Crypto.com price is close to confirming a breakout that will push CRO to $0.50

- Crypto.com has developed trading opportunities for bulls and bears.

- Upside potential could be significant.

- Downside risks may be substantial, especially below the $0.36 value area.

Crypto.com price action is in a make or break point. On the one hand, the momentum and mood have turned most of the altcoin market bullish, creating positive and bullish price action for CRO. However, on the other hand, CRO remains below some critical resistance levels and is in a bearish continuation pattern.

Crypto.com price could trigger rallies on both sides of the market

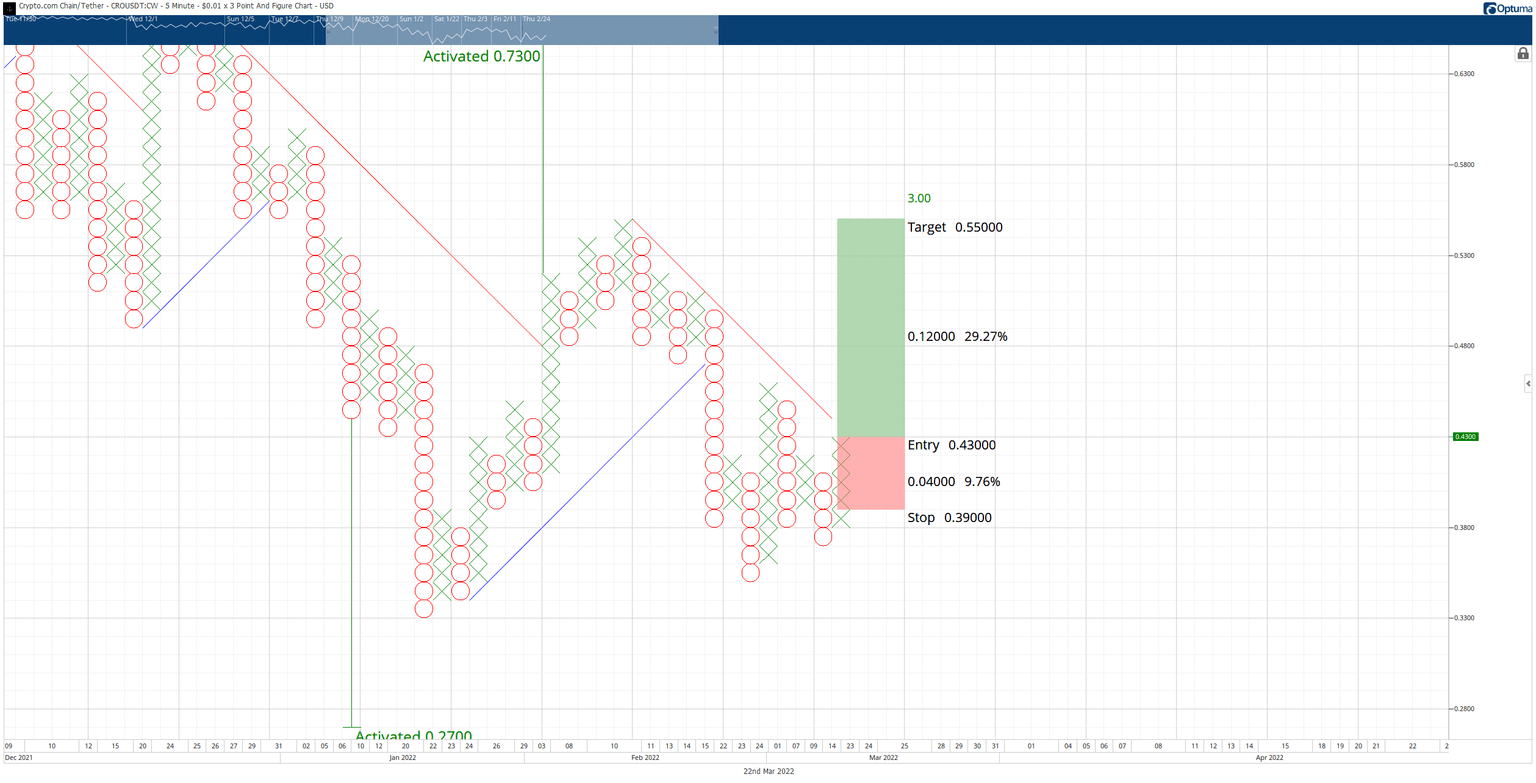

Crypto.com price has a hypothetical long trade idea on the $0.01/3-box reversal Point and Figure chart. The setup is a buy stop order at $0.43, a stop loss at $0.39, and a profit target at $0.55.

