Cryptocurrencies Price Prediction: Bitcoin, Ethereum & Ripple – European Wrap 24 April

Bitcoin Price Prediction: Road to $8,000 may be bumpy – Confluence Detector

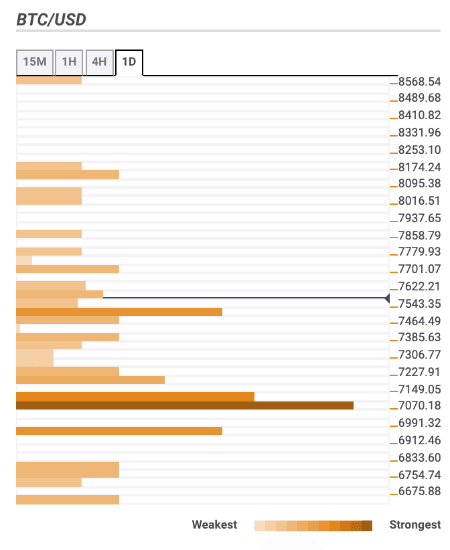

Bitcoin (BTC) has been hovering above $7,500 on Friday. A strong upside momentum on Thursday caused by BitMEX liquidations ahead of CME Bitcoin futures expiry, helped the coin to break above strong psychological resistance $7,000 and hit the highest level in the recent month $7,748. While BTC/USD retreated from the peak, many traders expect further recovery ahead of the halving event that will take place in May. However, the trip to the North is riddled with barriers and hurdles that may cause setbacks and discourage short-term bulls.

Ethereum Price Analysis: ETH/USD is within an arm's distance from $200.00, ready bullish breakthrough

At the time of writing, ETH/USD is changing hands at $188.4 with over 4% gains since this time on Thursday. Ethereum is moving within a short-term bullish trend and the upside momentum stays strong, however, it is still below the intraday high $189.98. Ethereum's market value reached $20.9 billion while its average daily trading volume is $20.4 billion.

Ripple Weekly Forecast: XRP/USD journey to $0.30 in May begins

Ripple was not the best-performing cryptocurrency among the top thirty coins in 2019 and the first quarter of 2020. Besides, some have called it out for lagging behind every bullish price action in the market but falling with a margin during bearish moves such as the one in mid-March; XRP/USD spiraled to $0.11 as Bitcoin dived to $3,800. However, while Bitcoin has recovered to levels above $7,500, XRP/USD is stuck under $0.20.

Author

FXStreet Team

FXStreet

-637233162224418273.png&w=1536&q=95)

%2520(3)-637233170508126379.png&w=1536&q=95)