Cryptocurrencies Price Prediction: Bitcoin, Bitcoin Cash & Litecoin – European Wrap 4 May

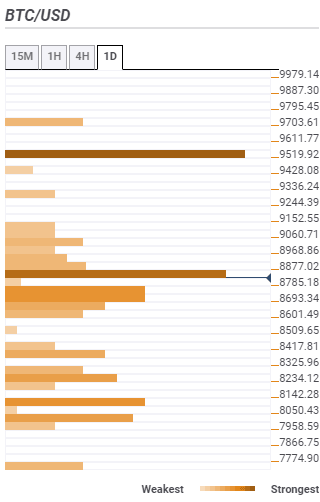

Bitcoin Price Prediction: BTC/USD nosedives towards $8,500 – Confluence Detector

Bitcoin price failed to make a comeback into the $9,000’s range over the weekend. The stability followed an incredible bullish action on Thursday last week that saw the price high new April highs at $9,466. The bullish action was, however, met by increased selling activity and coupled with the high volatility in the market, pulled Bitcoin into a reversal action, the extent of testing new support at $8,400. A minor recovery ensued but Bitcoin stalled under $9,000.

Bitcoin Cash Price Analysis: BCH/USD freefalls to $235

Bitcoin Cash extended the bearish action on Monday below the $240 support. A low was formed at $235, marking the end of the intraday bearish action. BCH/USD has corrected upwards to trade at $241. However, it is still far from the intraday high achieved at $252. With entire cryptocurrency market clouded by a bearish wave, BCH could retest the short support but no rapid price movements are expected in the near term especially with the volatility shrinking.

%2520(4)-637241810269245044.png&w=1536&q=95)

Litecoin Price Analysis: LTC/USD may retreat to $45.00 before the recovery resumes

Litecoin topped at $50.96 on April 30 and slipped back below $50.00 as the upside momentum faded away during the weekend. At the time of writing, LTC/USD is changing hands at $45.83, down over 5% in the recent 24 hours. Litecoin now takes seventh place in the global cryptocurrency market rating with the market capitalization $3 billion and an average daily trading volume of $4.4 billion.

Author

FXStreet Team

FXStreet

-637241820569334082.png&w=1536&q=95)