Crypto Today: Bitcoin retreats after tagging new record high, Ethereum upholds uptrend

- Bitcoin pulls back after reaching a new record high of $124,474 on Thursday.

- Ethereum holds near all-time highs amid rising institutional interest in spot ETFs.

- XRP bulls struggle to uphold the uptrend despite a steady increase in the futures weighted funding rate.

Bitcoin (BTC) corrects on Thursday after extending a breakout to a new record high of $124,474 earlier in the day, trading at $121,615 at the time of writing. The uptrend triggered price increases among altcoins, with Ethereum (ETH) approaching its record high above $4,800 reached in November 2021.

Ripple (XRP), on the other hand, is struggling to uphold its uptrend toward the all-time high of $3.66, signaling a potential correction to collect liquidity toward the key support at $3.00.

Market overview: Ethereum dominates institutional capital inflows

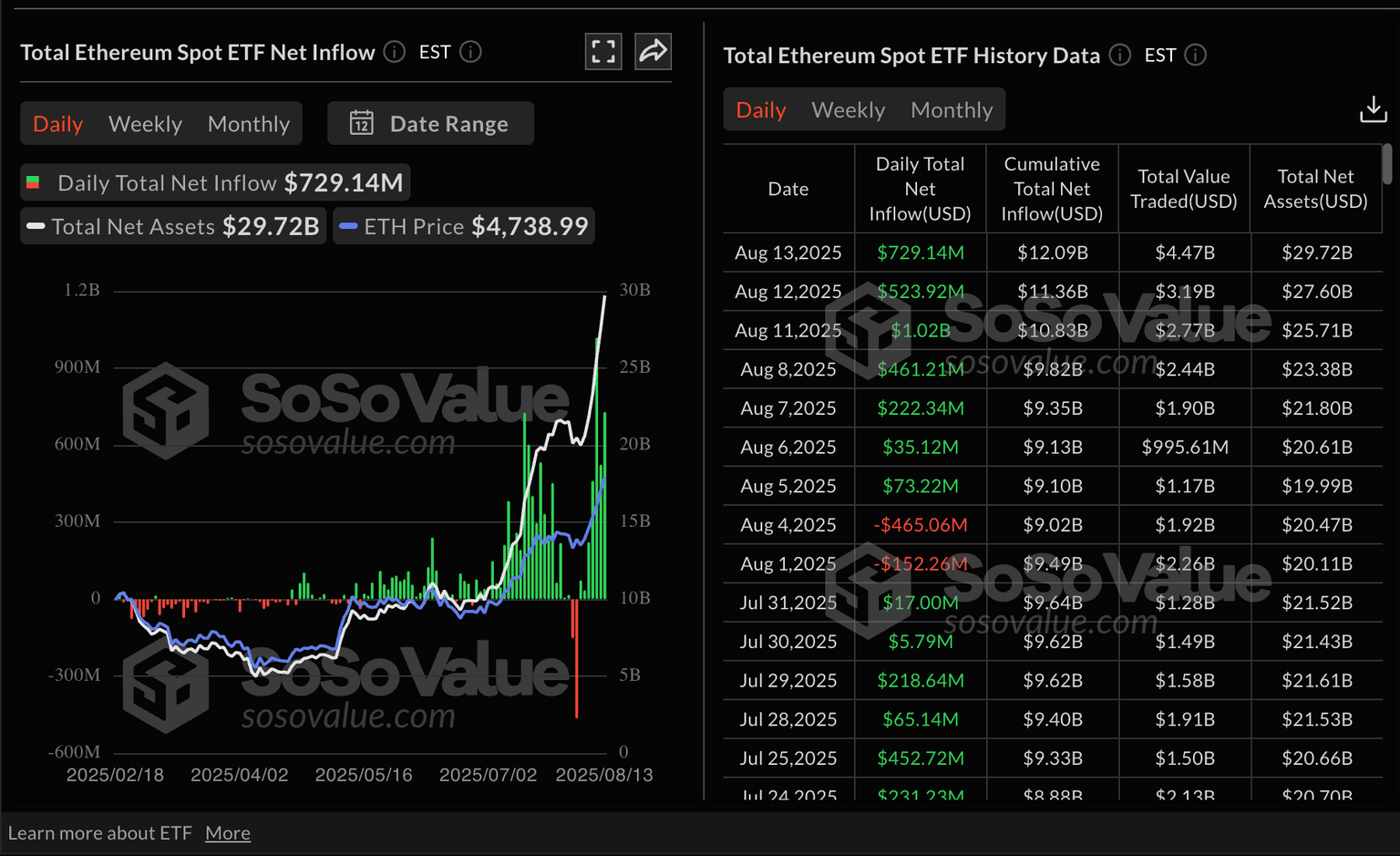

US-listed Ethereum spot Exchange Traded Funds (ETFs) continue to outperform BTC spot ETFs . According to SoSoValue data, ETH spot ETFs saw a total of $729 million in net inflows on Wednesday, up from the $524 million recorded on Tuesday.

