Crypto Selloff, Bitcoin again below $10K

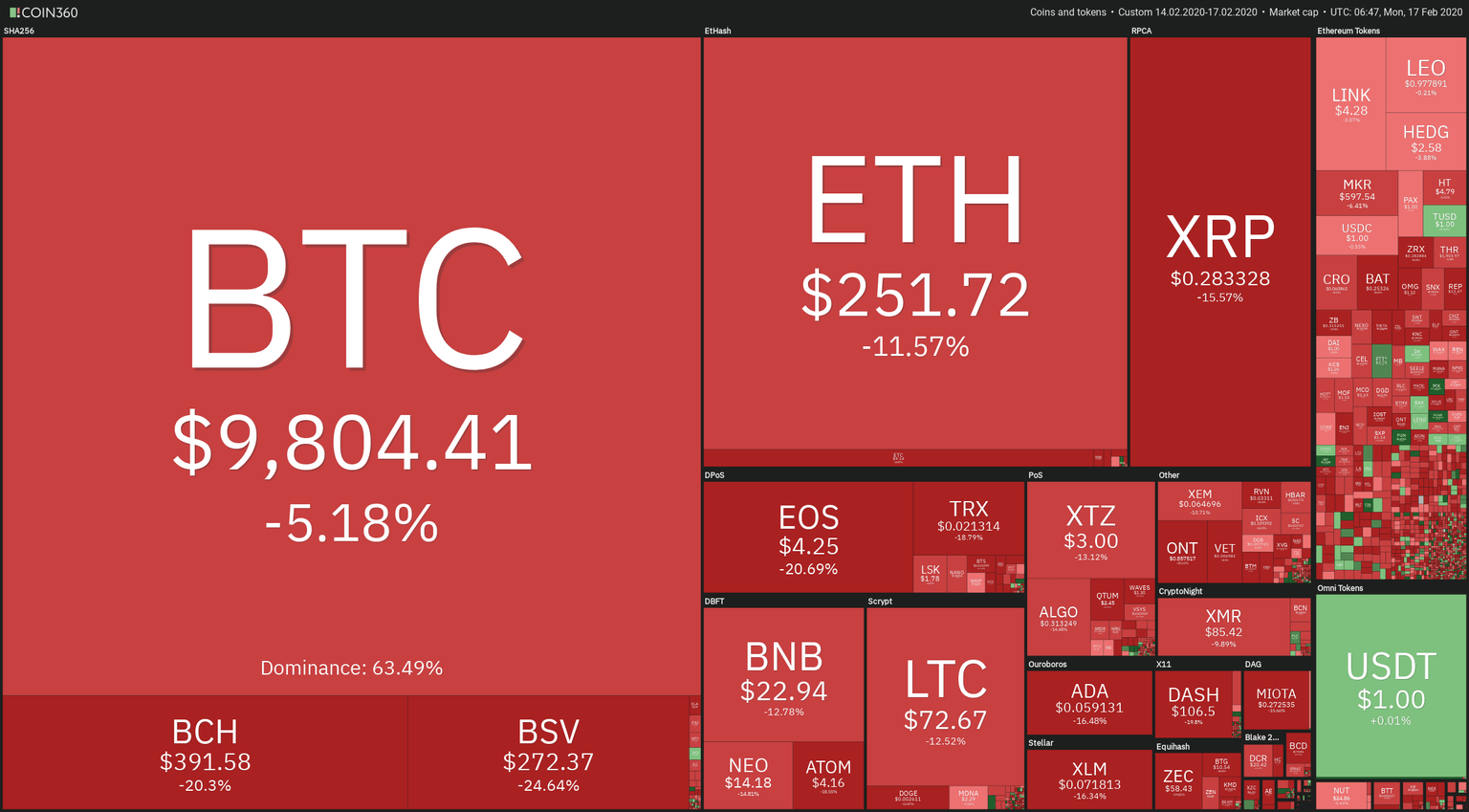

Cryptocurrency markets had a lousy weekend, especially altcoins. Bitcoin had a 5.18 percent drop to $9800, but it was the best performer. Bitcoin Cash, BitcoinSV, and EOS are falling over 20 percent, and the majority of the leading cryptos dropping over 10 percent. Ethereum tokens also took a hit, with ZRX(-19.3%), REP(-18.8%)OMG(-18.6%), and BAT(-18.21) among the worst performers during the weekend. Worth Noting that FFT* gained 8-66 percent and also moving strong FUN(+26.19%), POWR(+18.1%), FSN(+24.65%) and MX(+50.4%).

