Cryptocurrencies Price Prediction: ApeCoin, Solana & Cardano — Asian Wrap 21 Apr

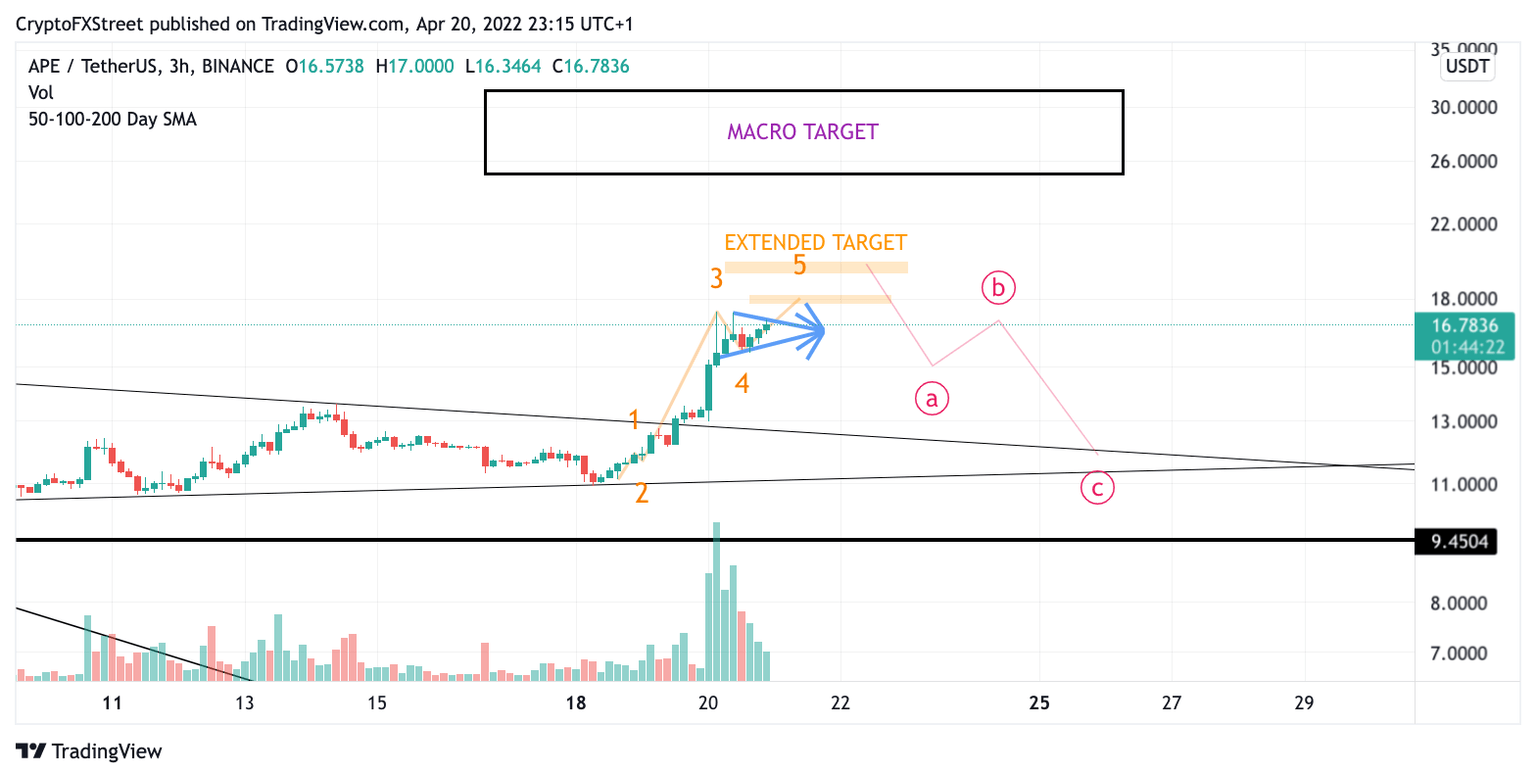

ApeCoin price could rally to $20, but traders should be cautious

ApeCoin price has confirmed a long-term uptrend bias. Traders should analyze the asset to find the best entry points. ApeCoin price has validated the more significant Macro thesis written during March. The APE price has broken out from the symmetrical triangle and now has a larger macro target at $27.