On Monday, Ethereum ETFs inflow exceeded $1 billion for the first time, underscoring the recent attention the largest smart contracts token is receiving from institutional investors.

Ethereum spot ETFs data | Source: SoSoValue

As for Bitcoin spot ETFs, inflows have been steady but significantly lower than levels seen before the price hit the previous all-time high of $123,218 in mid-July. SoSoValue data highlights approximately $87 million in net inflow on Wednesday, slightly above Tuesday’s inflow of $66 million.

Bitcoin spot ETFs data | Source: SoSoValue

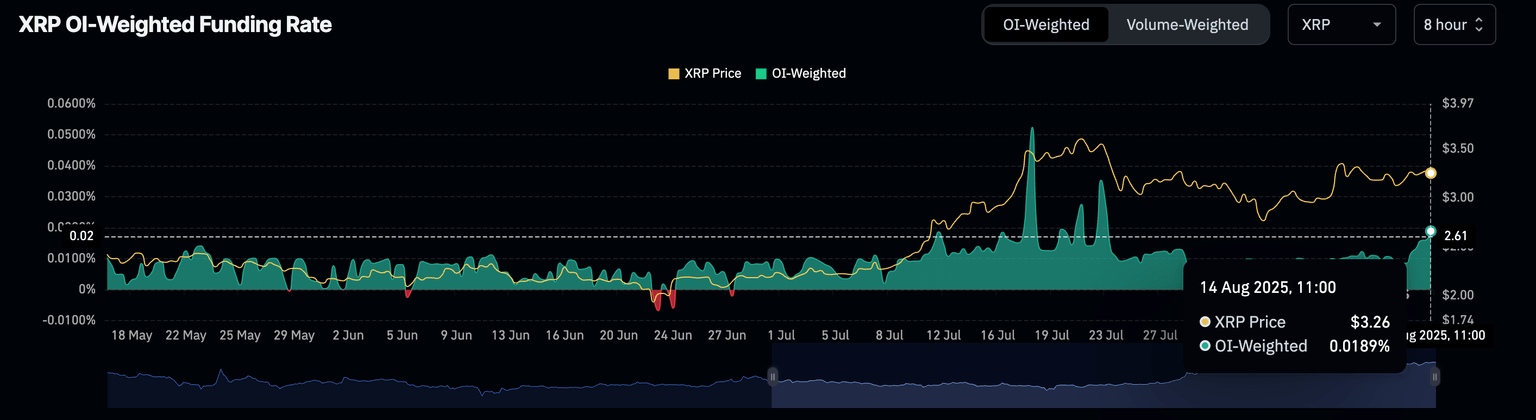

Meanwhile, interest in XRP remains elevated, considering the steady rise in the futures weighted funding rate, averaging at 0.0189%. The chart below shows that the weighted funding rate dipped slightly in the negative on August 1 before traders increased exposure, leveraging long positions in XRP.

A higher funding rate level indicates increased interest in the token backed by traders leveraging short-term price increases.

