Crypto market dips, wiping out over $630 million in liquidations while Metaplanet adds 5,419 BTC

- CoinGlass data indicates that over $630 million in leveraged crypto positions were liquidated within the past 24 hours.

- Long positions accounted for 89% of the wiped-out trades, with the largest single liquidation being a $12.66 million BTCUSD order on Binance.

- Metaplanet boosted its Bitcoin holdings with a fresh purchase of 5,419 BTC, raising its total stash to 25,555 BTC.

Crypto markets experienced turbulence over the past 24 hours, with over $630 million in leveraged positions liquidated, 89% of which were long positions—highlighting overly bullish positioning. Despite the sell-off, institutional sentiment stayed firm as Metaplanet expanded its Bitcoin holdings with a purchase of 5,419 BTC.

Over 218,000 traders were liquidated in the last 24 hours

The week started with a negative tone for the cryptocurrency market, with major crypto such as Bitcoin (BTC) falling below $115,000 during the early Asian trading session on Monday. Altcoins, such as Ethereum (ETH), Ripple (XRP), and Solana (SOL), experienced a pullback, while meme coins suffered deeper losses.

This sudden pullback sparked a wave of liquidations across the market, with over 218,000 traders liquidating positions worth more than $630 million in the last 24 hours, according to Coinglass data. Notably, 89% were long positions, underscoring the market’s overly bullish positioning. The largest single liquidation occurred on Binance, where a BTCUSD position worth $12.66 million was liquidated.

Liquidation Heatmap chart. Source: Coinglass

Metaplanet adds 5,419 BTC to its treasury

Despite this price drop, Bitcoin institutional demand started the week on a positive note. Japanese investment firm Metaplanet announced on Monday that it has purchased an additional 5,419 BTC, bringing the total holding to 25,555 BTC.

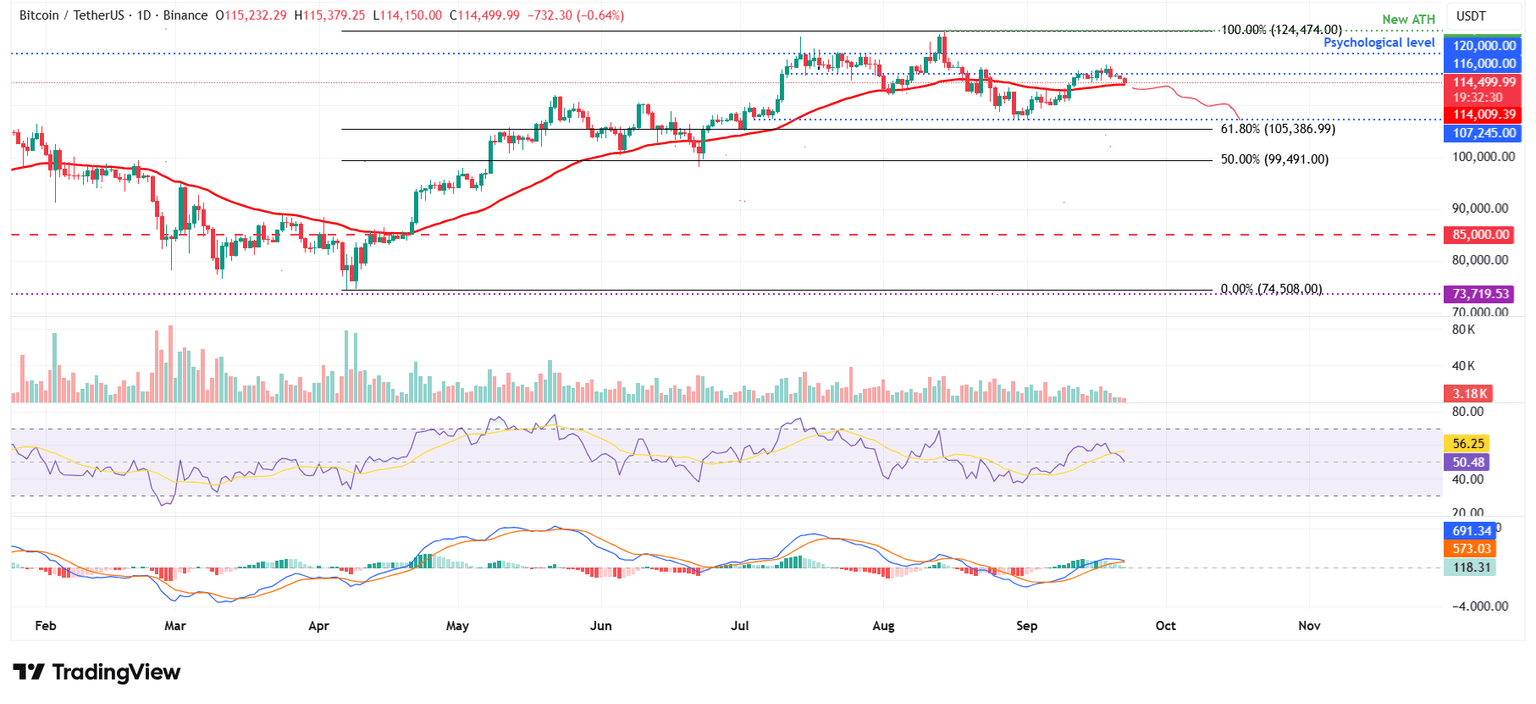

However, traders should still be cautious as the BTC daily chart below shows that it hovers around key support at $114,009, its 50-day Exponential Moving Average (EMA). A firm close below this support zone could extend further losses on BTC and the broader crypto market.

Additionally, the Relative Strength Index (RSI) on the daily chart is slipping below its neutral level of 50, indicating early bearish momentum. The Moving Average Convergence Divergence (MACD) is also converging and is about to flip to a bearish crossover, further supporting the bearish view.

BTC/USDT daily chart

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.