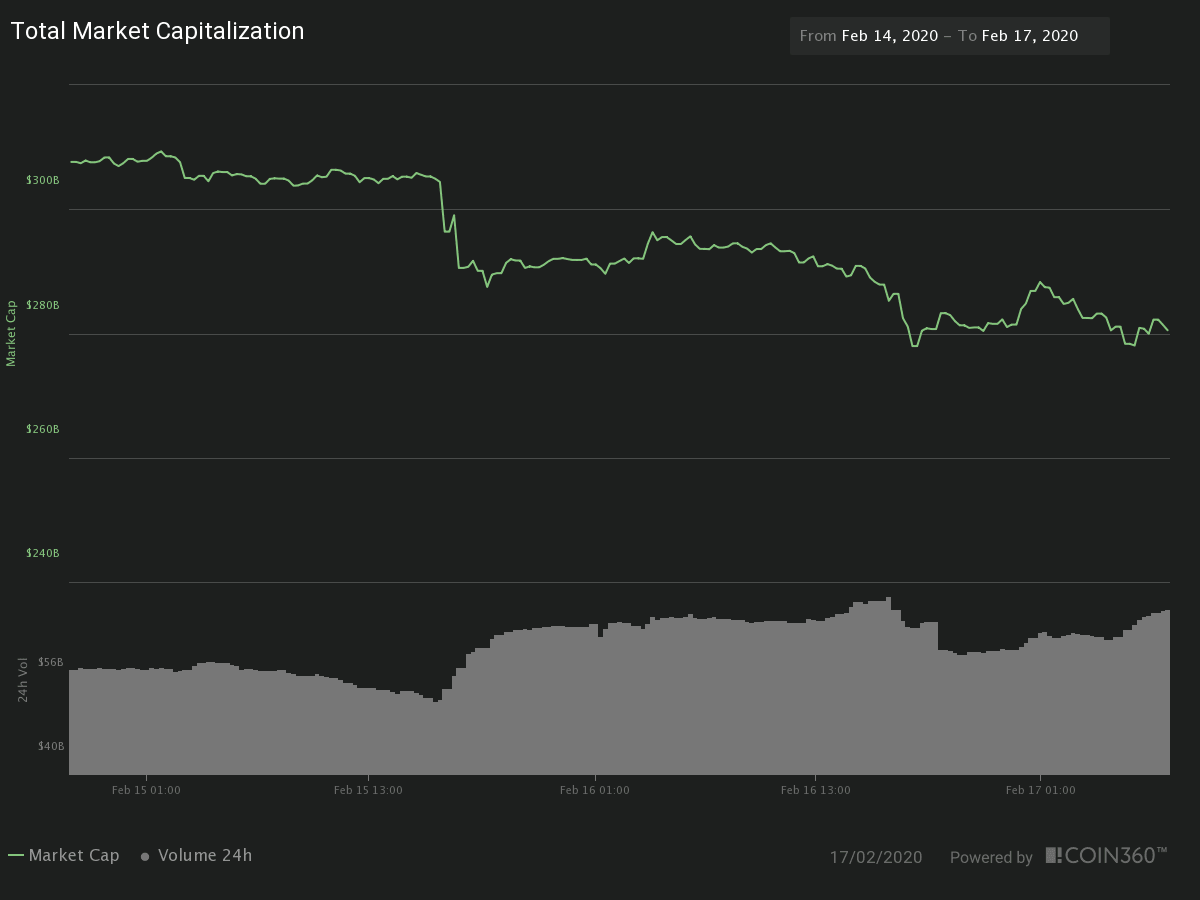

The Market capitalization dropped $28.8 billion during the whole weekend, which represents a 9.31 percent drop. The drop happened with a heavy volume of about $70 billion in a 24H period. As bitcoin was performing better than the rest of the market, its dominance grew to 63-68 percent.

Hot News

Craig Wright warns Bitcoin and Bitcoin Cash to stop using the Bitcoin database if they want to avoid a lawsuit, claiming that both may be violating the original terms of the original EULA and MIT license.

