Crypto.com price signals bears are ready to let go, targets $0.45

- Crypto.com price shows an important drop in selling pressure.

- CRO appears to be gaining momentum to break through resistance to print a higher high.

- Still, a dip below $0.325 might have the strength to invalidate the bullish thesis.

Crypto.com price has reset around $0.38 just below a crucial resistance level. With selling volume fading, a bullish scenario could present itself in the days to come.

Crypto.com price set up for a parabolic breakout

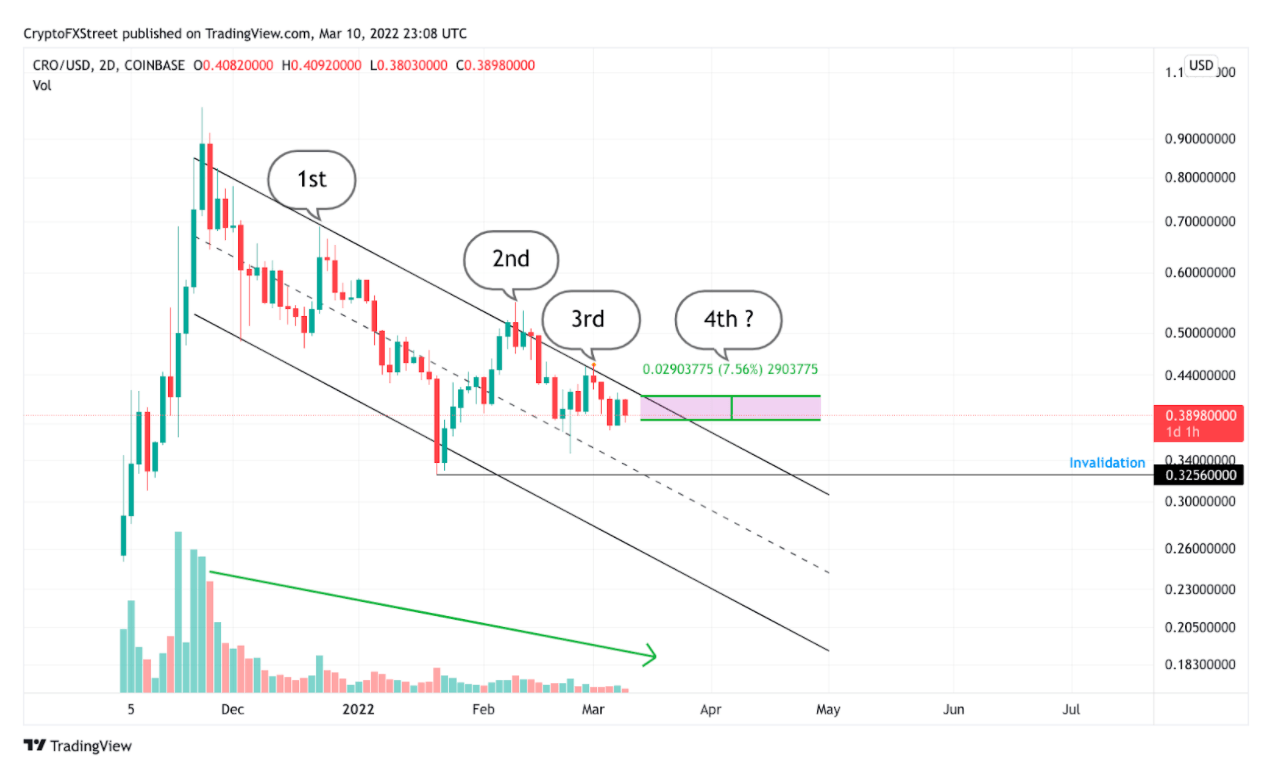

Crypto.com price is used to trend channel breakouts. It is also a common theme amongst traders to regard the 4th touch of a trendline as the most confident entry point. CRO price currently fluctuates about 7% below the upper trendline of a parallel channel and is days away from an inevitable collision.

Another bullish indicator is Crypto.com’s volume profile, as the sellers’ volume is tapering off. The volume profile and CRO price consolidate above the channel’s median trendline, which points to a bullish breakout for Crypto.com very soon.

Bulls have 7% of ground to cover before sidelined investors decide to renter the market and open long positions. If Crypto.com price successfully holds ground, a bullish impulse towards $0.45 will be the first target. Breaching the $0.45 resistance level can kick start a new uptrend for this cryptocurrency.

CRO/USD 2-day Chart

It is worth noting January 21's swing low marked at $0.325 sits 17% below Crypto.com price. Traders and long-term investors should consider $0.325 as a critical point that can invalidate the optimistic outlook.

If Crypto.com goes down to test this support level, it is unlikely to expect a bounce at all. Bears will have complete control of CRO price by then and will likely send it lower towards the bottom half of the channel between $0.27 and $0.25.

Author

FXStreet Team

FXStreet