Crypto scams drain $10 billion from users in pig butchering, AI and illicit schemes

- Crypto scam revenue exceeded $12 billion in 2024, according to Chainalysis.

- The rise of AIand illicit marketplaces is supporting the professionalization of scams in the US and worldwide.

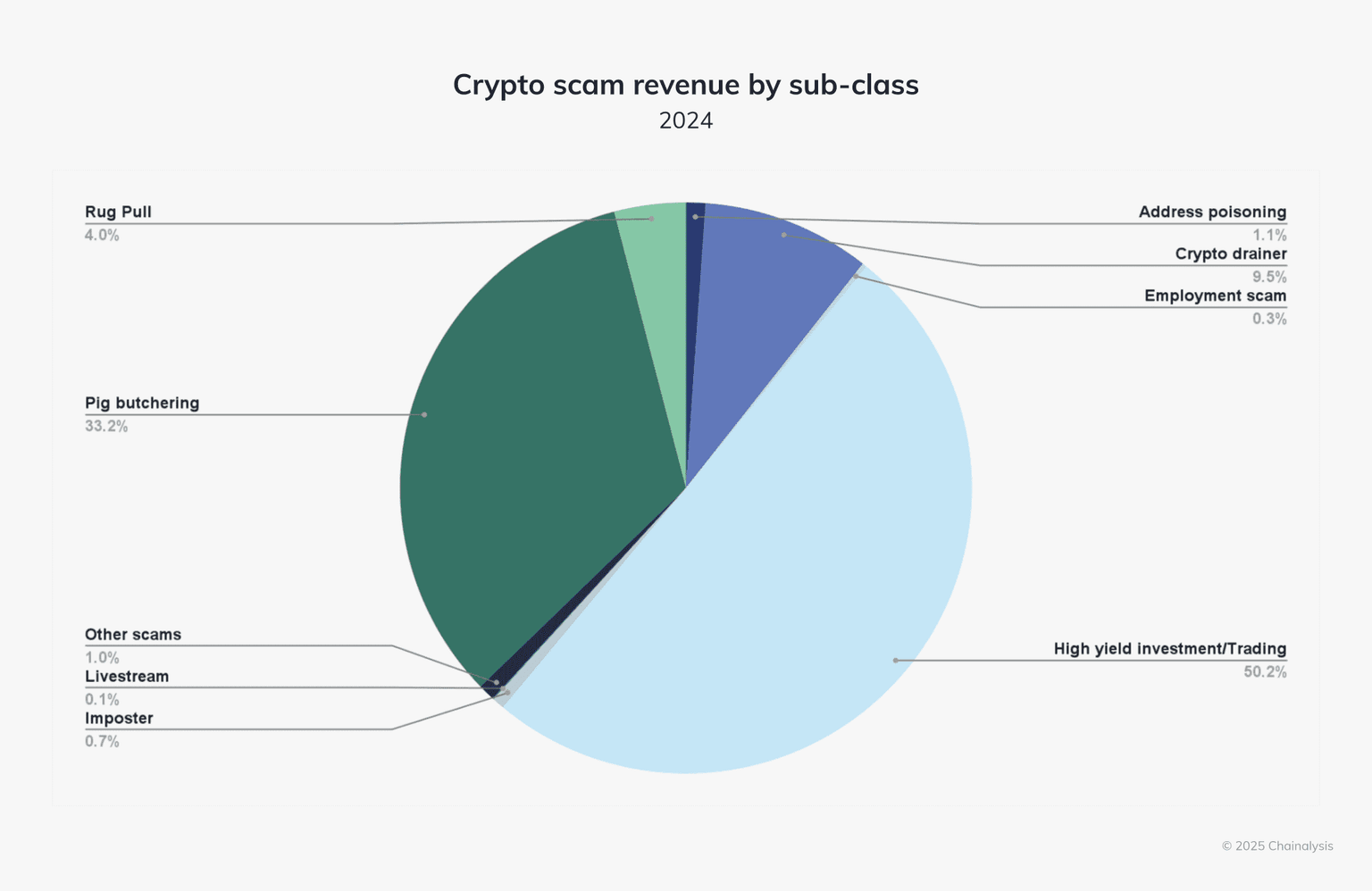

- High-yield investment scams accounted for over 50% of total scam revenue in 2024.

Crypto intelligence tracker Chainalysis tracked nearly $10 billion in funds lost to scams in the crypto ecosystem. The data firm projected that scam revenue would exceed $12 billion as the list of illicit addresses grew.

The firm published a preview of its 2025 Crypto Crime Report on Thursday listing the key sources of crypto scams and the volume of funds stolen from victims in 2024.

Crypto ATMs, high-yield investment scams and pig butchering drain victims

High-yield investment schemes (HYIS) are typically unregistered investments run by unlicensed individuals, defrauding investors and contributing to scam revenue tracked by Chainalysis. HYIS accounted for over 50% of the total scam revenue despite the year-on-year decline, according to the report.

Pig butchering scams, in which individuals are targeted and defrauded by being convinced to invest in ponzi schemes via large scam compounds in Southeast Asia, led the scam economy with a 40% year-on-year increase in scam revenue. The report traced a 210% rise in deposits made by victims to illicit addresses traced to such schemes in 2024.

Crypto ATMs wiped out over $65 million within the first half of 2024, primarily targeting the elderly. Even as agencies like the FBI and the Federal Trade Commission (FTC) issued warnings, the scams continued to grow in the United States (US) and abroad.

Crypto crime operations turned more sophisticated than in previous years, streamlining operations as a one-stop-scam-shop and money laundering services.

Crypto scam revenue by sub-class | Source: Chainalysis

Andrew Fierman, Head of National Security Intelligence at Chainalysis, commented on the professionalization of the scam ecosystem and how it has significantly lowered the barrier for entry for illicit actors.

“With the ability to purchase Personally Identifiable Information, AI technology, and falsified documentation in just a few clicks, scammers can launch operations quickly at minimal cost. While this ease of access fuels fraud, it also creates a major opportunity for the public and private sectors to leverage advanced blockchain analytics to disrupt these networks and recover funds,” Fierman said in the report.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.