Crypto Gainers: MemeCore rallies as WLFI prints listing gains, Four token follows

- MemeCore rallies in double-digits, with bulls targeting the $1 milestone.

- The WLFI token launch sustains post-listing gains, as the community desires 100% transaction fees to be burned.

- Four tokens’ falling wedge pattern’s breakdown sustains above the $3.00 support, eyeing a potential rebound.

MemeCore (M), World Liberty Financial (WLFI), and Four (FORM) have emerged as high-performing cryptocurrencies over the last 24 hours. MemeCore leads the gainers rally with a double-digit rise, inching closer to the $1 milestone.

The US President Donald Trump-backed World Liberty Financial rises post-listing, showcasing increasing investor confidence. The technical outlook of the Four token suggests that the risks are skewed as the falling wedge breakdown risks losing the $3.00 psychological support.

MemeCore emerges as a frontrunner among top gainers

MemeCore edges higher by 5% at press time on Tuesday, extending the uptrend by five consecutive days. The uptrend momentarily peaked at $1.13 on August 30, marking its all-time high.

A potential close above the $0.898 resistance level, marked as the highest close on the 4-hour chart, could extend the uptrend to the $1.00 psychological milestone.

The momentum indicators are fluctuating in bullish territory on the 4-hour chart. The Relative Strength Index (RSI) is at 70, moving close to the overbought boundary line, indicating heightened buying pressure. Still, the RSI signals a bearish divergence as its indicator line forms a lower high compared to the higher price action peaks.

The Moving Average Convergence Divergence (MACD) and its signal line soar higher into positive territory.

M/USDT daily price chart.

Looking down, a reversal in MemeCore could test the center pivot at $0.7382.

World Liberty Financial launch boosts bullish sentiment

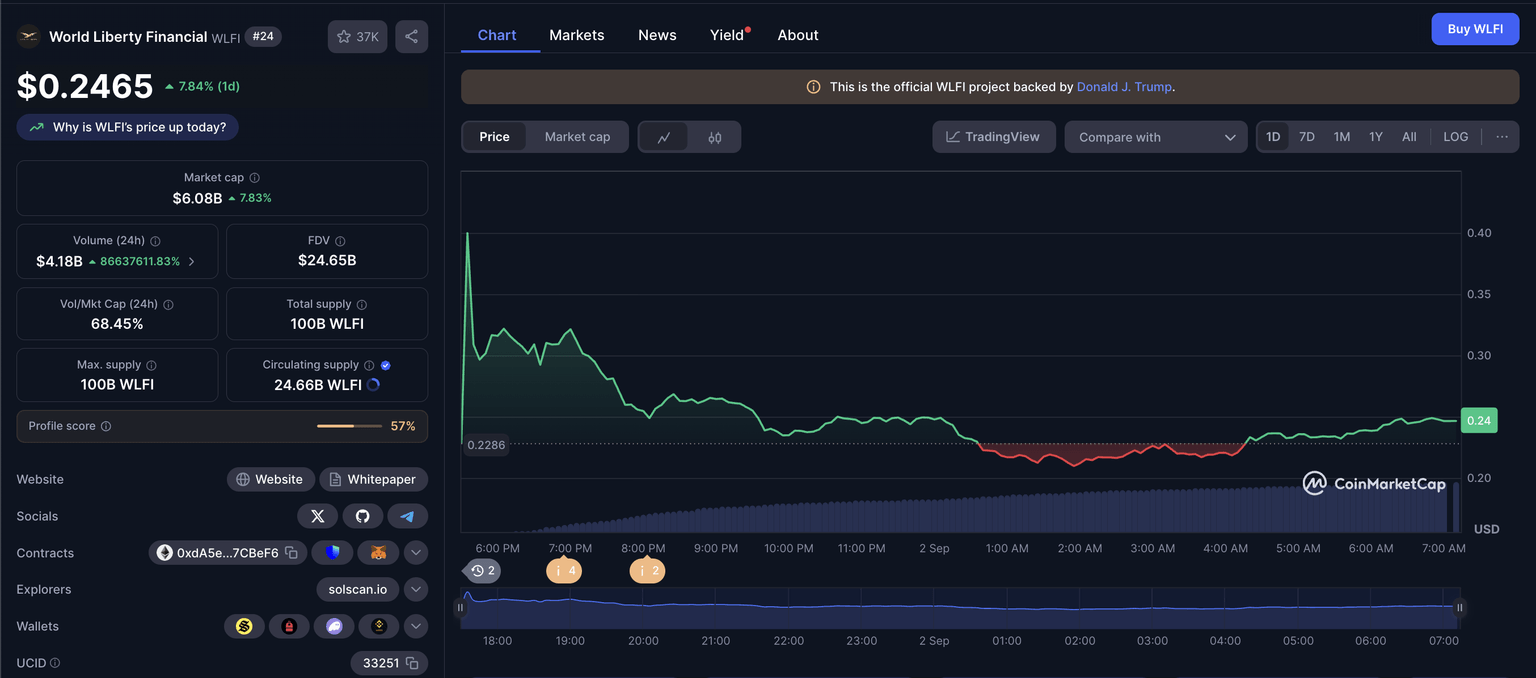

World Liberty Financial launched on Monday and sustained gains of over 7% at press time on Tuesday. The newly launched token is yet to build a technical chart on a higher timeframe.

Four market metrics. Source: CoinMarketCap

Despite the short-term price action, fundamental moves such as buying back WLFI tokens by 100% of the transaction fees in POL (formerly MATIC) have occurred. These reclaimed WLFI tokens are proposed to be burned to maintain a check on circulating risk.

If the uptrend holds, the buyback programs could boost the WLFI token to the $0.50 threshold.

Four hits at a crucial crossroads as sellers gain trend control

Four token trades at $3.18 at press time on Tuesday, rising from the intraday low of $3.05. The falling wedge breakout rally on the 4-hour chart struggles to break the $3.00 psychological mark.

To reinforce the uptrend, FORM should close above the $3.42 resistance level, which could potentially bring the $4.00 level into bullish focus.

The MACD and its signal line descend into the negative territory, indicating a surge in selling pressure. Additionally, the RSI is at 38 inches towards the oversold zone, indicating a rise in selling pressure.

FORM/USDT daily price chart.

Looking down, if Four slips below the $3.00 level, it could extend the decline to the $2.76 low from Monday.

Author

Vishal Dixit

FXStreet

Vishal Dixit holds a B.Sc. in Chemistry from Wilson College but found his true calling in the world of crypto.