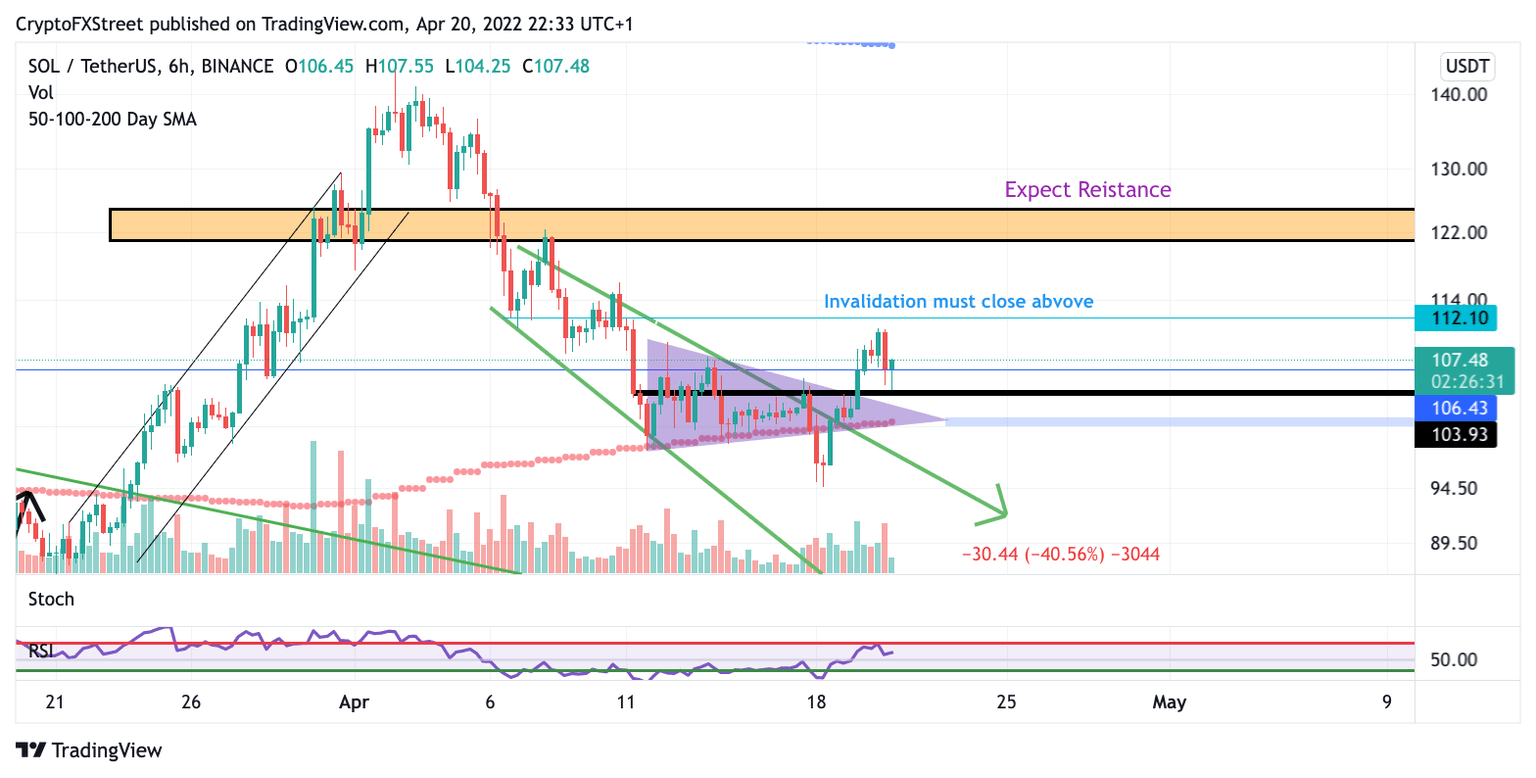

Solana price needs to break $112 to mark the end of the downtrend

Solana price is inching towards an end of correction confirmation. Risking money in SOL price is considered a high trade risk until the breach at $112 occurs. Solana price is seeing a significant resistance as the price failed to breach the $112 invalidation level of last week's bearish thesis.

Cardano price loading up for a 50% rally, targets $1.40

Cardano price action is setting up for a colossal bull rally. Traders should hone in on this digital asset to get the best entry and maximize profits in the coming days. Cardano price is one of the more favorable charts amongst cryptocurrencies this week.

Author

FXStreet Team

FXStreet