The entry, if hit, confirms two important Point and Figure objectives simultaneously. First, the entry confirms a Bear Trap pattern. Second, and perhaps most importantly, the entry breaks the bear market angle (red diagonal line) and converts the $0.01 3-box reversal Point and Figure chart into a bull market.

CRO/USDT $0.01/3-box Reversal Point and Figure Chart

The trade represents a 3:1 reward for the risk with an implied profit target of nearly 30% from the entry. A two-box trailing stop would help protect any profit made post entry.

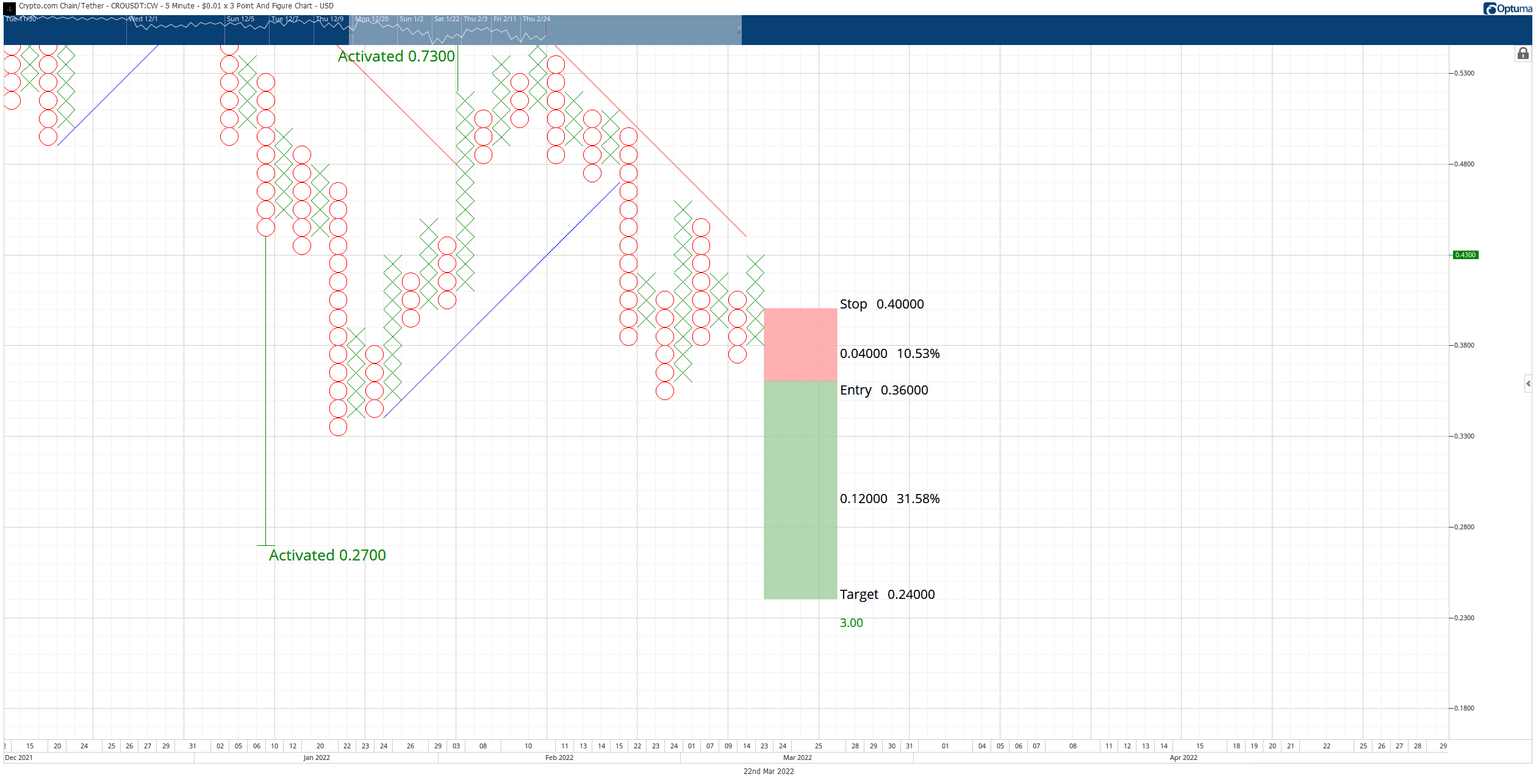

On the short side of the trade, the theoretical short entry for Crypto.com price is a sell stop order at $0.36, a stop loss at $0.40, and a profit target at $0.24. The entry, if triggered, confirms two entry conditions: a Bull Trap and Descending Triple Bottom entry. The combination of the two patterns would likely start a swift move south.

CRO/USDT $0.01/3-box Reversal Point and Figure Chart

The short idea is invalidated if Crypto.com price moves to $0.45 before the short entry is triggered.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.