XRP Weighted Funding Rate | Source: CoinGlass

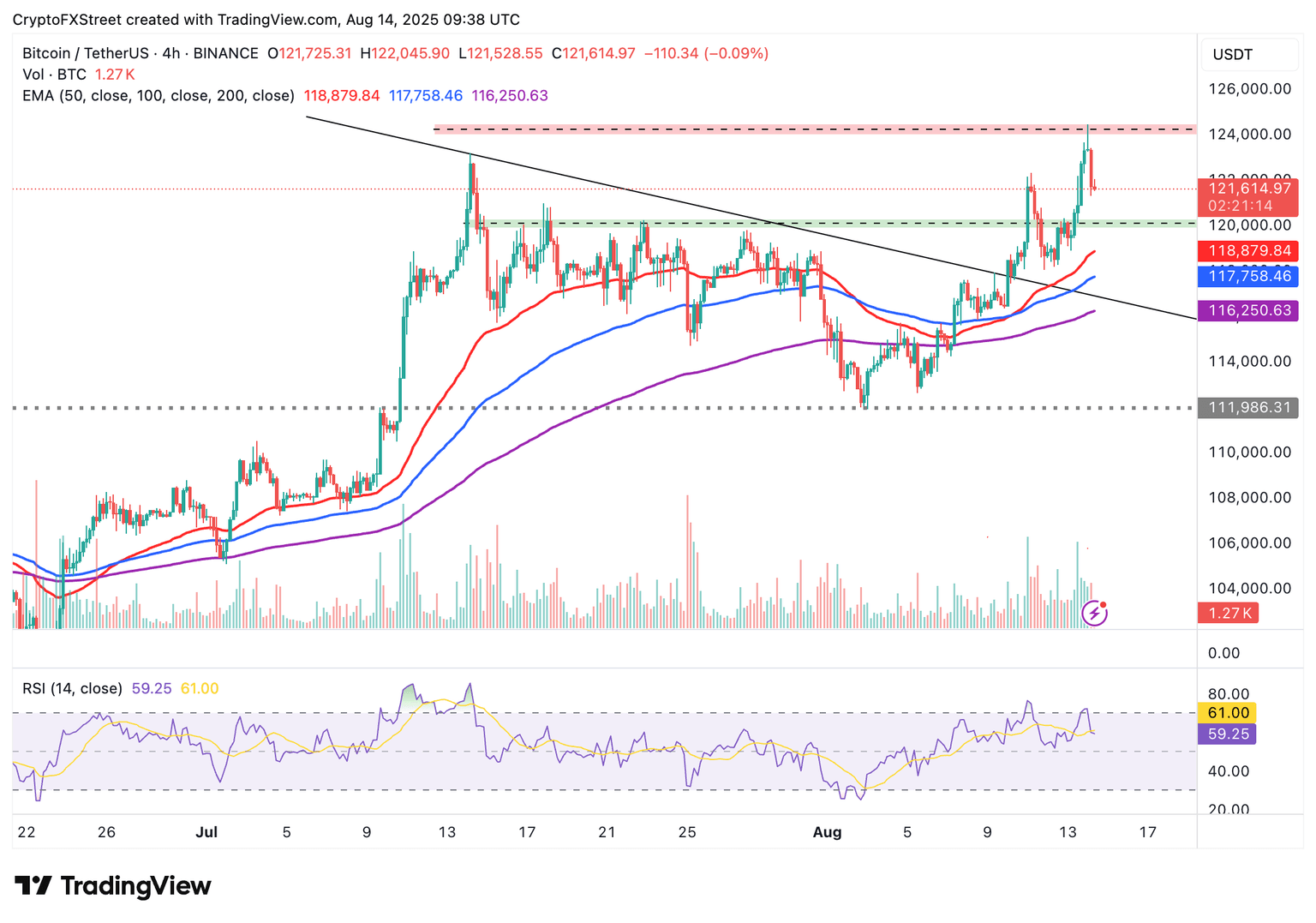

Chart of the day: Bitcoin holds above $120,000 support

Bitcoin price extended the breakout on Thursday, tagging a new record high before correcting due to potential profit-taking or to collect liquidity before attempting a bid for a new milestone above the $125,000 mark.

