Crypto VC firm Spartan Capital invests in Pendle to drive DeFi growth

Singapore-based digital asset investment firm Spartan Group has announced an investment in the decentralized finance (DeFi) protocol Pendle Finance (PENDLE). The size of the investment was not disclosed.

After actively supporting Pendle since its launch in 2021, Spartan Group’s crypto venture capital arm Spartan Capital has made a follow-on investment in Pendle Finance through an over-the-counter, or OTC, purchase.

The firm emphasized that Spartan and Pendle have had a strong partnership since the DeFi’s project inception, noting that the latest investment aims to support the project in its further ambitions.

Spartan Capital has been with Pendle since the very beginning of our journey since the days of Pendle V1.

— Pendle (@pendle_fi) November 9, 2023

It's an honour to link hands with one of our longest supporters once more on our next leg of journey, as we strive to reshape the crypto landscape together https://t.co/7C1t8g5DQu

“At Spartan Capital, we recognize the transformative potential of Pendle and their pivotal role in driving the advancement of on-chain yield trading,” Spartan noted.

Spartan mentioned that Pendle has been steadily emerging as a major DeFi protocol, with total value locked (TVL) surging more than 2,000% in a year from November 2022, according to data from DefilLama. The VC firm expressed confidence that Pendle’s solutions like Liquid Staking Derivatives and its yielding project, the Real World Assets, will help bring more off-chain capital to the industry.

Pendle Protocol TVL. Source: DefilLama

“The convergence of Liquid Staking Derivatives and Real World Assets presents an exceptional growth opportunity for the DeFi sector,” Spartan Capital managing partner Kelvin Koh said, adding:

Their yield trading toolkit is designed to complement and bring value to any digital, yield-bearing assets, which also means that Pendle will be in a unique position as an accelerant for more future DeFi developments.

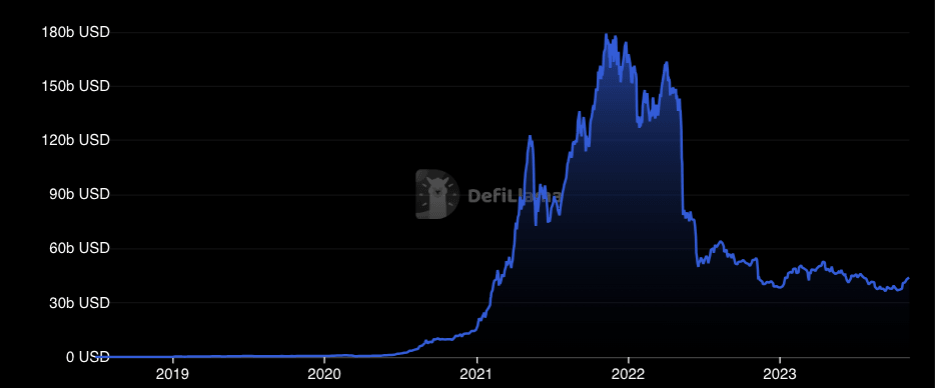

Spartan’s optimism about DeFi comes amid the industry's failure to gain much momentum in 2023. Despite total DeFi TVL edging up about 18% since the beginning of the year, the industry has not managed to reach early 2022 levels and is down 279% from the all-time highs above $177 billion recorded in November 2021.

Total DeFi TVL historically. Source: DefilLama

In contrast to DeFi, some other markets like Bitcoin (BTC $37,097) have been surging notably this year. The world’s largest cryptocurrency has added more than 120% since January after starting the year at around $16,600, according to data from CoinGecko.

Despite the DeFi-related economic activity dropping significantly in 2023, the sector has seen significant funding. Earlier this year, venture capital group Blockchain Capital announced two new funds, totalling $580 million, targeting the DeFi development alongside gaming and infrastructure investment.

Spartan Capital did not immediately respond to Cointelegraph’s request for comment.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.