Crypto Today: Traders take $12 billion in profits in June, this will be the effect on Bitcoin

- Bitcoin traders realized over $12.3 billion in profits on their holdings in June.

- Ethereum ETF issuers have at least one more round to go before SEC approval.

- Ripple ruling set a precedent for SEC vs. Binance lawsuit, XRP extends gains on Monday.

Bitcoin traders took over $12 billion in profits in the past month, per Santiment data. Amidst German Government’s Bitcoin transfers, Ethereum Exchange Traded Fund (ETF) optimism and the Securities and Exchange Commission (SEC) vs. Ripple lawsuit, market participants are taking gains ahead of the volatility-filled week.

The positive spikes in Network Realized Profit/loss (NPL) metric represent the gains of BTC traders.

BTC price vs. NPL

Key US macroeconomic events are lined up this week. Federal Reserve Chair Jerome Powell is expected to deliver a speech on July 2, FOMC minutes will be released on July 3 and Nonfarm Payrolls on July 5.

Bitcoin, Ethereum, Ripple updates

- BTC/USDT trades at $62,950 on Monday at the time of writing. Bitcoin rallied above $62,000 despite mass profit-taking activities of holders. The German Government’s Bitcoin transfers and the upcoming Mt.Gox payback to creditors are the key market movers. US macroeconomic events could usher in volatility in BTC this week.

- ETH/USDT trades at $3,475. Ether has failed to rally past the resistance at $3,500 despite the optimism surrounding Spot Ethereum ETF approval. The Ethereum ETF could be approved as early as Thursday, July 4.

- XRP/USDT extends gains and trades at $0.4815 on Monday. The altcoin has recovered as a recent ruling in the SEC vs. Binance's lawsuit used the XRP secondary market sales judgment as precedent. XRP holders gained clarity on the status of XRP as a non-security in secondary market transactions.

Chart of the day

WIF/USDT daily chart

Dogwifhat (WIF) could extend gains by over 25% in its uptrend. The meme coin recently filled the Fair Value Gap between $2.3616 and $2.3281. The Moving Average Convergence Divergence (MACD) indicator shows underlying positive momentum in WIF price trend.

WIF could rally to $2.7699, the 38.2% Fibonacci retracement of the decline from the March 31 peak of $4.860 to the June 24 low of $1.487.

If WIF suffers a correction, the meme coin could find support at the FVG between $1.86 and $1.90.

