Cryptocurrencies Price Prediction: ApeCoin, Hedera & VeChain — Asian Wrap 01 March

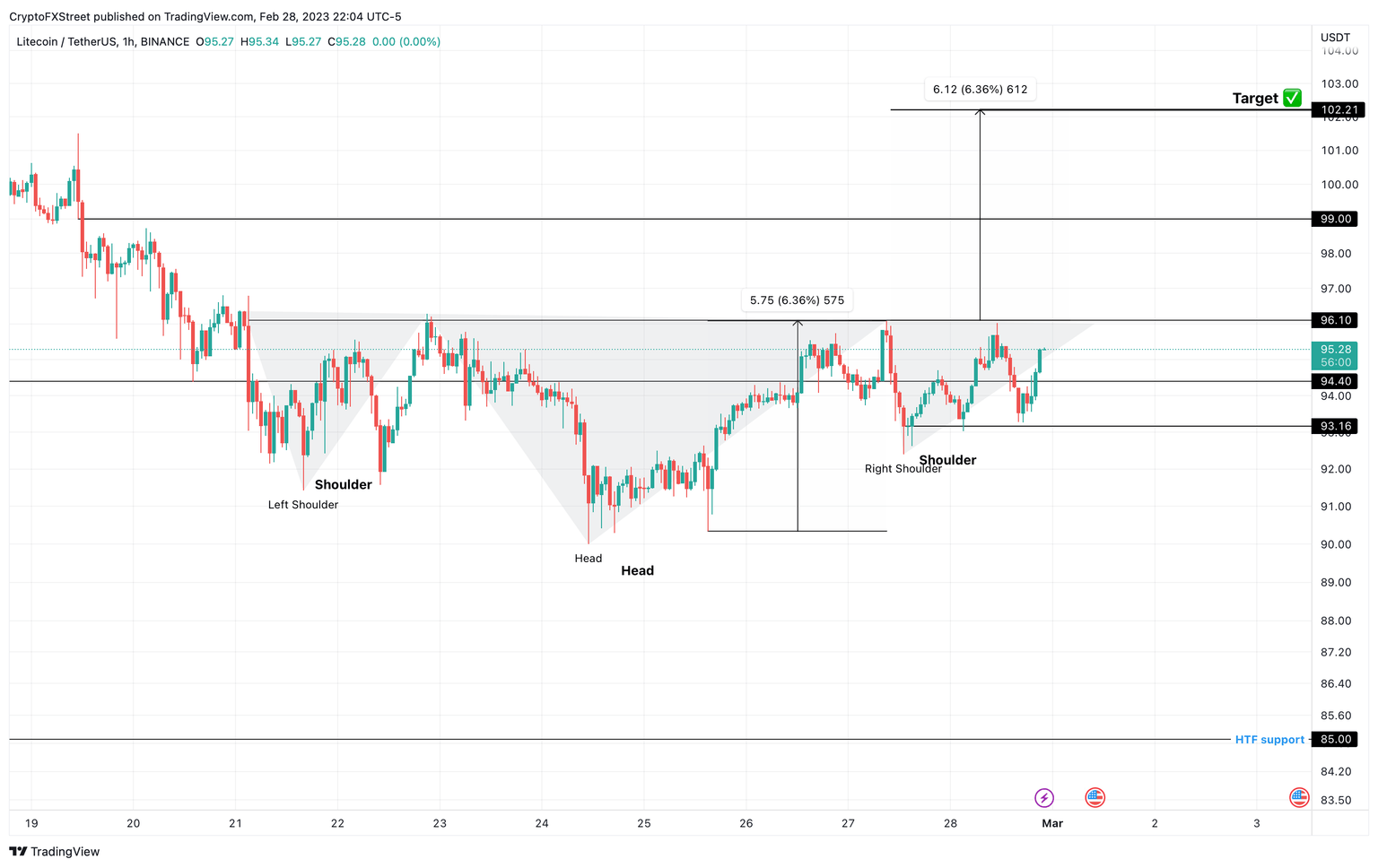

Litecoin price could explode to $100 due to this LTC accumulation pattern

Litecoin price shows a bullish setup on the one-hour timeframe, which is getting ready for a breakout. If played correctly with leverage and risk, this outlook could yield LTC futures traders a neat little chunk of profit.