The Relative Strength Index (RSI) is stabilizing slightly above the midline on the 4-hour chart, suggesting that there is room for more growth if traders increase exposure.

Still, if the RSI declines below the midline as the price of BTC falters toward support at $120,000, tested as resistance on August 12, the path of least resistance could remain downward.

BTC/USDT daily 4-hour chart

Altcoins update: Ethereum holds uptrend as XRP falters

Ethereum is trading close to its record high above $4,800 and the weekly high at $4,788. Bulls are largely in control, backed by a rising RSI currently stable in overbought territory on the daily chart.

ETH/USDT daily chart

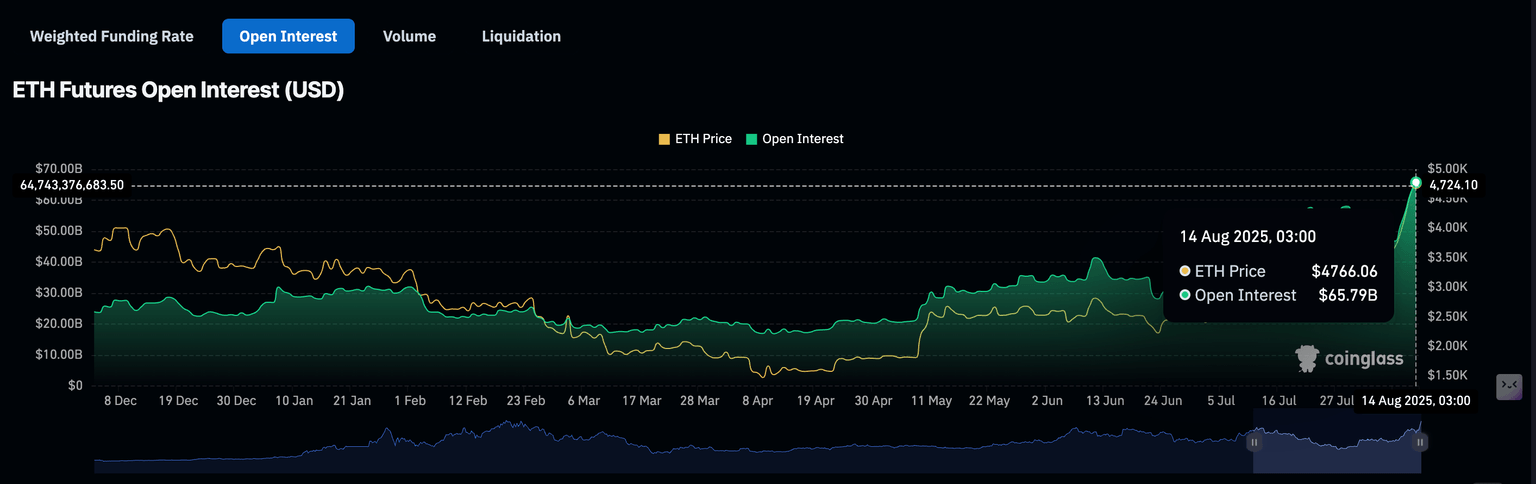

The steady increase in speculative demand, both from institutional and retail investors, reinforces Ethereum’s bullish outlook. A breakout above its record high could boost interest in ETH, especially with the futures Open Interest (OI) accelerating to $66 billion on Thursday.

Ethereum Futures Open Interest | Source: CoinGlass

As for XRP, sellers are becoming dominant on Thursday, with the price declining over 1% to exchange hands at around $3.23. The downward-trending RSI backs the short-term bearish outlook.

XRP/USDT daily chart

Key areas of interest for traders are the support at $3.00, tested in late July, while resistances are around $3.40 tested on Friday and the record-high of $3.66 reached on July 18.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren