Ethereum price looks ready for lift-off, targeting new all-time high of $1,700

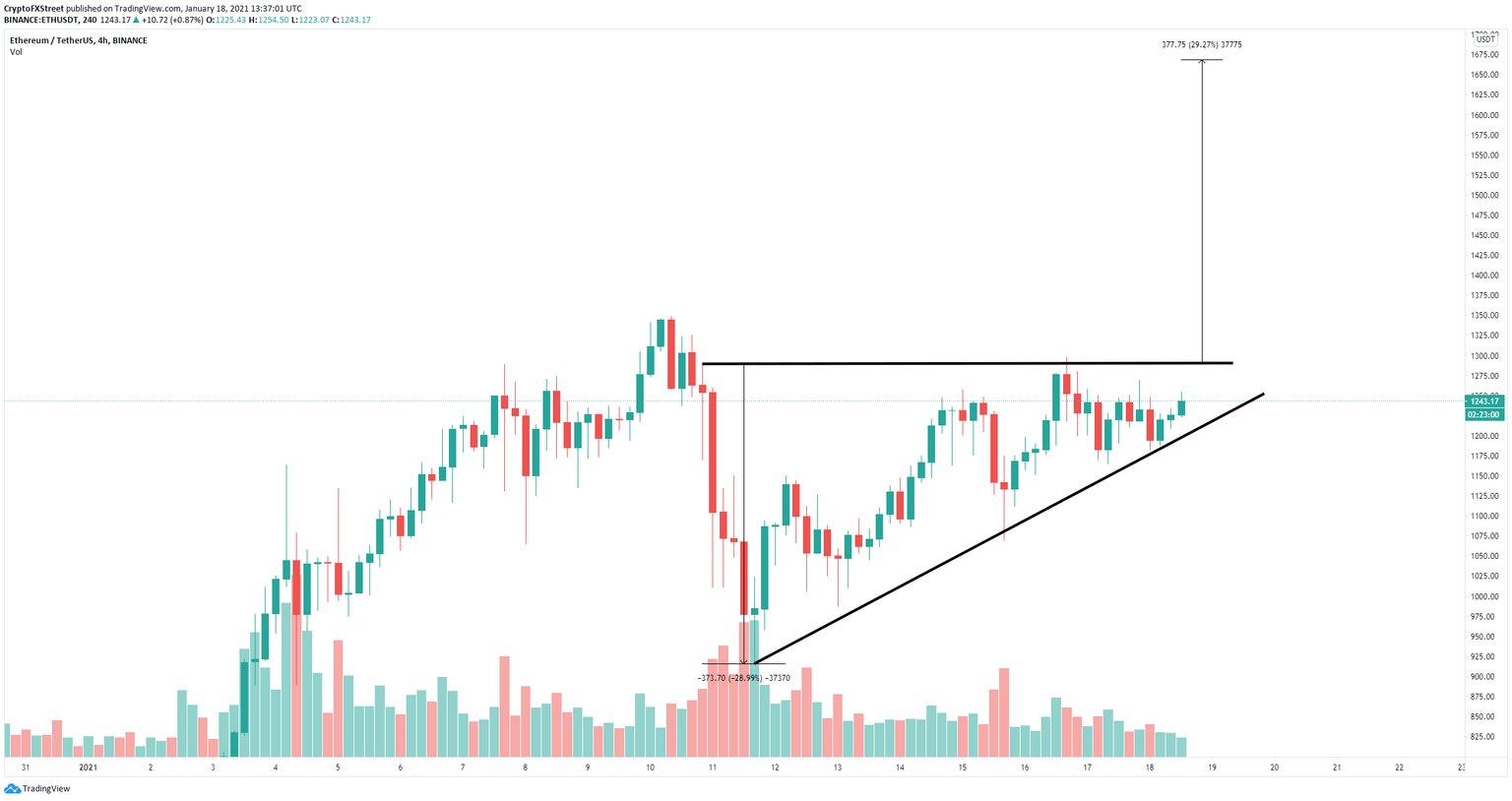

- Ethereum price seems to be contained inside an ascending triangle pattern.

- A clear breakout could impulse the digital asset to new all-time highs above $1,440.

Ethereum outperformed Bitcoin this past weekend and remains trading above $1,200. The digital asset seems to be contained inside an ascending triangle pattern on the 4-hour chart and could see a breakout in the near term.

Ethereum price faces only one critical resistance level before new all-time high

On the 4-hour chart, Ethereum has established an ascending triangle pattern that is on the verge of bursting. There is a significant resistance level formed at $1,290, which is the top trendline of the pattern.

ETH/USD 4-hour chart

A breakout above this crucial resistance point could quickly push Ethereum price towards a high of $1,700. Additionally, the SuperTrend index also suggests that ETH faces a significant resistance level at $1,290.