"As the creator of Bitcoin, I maintain the sui generis rights to any copy of the database created from Genesis in January 2009. I shall not be relinquishing the ownership. I will be licensing it, and have already engaged in a process." (Source: cointelegraph.com)

Technical Analysis - Bitcoin

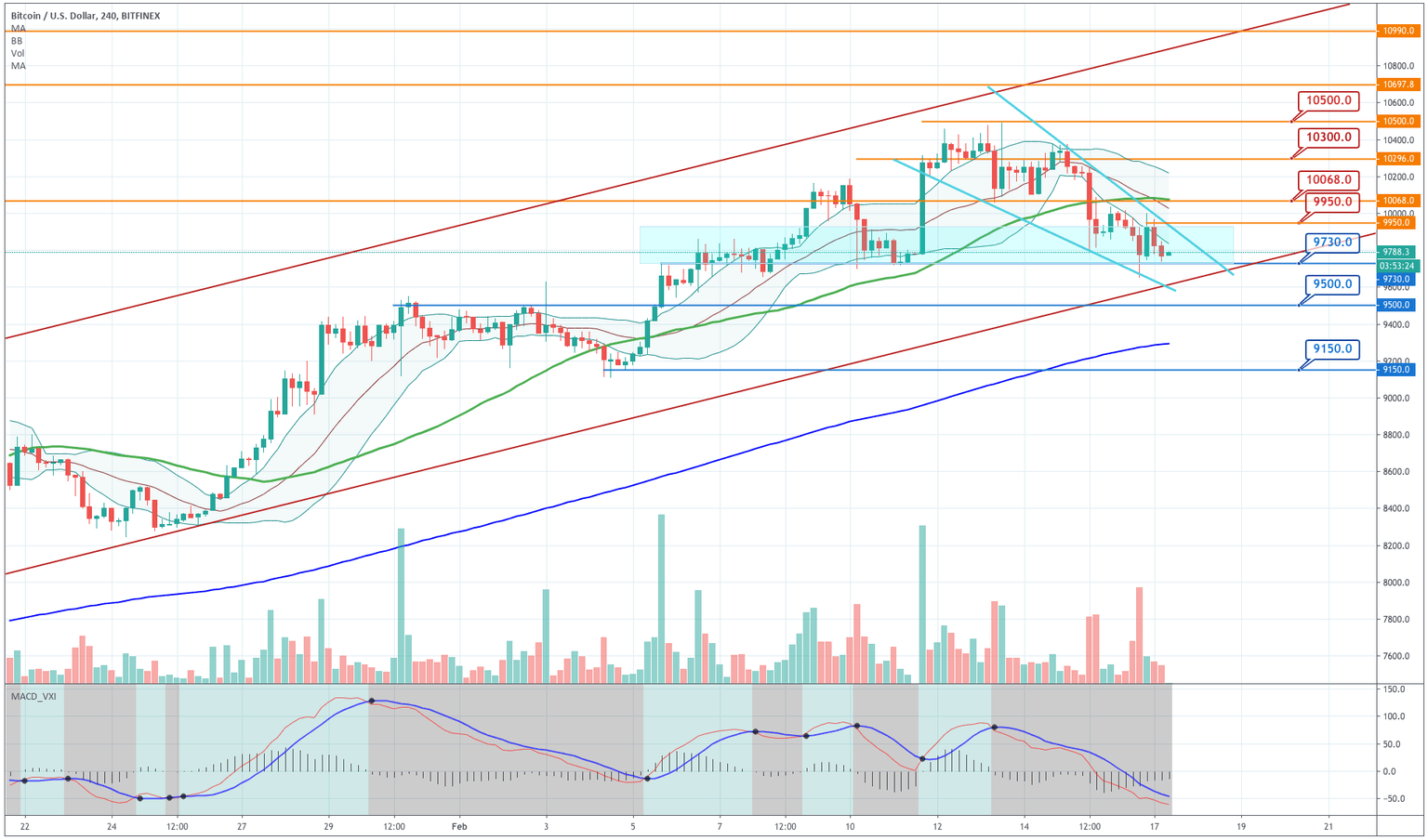

Bitcoin dropped below $10K on Saturday, and continue doing so on Sunday and Monday's early morning. In the 4H chart, we can see that the price is approaching the lower side of the ascending channel and that the $9,730 level seems to act as support. Currently, the price is moving below the -1SD Line, in what looks like a descending wedge. Right now, the price is in a support area; thus, we need to observe the resolution of the fight between buyers and sellers to control the movement of the price. The critical levels to keep are $9,730 to the downside and 9950 to the upside.

|

Support |

Pivot Point |

Resistance |

|

9,730 |

9,950

|

1,068 |

|

9,500 |

10,300 | |

|

9,150 |

10,500 |

Ripple

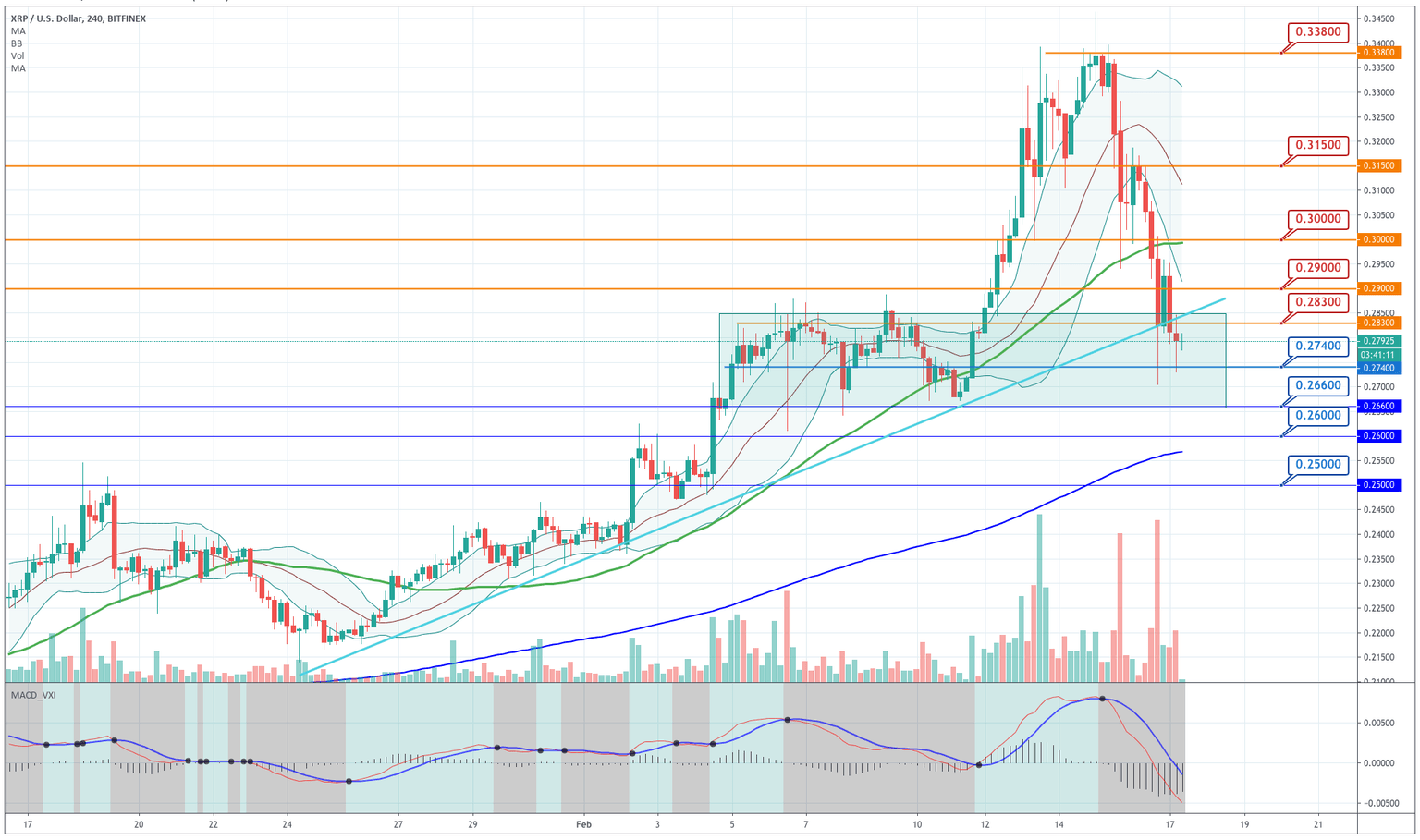

Ripple has been dropping very hard in the last few days, and its price lost 19 percent since its top made last Saturday. Currently, the price went back to the consolidation area, previous to its last run-up. The $0.274 and $0.266 levels are essential to hold the price. If that does not happen, it would be the end of the bull run of this asset. The price is below its -1SD Bollinger line and the MACD in a bearish phase; thus, it is better to be in the sidelines.

|

Support |

Pivot Point |

Resistance |

|

0.2660 |

0.2900

|

0.3000 |

|

0.2500 |

0.3150 | |

|

0.2370 |

0.3380 |

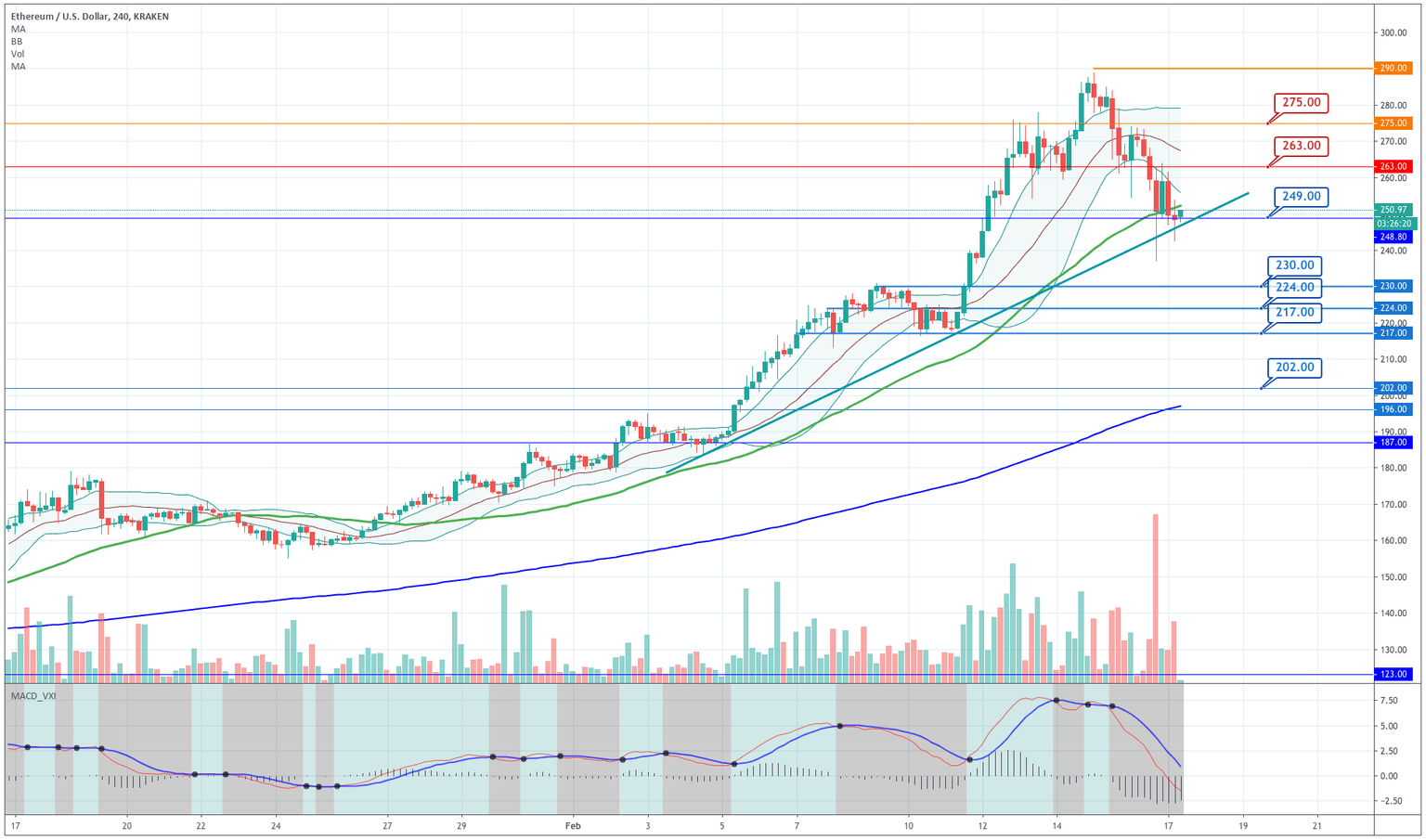

Ethereum

Ethereum had an incredible run up last week, which drove its valuation from $217 to $288, a 32 percent move up. During the last weekend, it is retracing part of its gains, as it was highly overbought. The price needs to create a bottom to resume the trend from there. Currently, it is moving in the $250 level, under the -1SD Bollinger line, and touching its 50-period SMA. We see also that the upward trendline still holds. Thus, we still think this is a healthy correction and that ETH still has room to move up. Another break of the $263 level would bring strength to the buyers.

|

Support |

Pivot Point |

Resistance |

|

249 |

263

|

275 |

|

238 |

290 | |

|

230 |

300 |

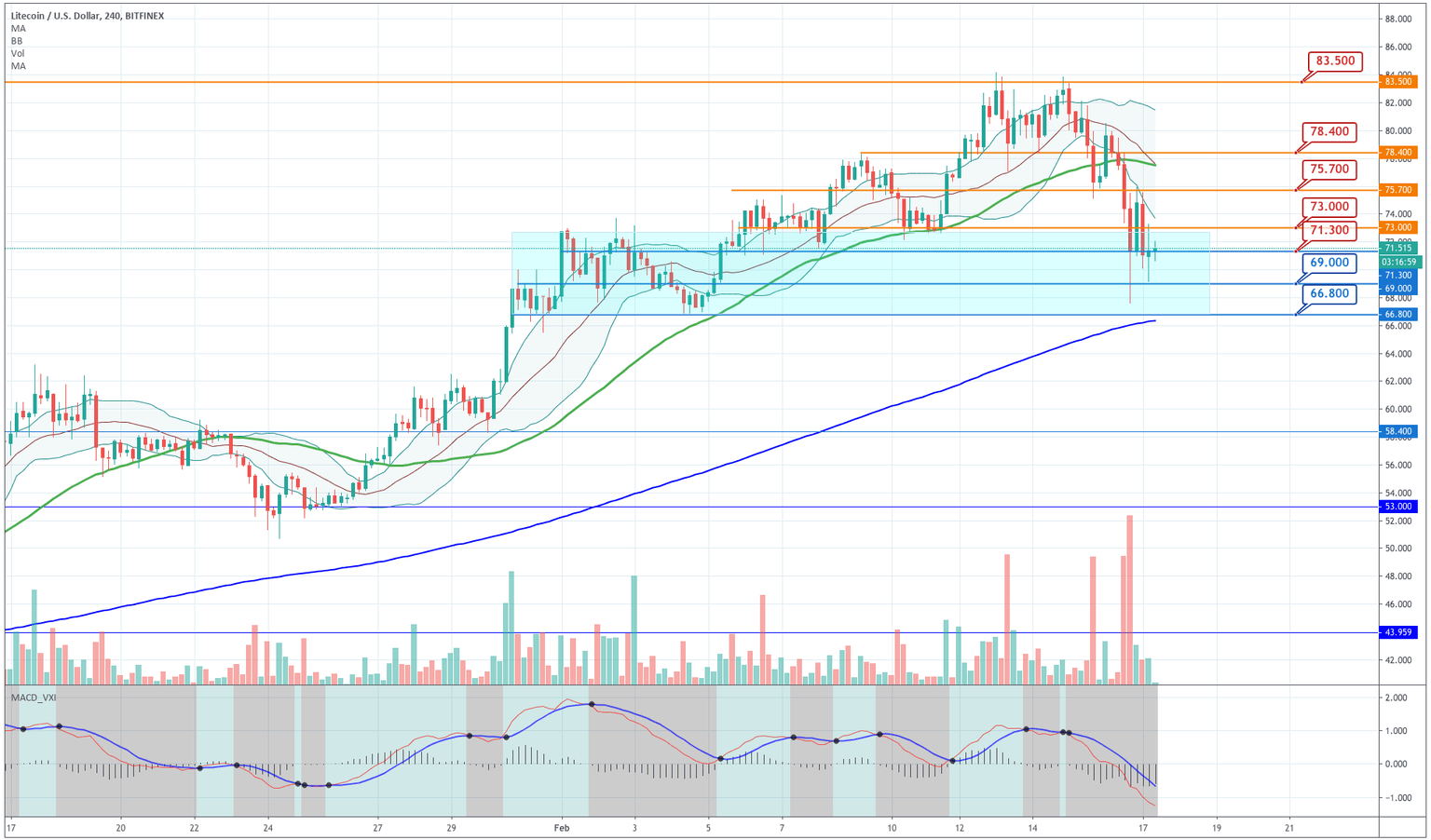

Litecoin

Litecoin has dropped hard at the weekend and has erased almost all the gains made in February. The price is moving quite bearish, and now it is entering into what was the consolidation region made at the beginning of February. We have to wait for the price to make a bottom here. We still maintain the upward bias, as its 200-period SMA is still pointing upward, but the current situation is not. We can see that the bearish candlesticks show a strong volume. Maybe this is a bottoming volume, but, as said, we need to see it create a bottom and the price move to the upper side of the Bollinger bands.

|

Support |

Pivot Point |

Resistance |

|

71.3 |

75.7

|

78.4 |

|

69 |

80 | |

|

66.8 |

83.5 |

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and