Why Dogecoin (DOGE) may be entering a new parabolic bull run

Dogecoin’s (DOGE) price history shows three major parabolic rallies in 2017, 2021, and 2024. With clearer drivers emerging in 2025, analysts expect another parabolic bull phase to be on the horizon.

What forms the basis of this expectation? The following sections break it down in detail.

DOGE holders reach an all-time high in September

The number of Dogecoin holders hit a new all-time high in September 2025, surpassing 8 million.

A Santiment chart highlights this surge. The red line, representing total holders, has risen sharply since 2020, reaching 7 million in early 2025 and climbing past 8 million recently.

%20%5B09-1758288128269-1758288128270.48.31%2C%2018%20Sep%2C%202025%5D.png&w=1536&q=95)

Total Amount of Holders (DOGE). Source: Santiment.

With DOGE trading around $0.28, this rise in holders signals fresh capital entering the market. It may also serve as an early indicator of a new bull cycle.

The growing community not only reflects renewed confidence but also strengthens liquidity. This higher liquidity helps DOGE withstand volatility more effectively.

CoinMarketCap data shows that DOGE ranks fourth in daily trading volume, excluding Bitcoin and Tether—behind only Ethereum, Solana, and XRP.

Whale transactions surge in Q3

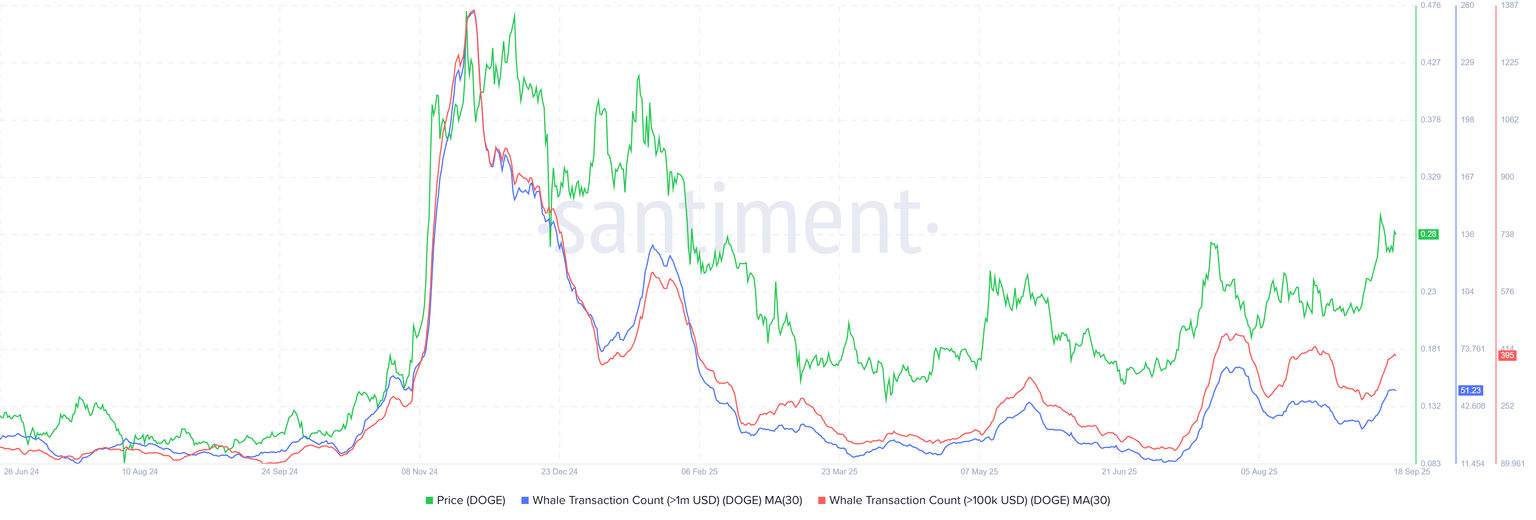

Large whale transactions above $100,000 and $1 million increased sharply in Q3 2025, signaling the early stages of a potential parabolic move.

DOGE Whale Transaction Count. Source: Santiment

A second Santiment chart illustrates this clearly. The green line shows DOGE’s price, the red line represents whale transactions above $1 million (30-day MA), and the blue line tracks transactions above $100,000 (30-day MA).

Since June 2025, both whale metrics have risen in parallel with DOGE’s recovery from below $0.15. This trend suggests that large investors are accumulating and positioning ahead of incoming capital that could drive the price to new highs.

Another key catalyst is the launch of the first U.S.-listed ETFs offering spot exposure to DOGE.

According to announcements, the DOGE ETF (ticker: DOJE) will begin trading on September 18, 2025, alongside an XRP ETF. This milestone marks the first time a meme coin gains access through traditional financial products. The development mirrors Bitcoin ETFs, which helped push BTC to its all-time high in 2024.

DOGE price structure repeats historical patterns

DOGE’s price structure also repeats patterns observed during past parabolic rallies in 2017 and 2021.

DOGE Price Structure. Source: EtherNasyonaL

Charts show that DOGE typically enters a strong uptrend after breaking out from a four-year resistance zone and retesting it. The rally continues until the monthly RSI moves into overbought territory above 80 points.

Dogecoin, the pioneer of the super memecoin cycle, is entering its parabolic phase,” analyst EtherNasyonaL predicted.

The combination of record-high holders, surging whale activity, the upcoming ETF launch, and repeating price patterns creates a strong case for optimism around DOGE.

However, the cryptocurrency market remains volatile. Regulatory shifts or macroeconomic factors could still trigger unexpected outcomes.

Author

BeInCrypto

BeInCrypto

Since 2018, BeInCrypto has grown into a leading global crypto news platform. Through our award-winning journalism and close ties with industry leaders, we deliver trusted insights into Web3, AI, and digital assets.