Market updates

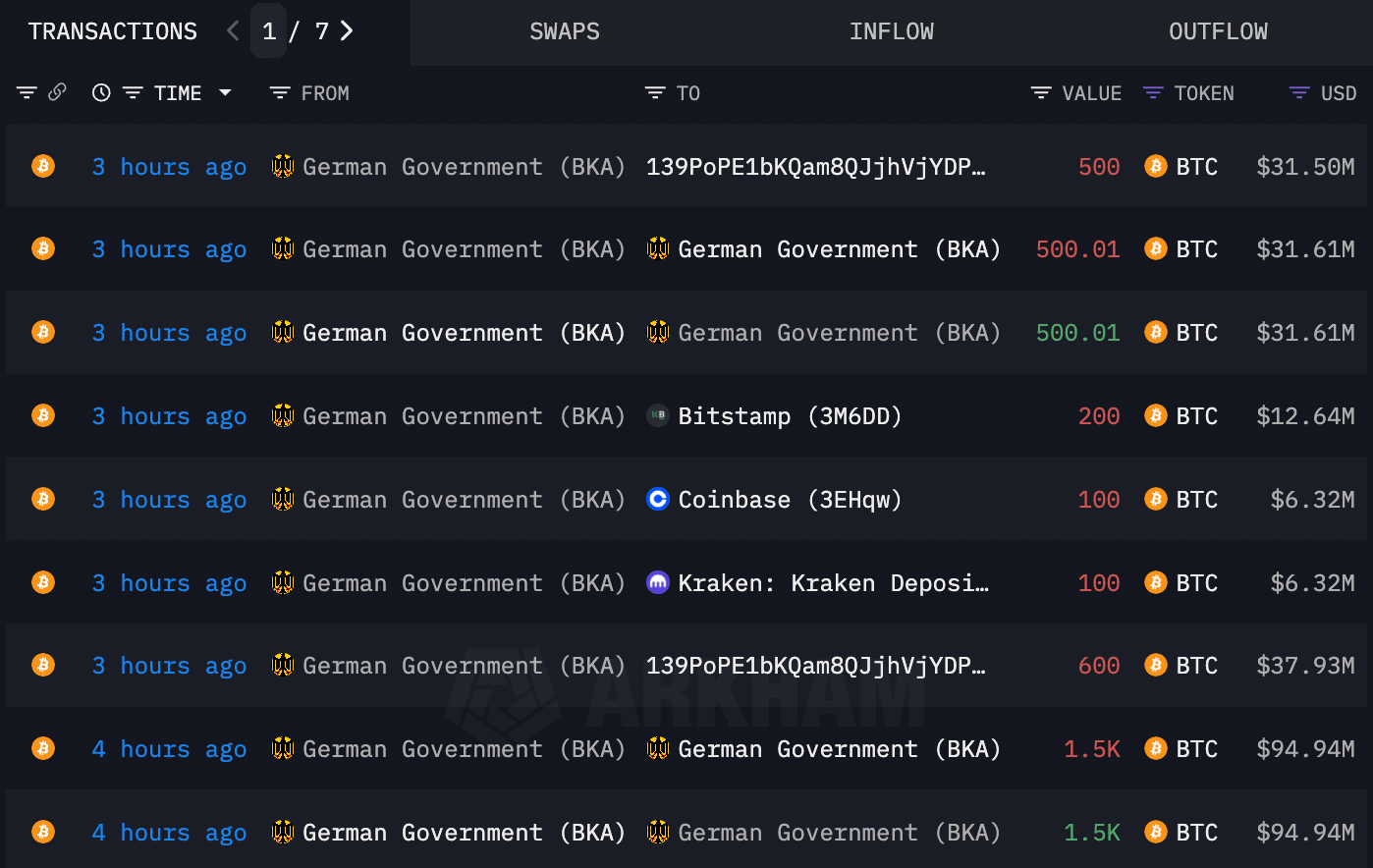

- Arkham Intelligence data shows that the German Government transferred a total of 400 BTC to exchanges BitStamp, Coinbase, Kraken. This represents over $25 million in BTC, fueling concerns among Bitcoin holders.

German Govt. Bitcoin transfers

- Analyst calls crypto market bottom, backs it with on-chain data, and identifies the right time to buy Bitcoin.

Crypto Market has potentially found a bottom, i've enough data to prove that

— hitesh.eth (@hmalviya9) June 25, 2024

- The Artificial Superintelligence Alliance announced ASI Phase 1 of token migration. Crypto exchanges have started delisting AGIX and OCEAN and balances will reappear as FET. FET holders do not need to take additional steps per the announcement.

ASI Phase 1 Token Migration

— Artificial Superintelligence Alliance (@ASI_Alliance) July 1, 2024

Exchanges have begun delisting of AGIX and Ocean, users may see their balances affected by this, we are working with all supporting parties to execute the migration, and then user balances will reappear as FET.

The first AGIX and OCEAN migrations…

Industry updates

- Sony subsidiary Amber Japan has rebranded to S.BLOX. The firm has plans to expand its crypto trading services.

Exclusive: Sony Group, one of Japan's largest companies, has acquired Amber Japan, officially entering the crypto exchange field. Sony's businesses include games, music, cameras, etc., with a market value of more than $100 billion. Singapore market maker Amber Group acquired… pic.twitter.com/XOHFIUmKtJ

— Wu Blockchain (@WuBlockchain) July 1, 2024

- Roaring Kitty, aka Keith Gill, is facing a class action lawsuit for the alleged “pump and dump” of Gamestop’s GME.

$GME -7% premkt

— *Walter Bloomberg (@DeItaone) July 1, 2024

GAMESTOP SHARES SLIDE AS ROARING KITTY HIT WITH SECURITIES FRAUD LAWSUIT

Keith Gill, a stock trader known for his role in the 2021 GameStop short-squeeze, is facing securities fraud allegations in a class-action lawsuit related to recent social media posts that…

Crypto market capitalization climbed nearly 2% in the past 24 hours, crossing $2.429 billion per CoinGecko data.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B16.55.56%2C%252001%2520Jul%2C%25202024%5D-638554366505481613.png&w=1536&q=95)