Crypto assets see $1.18 billion in inflows after Bitcoin ETF approval

- Crypto investment products, including Bitcoin, Ethereum and Solana, noted inflows amounting to $1.18 billion last week from institutional investors.

- These inflows did not break the record set by Futures BTC ETF, which totaled $1.50 billion in October 2021.

- Solana is the only altcoin facing outflows year-to-date despite being the best-performing altcoin in 2023.

The repercussions of the spot Bitcoin ETF approval saw billions of dollars flow into investment products, but the hype surrounding the event did not manage to recreate history. The initial flow of funds recorded at the time of the Futures Bitcoin ETF approval in 2021 remains unsurpassed.

Bitcoin institutional inflows make a different history

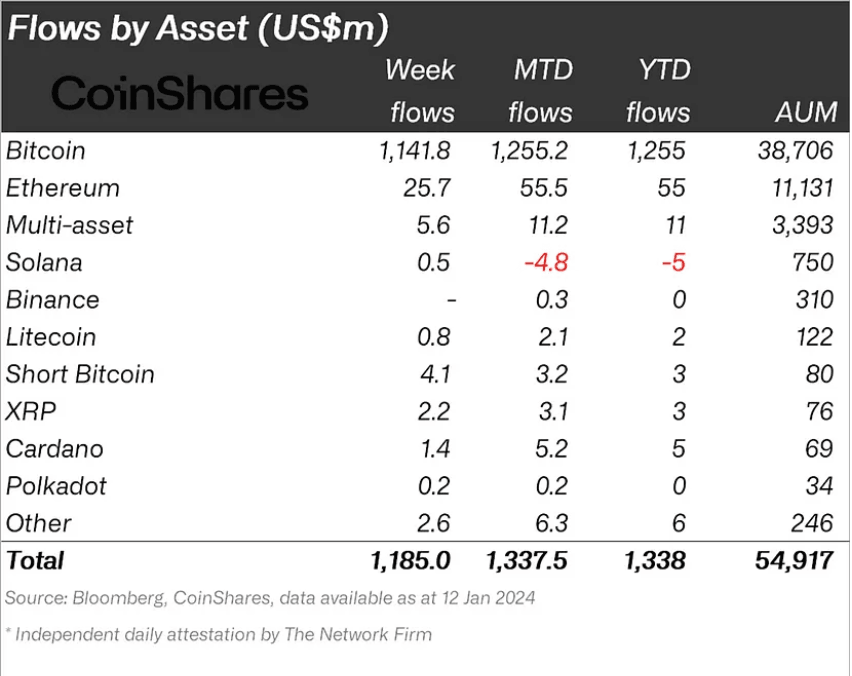

Spot Bitcoin ETF approval led to $1.14 billion being poured into BTC alone, according to data presented by CoinShares. The figure, as of January 12, managed to make head turns but, despite the approval being a global event, failed to live up to the benchmark set by Futures Bitcoin ETFs.

Institutional inflows as of January 12

As noted in the report, Futures-based Bitcoin ETFs totaled $1.50 billion at the time of launch in October 2021. This is a 31.5% higher figure than the one noted in the past week.

However, the total ETP (Exchange Traded Product) trading volume did break certain records, as the figure came in at $17.50 billion last week. In comparison, the average trading volume per week in 2022 was $2.00 billion.

This amount represented about 90% of the daily trading volume noted on trusted exchanges, significantly higher than the average of 2% to 10%.

Solana stands subdued

Apart from the record-breaking trading volume, another surprising development was the lack of inflows into Solana. This comes despite SOL being the standout altcoin in 2023, noting the highest institutional inflows in comparison to all the other assets.

The demand for Solana was such that it managed to surpass the total money poured into Ethereum throughout last year. While ETH witnessed institutions pouring $78 million into the asset, SOL registered inflows of $167 million.

Institutional inflows in 2023

2024 is a different story for SOL. As of January 12, Solana registered inflows of just $500,000 in a week against $5 million pulled out of Solana since the beginning of the year. While the spot Bitcoin ETF approval has flipped the demand for now, this could change going forward.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.