Cryptocurrencies Price Prediction: Bitcoin, Ethereum & Stellar – American Wrap 18 January

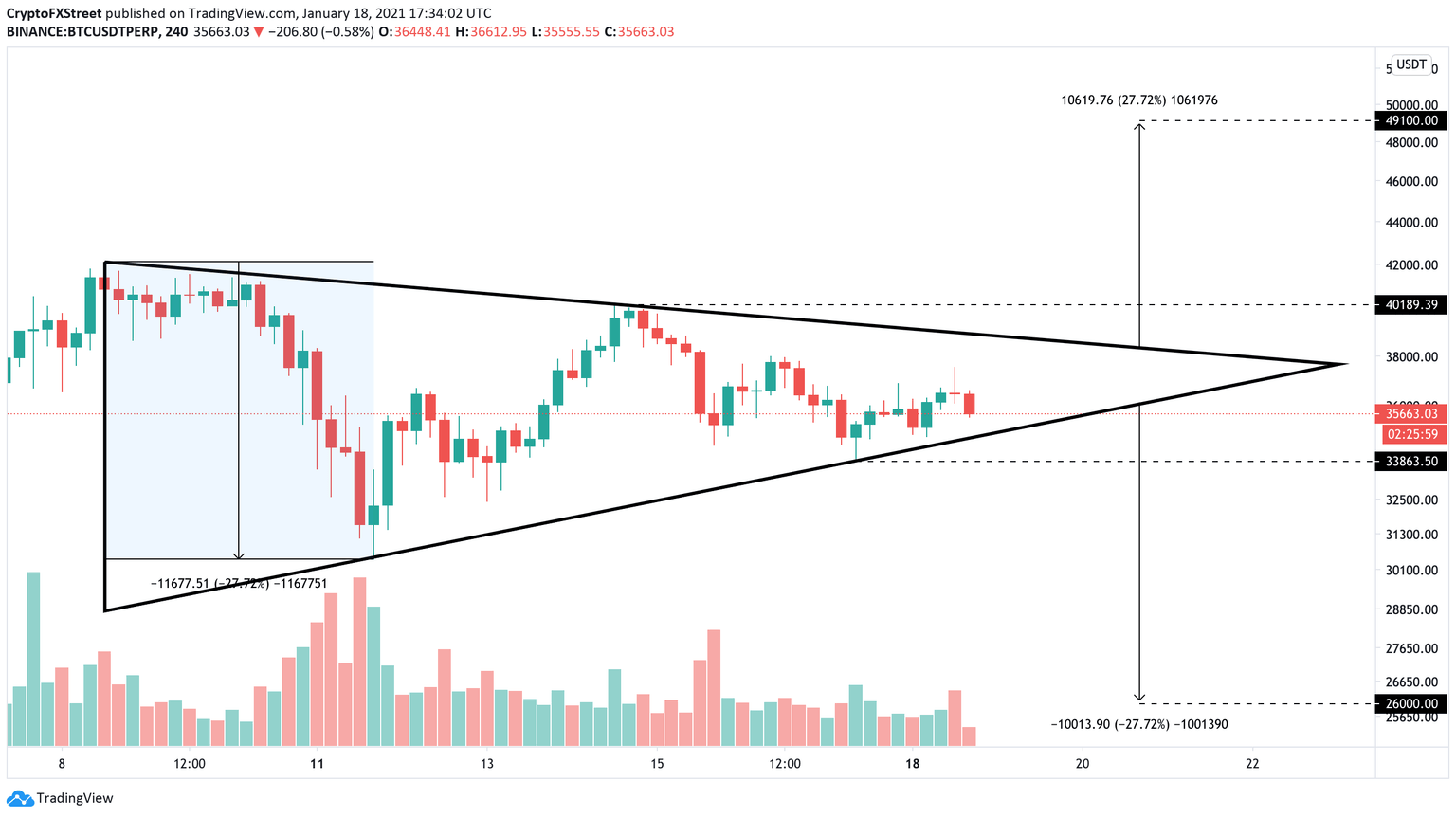

Bitcoin price shows ambiguity as a 30% move is underway according to technicals

Bitcoin has been trading inside a tight range after establishing a new all-time high at $41,950. The digital asset plummeted down to $30,420 and then formed a lower high at $40,100 followed by what seems to be a higher low at $33,850.

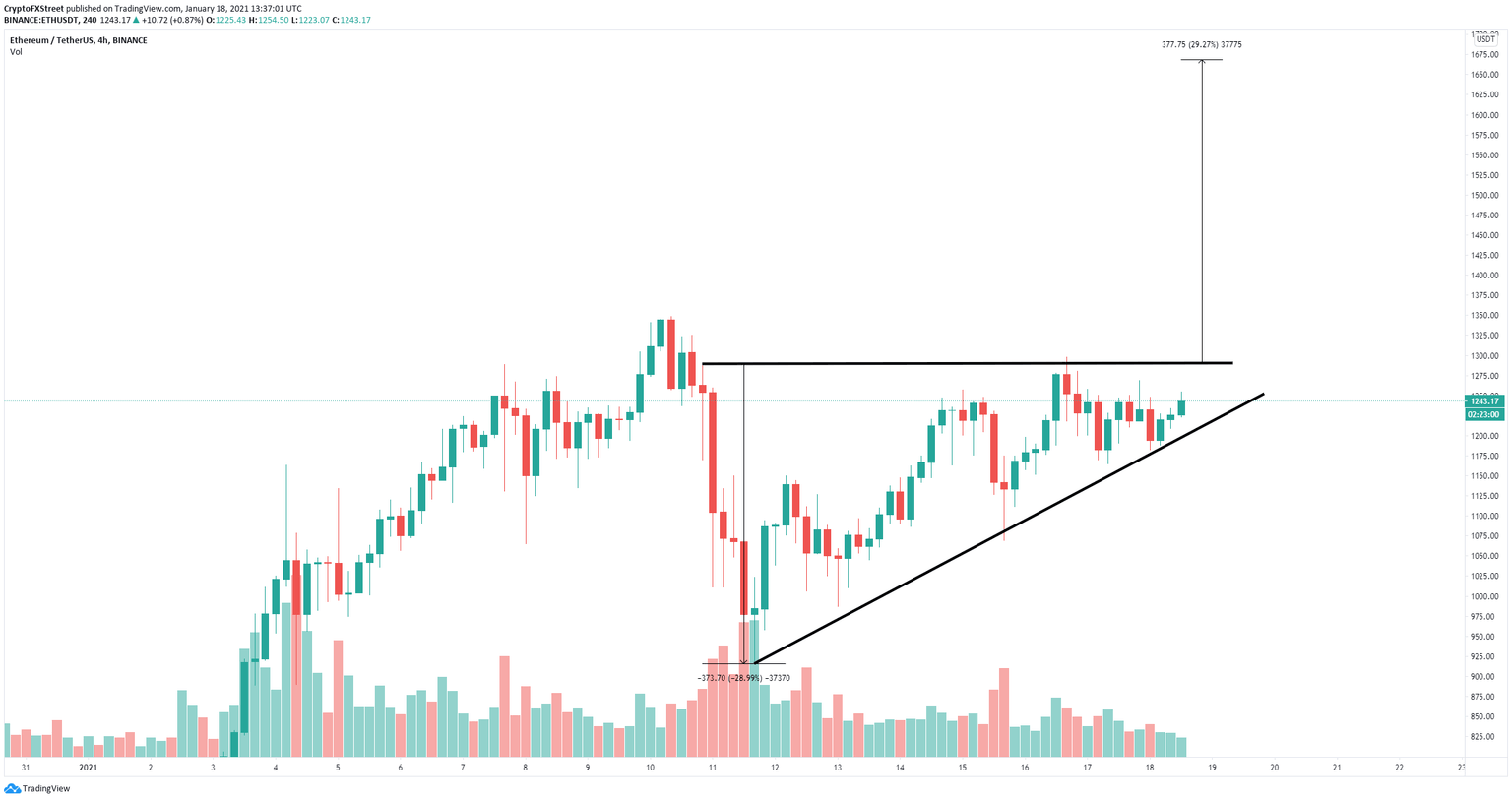

Ethereum price looks ready for lift-off, targeting new all-time high of $1,700

Ethereum outperformed Bitcoin this past weekend and remains trading above $1,200. The digital asset seems to be contained inside an ascending triangle pattern on the 4-hour chart and could see a breakout in the near term.

