Gold analysis: Gains faster than expected

Gold

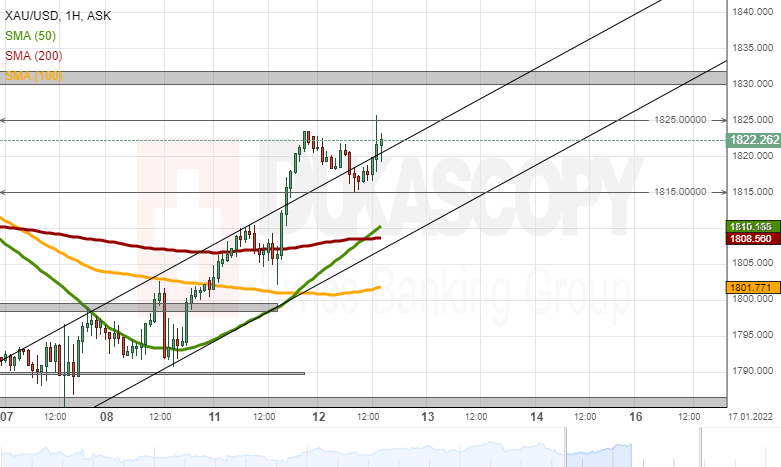

The price for gold surged faster than expected, as the bullion broke through the upper trend line of the channel up pattern and reached the 1,823.50 level on Tuesday. Afterward, a consolidation down to the 1,815.00 level occurred. The 1,815.00 acted as support and started a surge.

On Wednesday, at 13:30 GMT, the US Consumer Price Index and Core Consumer Price index data was released. The USD reacted by declining. On the bullion charts the move was observed as a test of the resistance of the 1,825.00 mark. By large, it can be observed that the price respects round price levels.

If the price for gold continue to surge, the bullion would most likely encounter resistance in 1,825.00. The surge could eventually end at the summer high-level zone that starts at 1,830.00. On the other hand, a decline would need to pass the 1,815.00 mark, before reaching the 50 and 200-hour simple moving averages at 1,810.00.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.