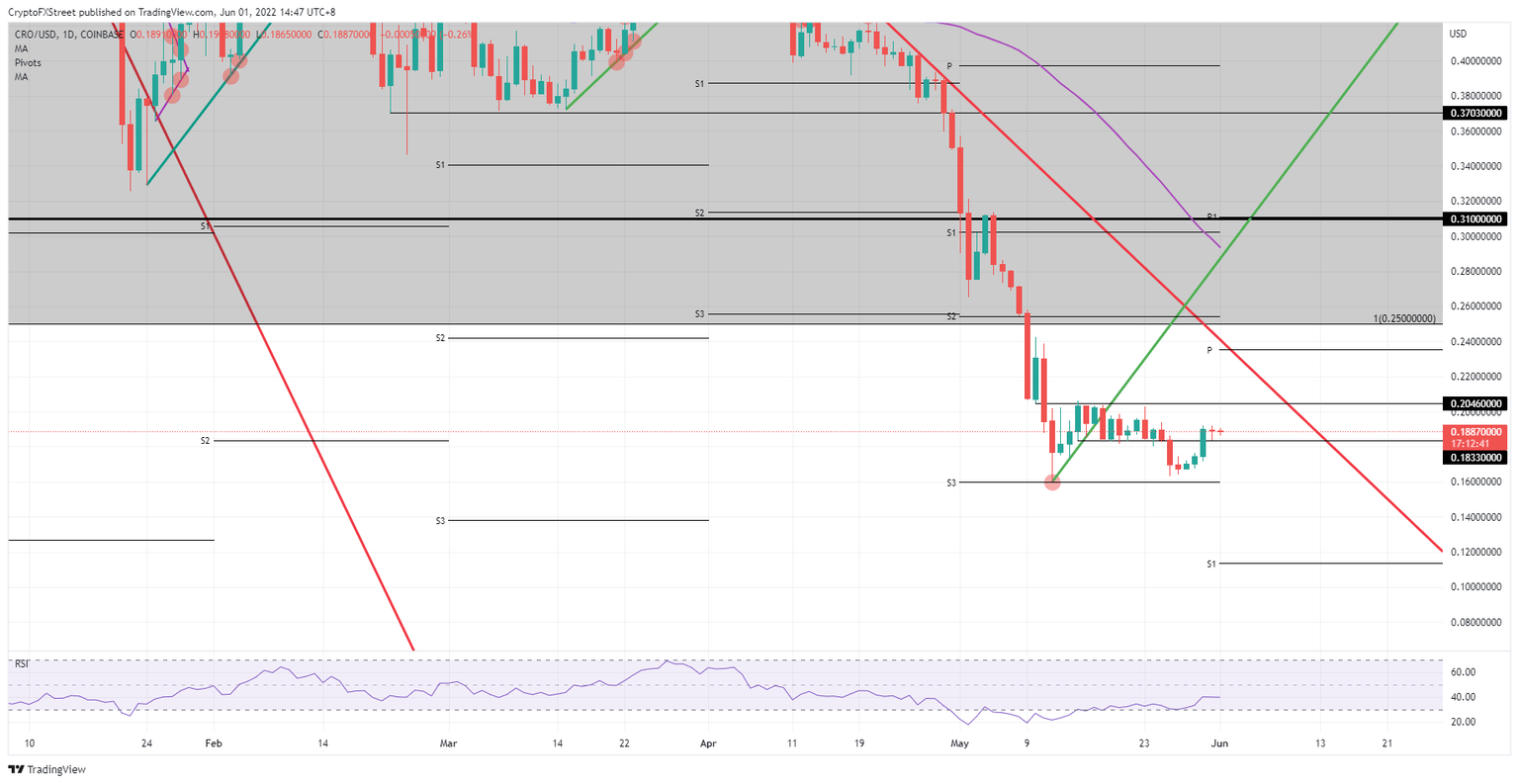

Crypto.com price shows a vital level that traders must pay attention to before entering any positions

- Crypto.com coins are stabilising around $0.1880 as price action consolidates.

- CRO price shot through a near-term pivotal level and is holding the area above.

- Expect to see a pop higher, toppling $0.20 in the process, and a rally towards $0.30.

Crypto.com coins (CRO) are trying to face the headwinds arising after a few consecutive days of gains. A pullback or some profit-taking is now to be expected as the backdrop sees traders focus back on inflation and recession fears, and as the relief rally from China ending its lockdowns fades. Expect $0.1833 to turn from resistance into support and see CRO price pump higher towards $0.3000.

CRO price will add 56% gains in the first trading week of June

Crypto.com coins are seeing traders gearing up for a hot summer as more signals are emerging that investors are fed-up with the current turn of events, in which most asset classes have been in a downtrend since February. A turn in sentiment is more than possible despite the daily wear and tear that goes on in global markets where sentiment can switch 180 degrees overnight. For example, where on Monday, markets were all rosy and sunshine and lollipops, on Tuesday dark clouds dominated, as inflation fears and recession woes took over.

CRO price sees investors sitting on their hands, not giving up on their acquired positions but not adding to them. This has resulted in the Relative Strength Index flatlining and price action not going anywhere. The fact that bulls can keep control of the price action above $0.1833 and have even already tested it as support, suggests this area will not fall into the hands of bears anymore. Instead, CRO price is more likely to rally upwards towards $0.25 in the first jump and next $0.30 by the end of next week.

CRO/USD daily chart

The risk traders have with inflation worries and recession risks on the horizon is that this is not a theme or catalyst that could fade overnight. A broad global topic like this needs several data points and central bank interventions from multiple big economies to turn it around and is thus likely to be a key theme for months to come. This could limit upside potential and even weigh so badly that it could push price-action back below $0.1833 and see it drop back to $0.1600.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.