Cryptocurrencies Price Prediction: Avalanche, Ethereum & Hedera — Asian Wrap 01 December

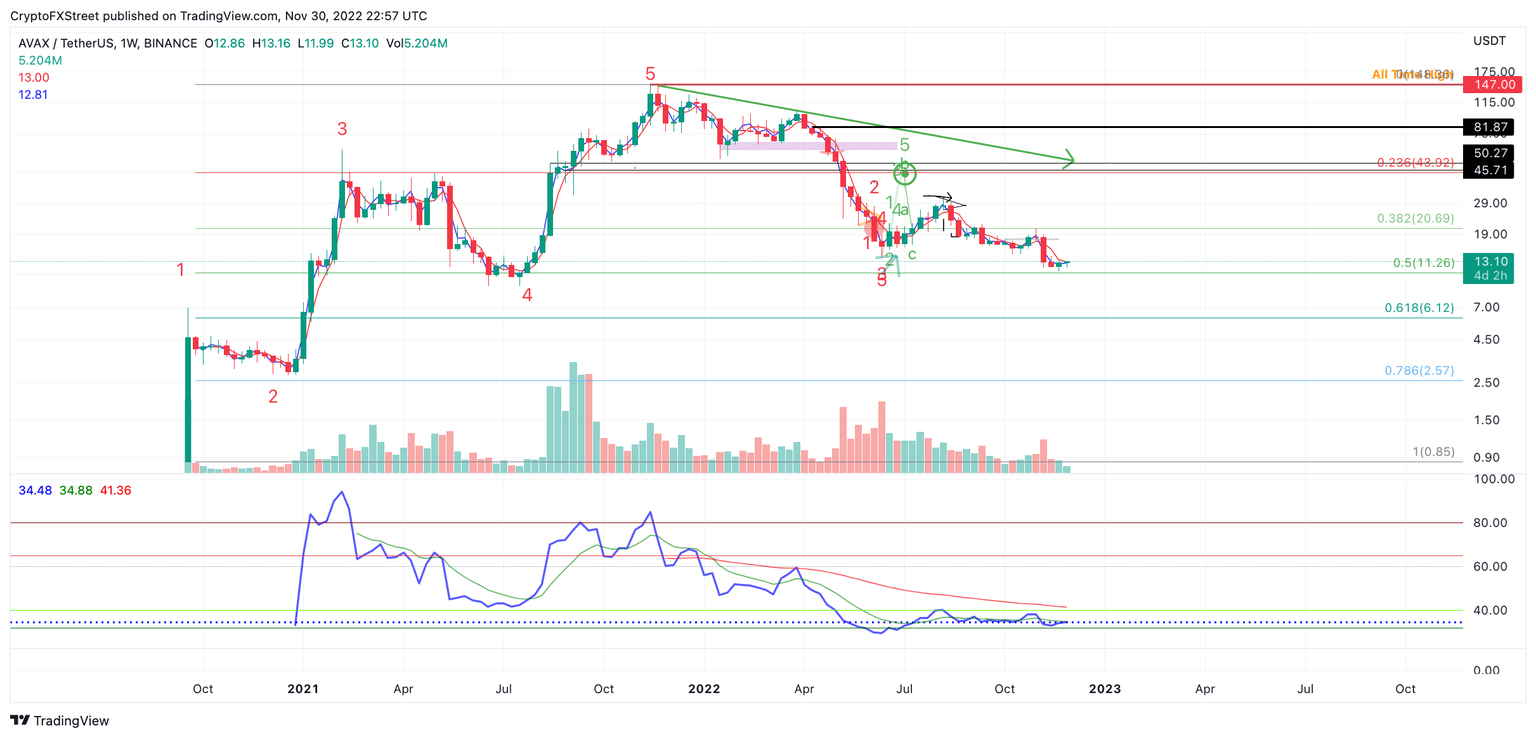

Avalanche price remains submerged, but bulls can come out on top if this happens

Avalanche price may be setting up for one more decline targeting the halfway point of the 2020-2021 bull run. Despite this fact, the bulls are showing efforts to refute the bearish stronghold. The $14 price zone is crucial for defining the next directional rally.

This is how Ethereum price could react following the shutdown of Ropsten network

Ethereum will soon end the very testnet that began the journey of transition from Proof-of-Work (POW) to Proof-of-Stake (POS). However, at the same time, Ethereum’s reach is expanding to a wider user base as well. These developments could neutralize the impact on Ethereum price, which is looking to achieve a recovery.

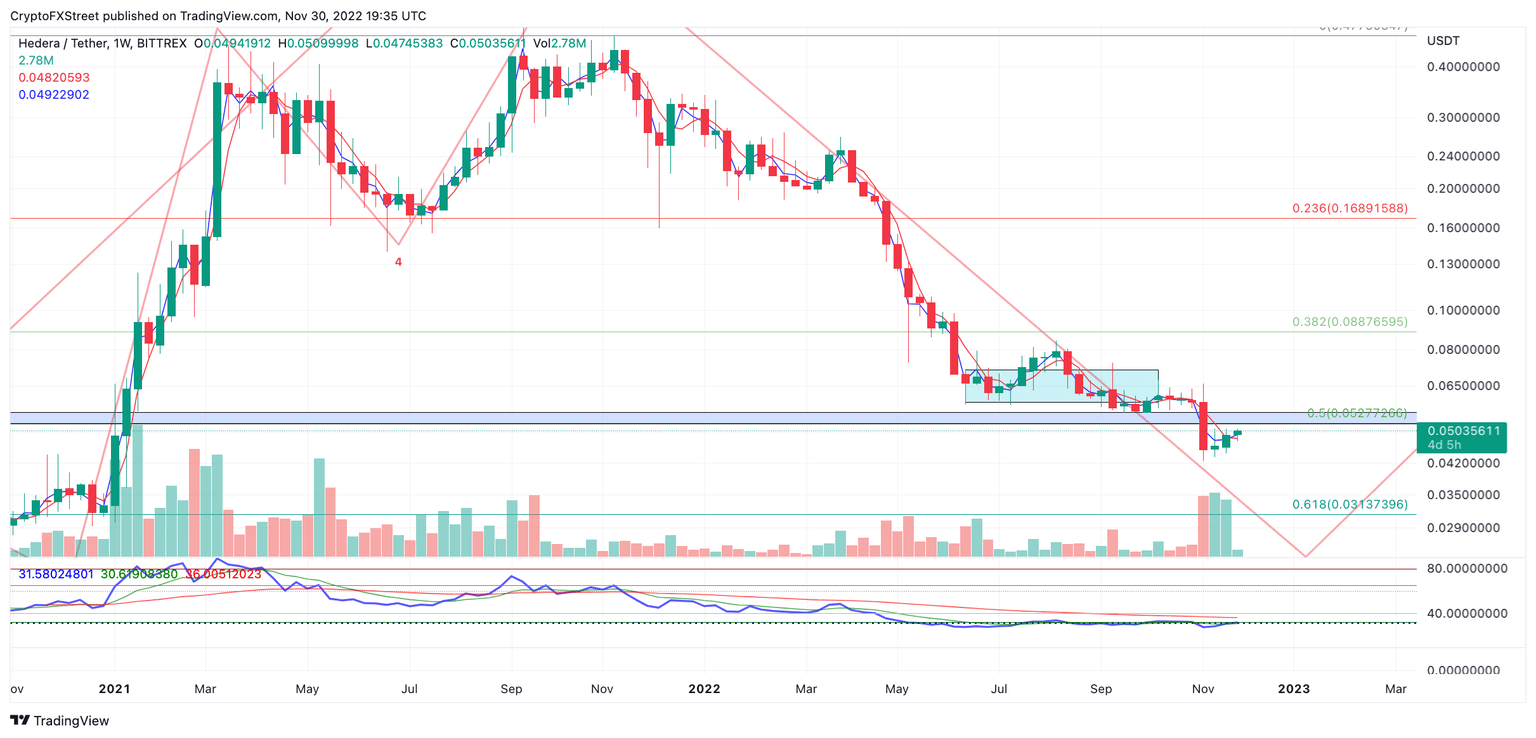

Hedera Hashgraph (HBAR) Price Prediction: Countertrend bulls seem poised for more gains

Hedera Hashgraph price rose by 18% after establishing new yearly lows earlier in the month. A bullish shooting star pattern occurred on the weekly time frame, which projects HBAR rising another 8% to 12%. A breach below $0.047 would invalidate the bulls’ potential to tackle the mid $0.05 zone.

Author

FXStreet Team

FXStreet