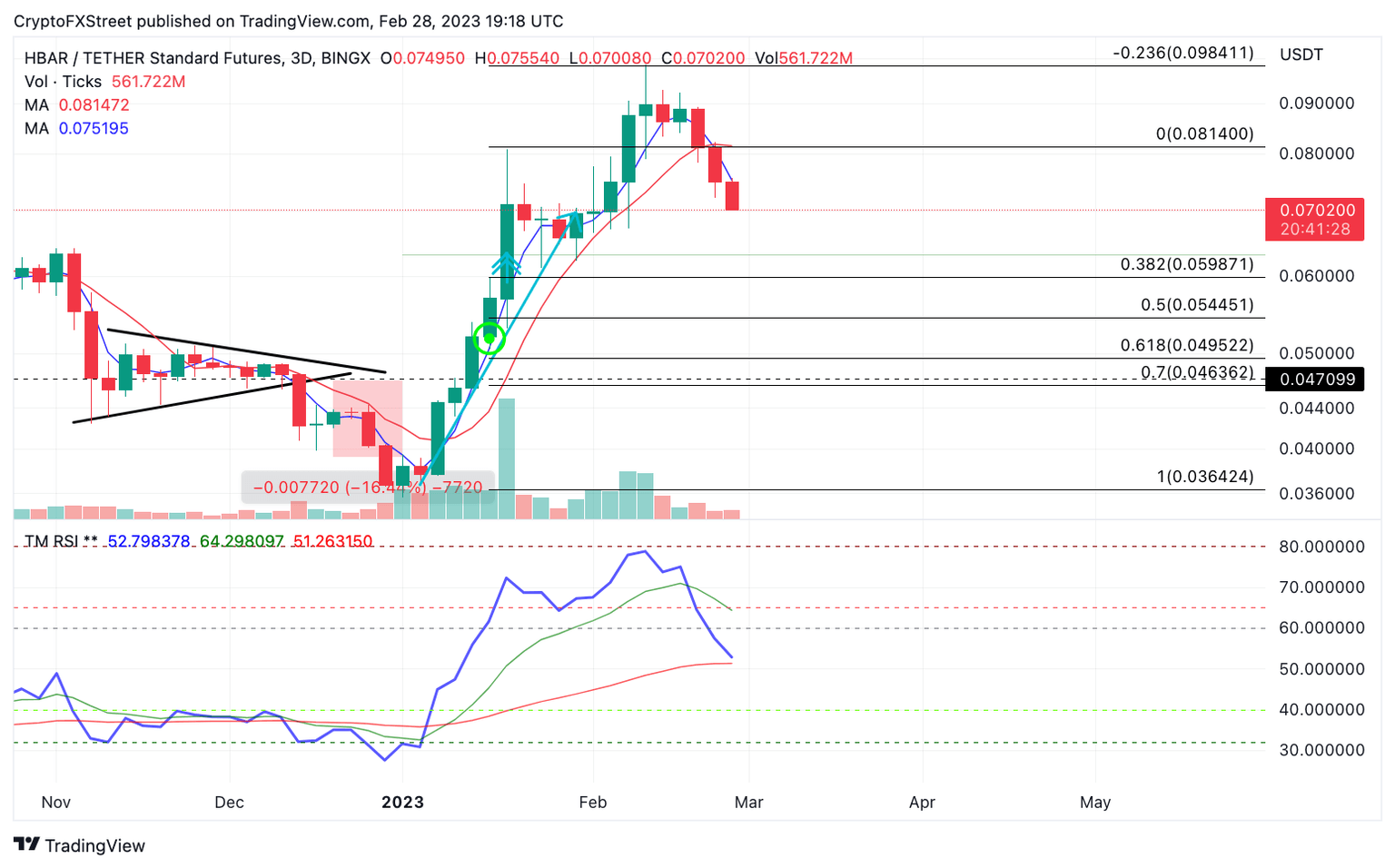

Hedera Hashgraph Price Prediction: HBAR points south but the macro setup suggests otherwise

Hedera Hashgraph price shows short-term bearish trading within an overall strong uptrend. Traders should keep their eyes on the technicals in search of a market reversal signal.

