Cryptocurrencies Price Prediction: Bitcoin, Dogecoin & Memecore — Asian Wrap 2 September

Bitcoin sees declining volume amid rising bearish market sentiment

Bitcoin (BTC) traded near $110,000 in the early Asian session on Tuesday as declining spot and futures volumes coupled with strained on-chain activity signal rising bearish pressure. The report stated that Bitcoin’s Relative Strength Index (RSI) dropped from 37.4 to 33.6 last week, slipping into oversold territory and signaling growing selling pressure. Glassnode analysts added that spot trading volumes declined nearly 9% to $7.7 billion, indicating weaker investor participation and uncertainty in market sentiment.

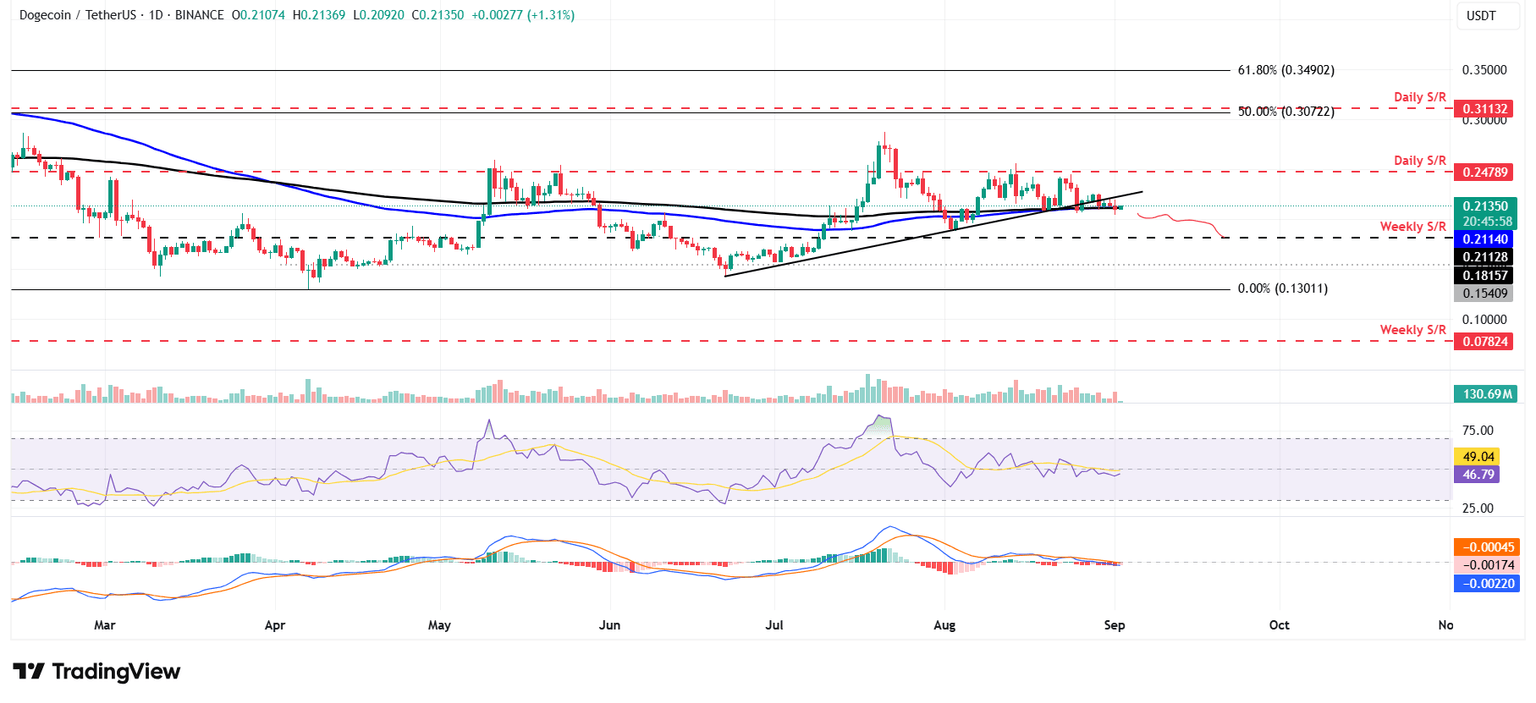

Dogecoin Price Forecast: DOGE struggles at 200-day EMA as selling pressure builds

Dogecoin (DOGE) is trading cautiously around its key level at $0.211 at the time of writing on Tuesday, a level that could determine DOGE’s next directional move. While the dog-based meme coin attempts to hold ground, derivatives data and on-chain metrics suggest growing bearish sentiment, raising the risk of further downside if selling pressure intensifies. The metric flipped to a negative rate on Tuesday, reading 0.0010%, indicating that shorts are paying longs. Historically, as shown in the chart below, when the funding rates have flipped from positive to negative, DOGE’s price has fallen.

Crypto Gainers: MemeCore rallies as WLFI prints listing gains, Four token follows

MemeCore edges higher by 5% at press time on Tuesday, extending the uptrend by five consecutive days. The uptrend momentarily peaked at $1.13 on August 30, marking its all-time high. A potential close above the $0.898 resistance level, marked as the highest close on the 4-hour chart, could extend the uptrend to the $1.00 psychological milestone.

Author

FXStreet Team

FXStreet