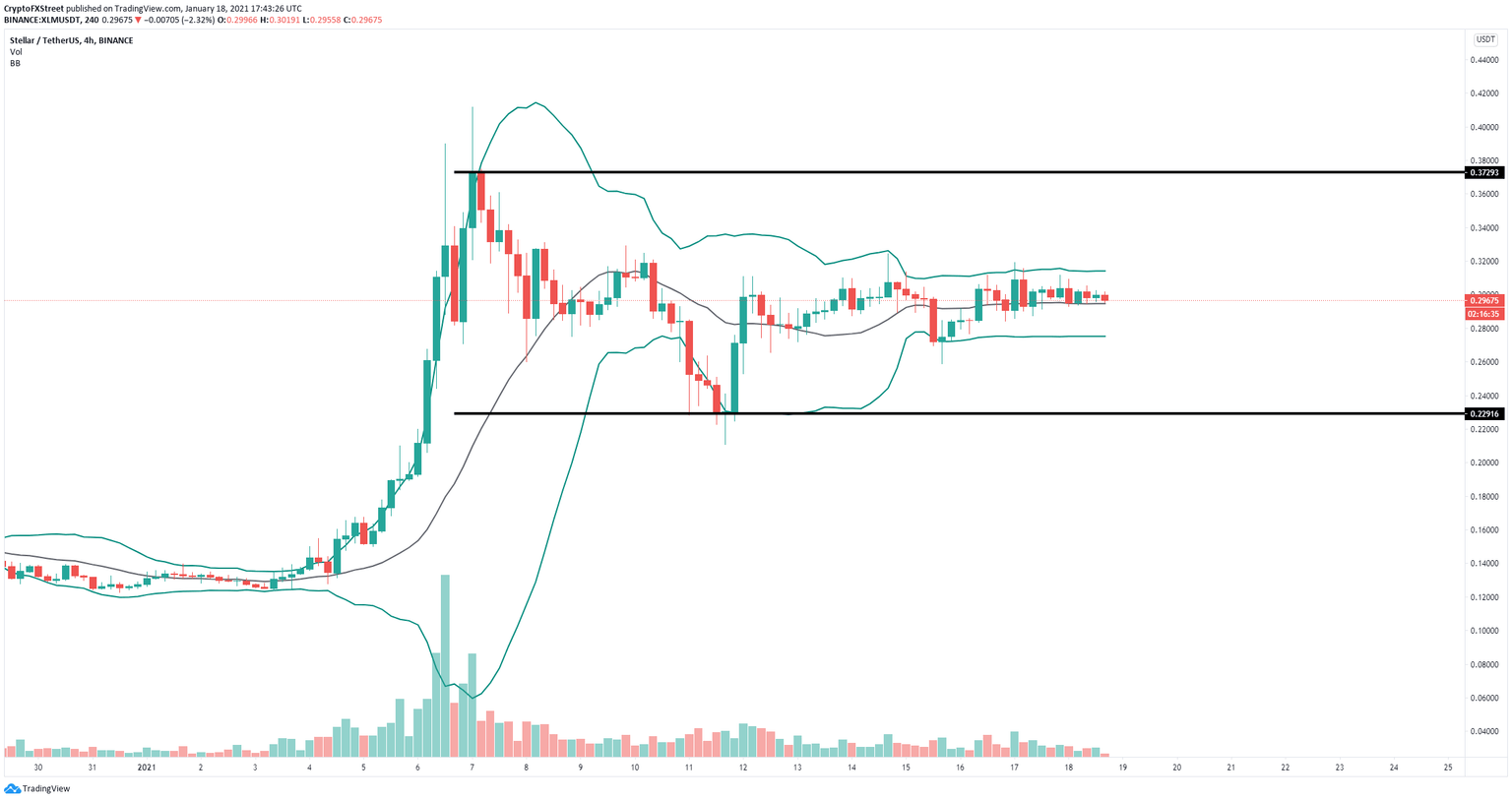

XLM Price Prediction: Stellar awaits a massive breakout but remains inside a no-trade zone

XLM has continued to trade sideways since we last reported about it. The digital asset remains locked inside a tightening range which will eventually burst. Let’s analyze some of the most important indicators to understand the most likely scenario.

Author

FXStreet Team

FXStreet