ETH/USD 4-hour chart

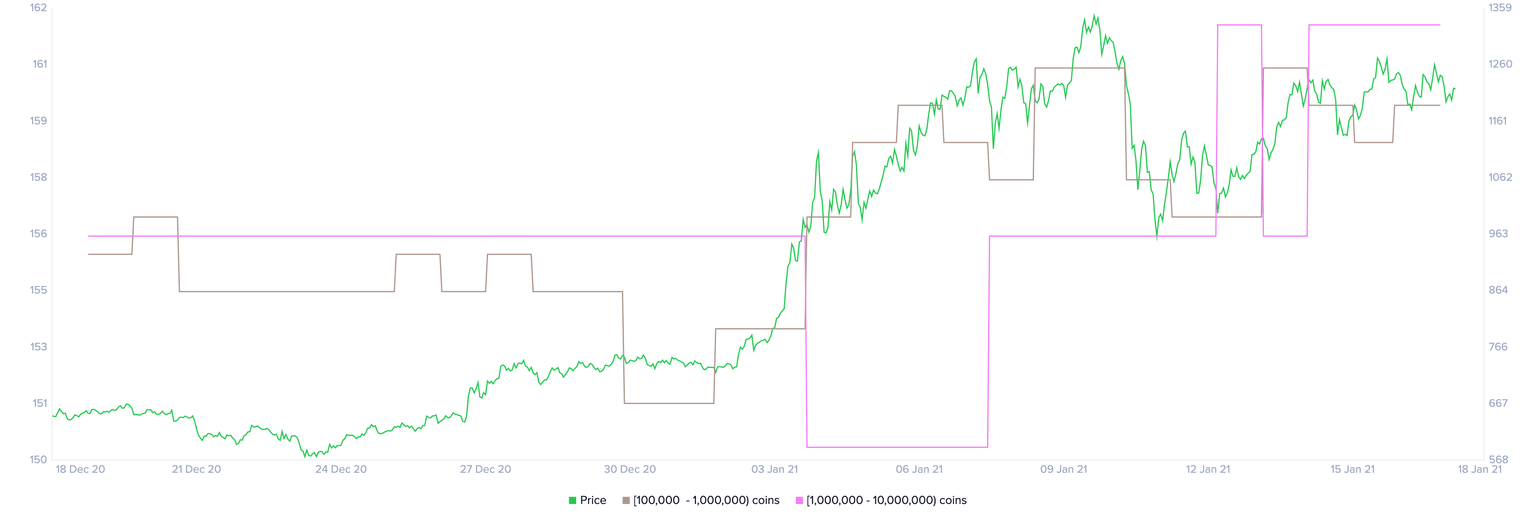

It’s important to note that despite Ethereum price rising higher, large investors are not taking profits just yet. The number of whales holding at least 1,000,000 ETH coins has increased since January 6. Similarly, the number of large investors holding between 100,000 and 1,000,000 coins has also been in an uptrend since December 30, 2020.

ETH Holders Distribution

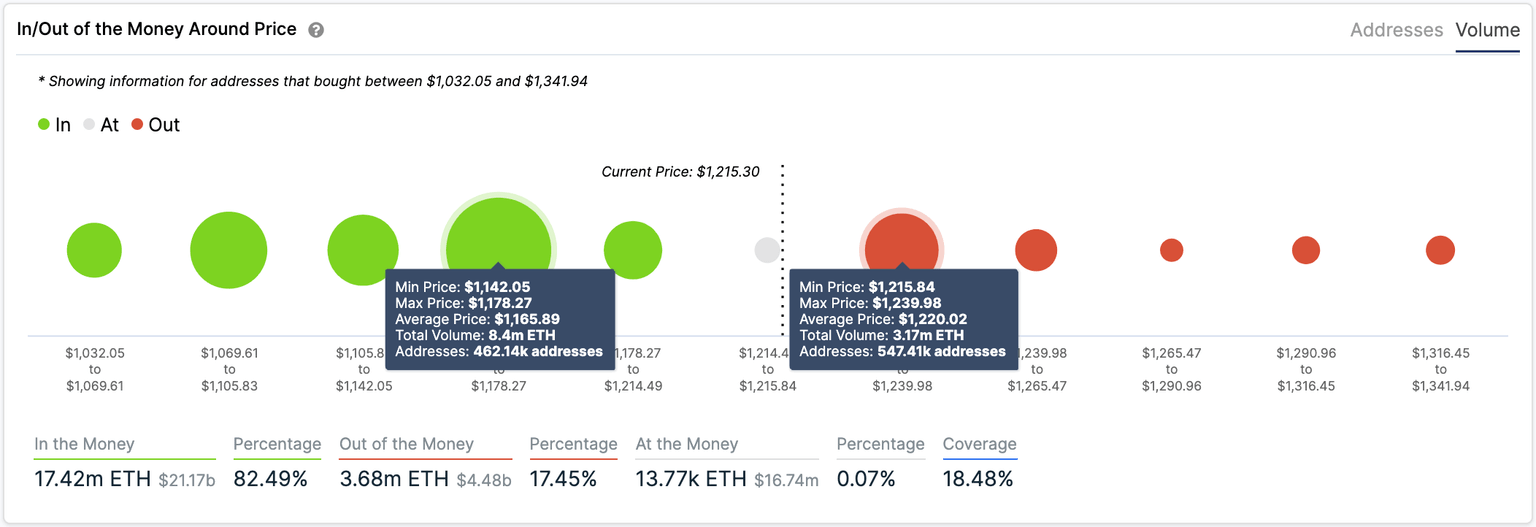

The IOMAP chart shows only one significant resistance area between $1,215 and $1,239, which gives credence to the bullish outlook as it indicates the $1,290 level, shouldn’t be hard to break.

ETH IOMAP chart

The IOMAP model also indicates that Ethereum is currently sitting on top of a robust support area between $1,142 and $1,178. Failing to hold this range of support would be a significantly bearish indicator and would invalidate the bullish outlook.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

-637465742683807839.png&w=1536&q=95)