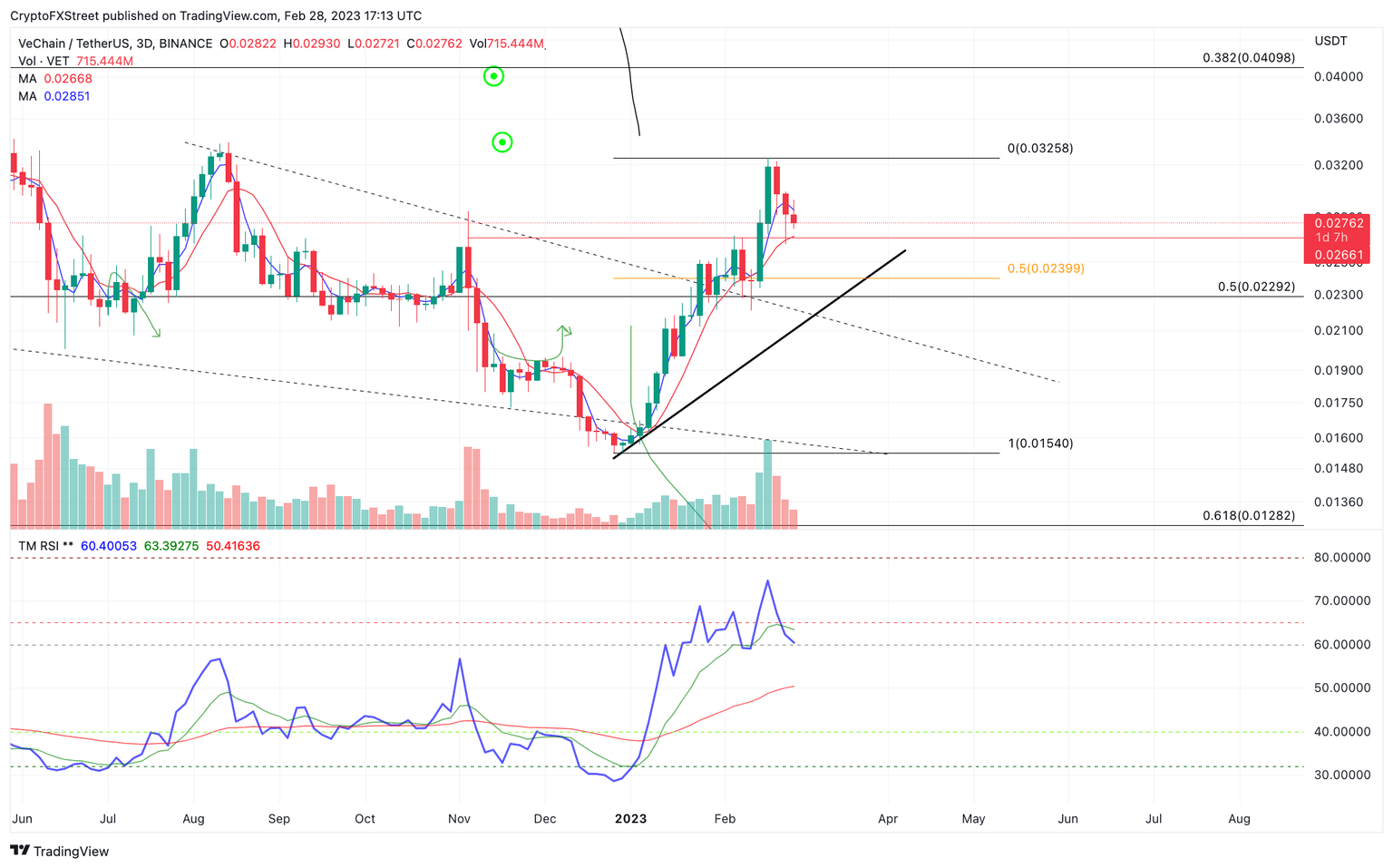

VeChain Price Prediction: Can bulls recover after six consecutive days of losses?

VeChain price has declined nearly 10% over the last six days, marking the longest declining streak for the token in 2023. Despite the profit-taking move, VET’s technicals are still in line with the overall bullish uptrend. The Relative Strength Index (RSI) suggests that the uptrend rally, which is 80% above its origin point at $0.015, still has the potential to extend higher.

Author

FXStreet Team

FXStreet