Compound Price Forecast: COMP breaks out of head-and-shoulders pattern targeting $250

- Compound price is on its way to hit $250 as there is very little resistance to the upside.

- The digital asset has broken out of a critical bullish pattern on the 1-hour chart.

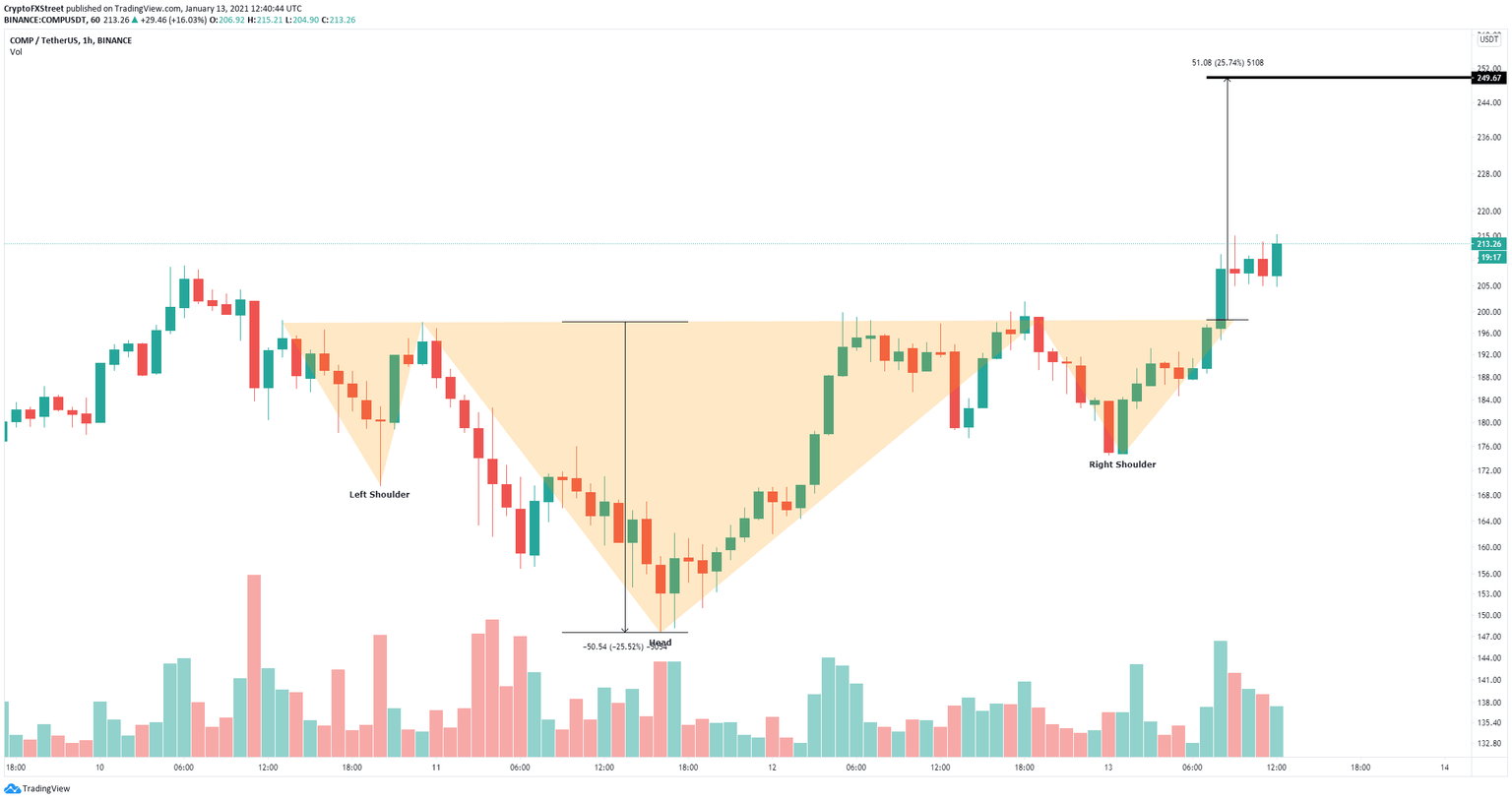

Compound has been trading inside a reverse head and shoulders pattern on the hourly chart since January 10. Finally, COMP had a breakout above the neckline resistance level at $198 while bulls target $250.

Compound price faces almost no opposition towards $250

On the hourly chart, Compound bulls have managed to push the digital asset above the critical resistance level at $198 which was the neckline of the head and shoulders pattern. The breakout took Compound price up to $214.

COMP/USD 1-hour chart

Using the height of the pattern as a reference point, it can be determined that the bullish price target is $250. According to various metrics, there is very little resistance towards this level.

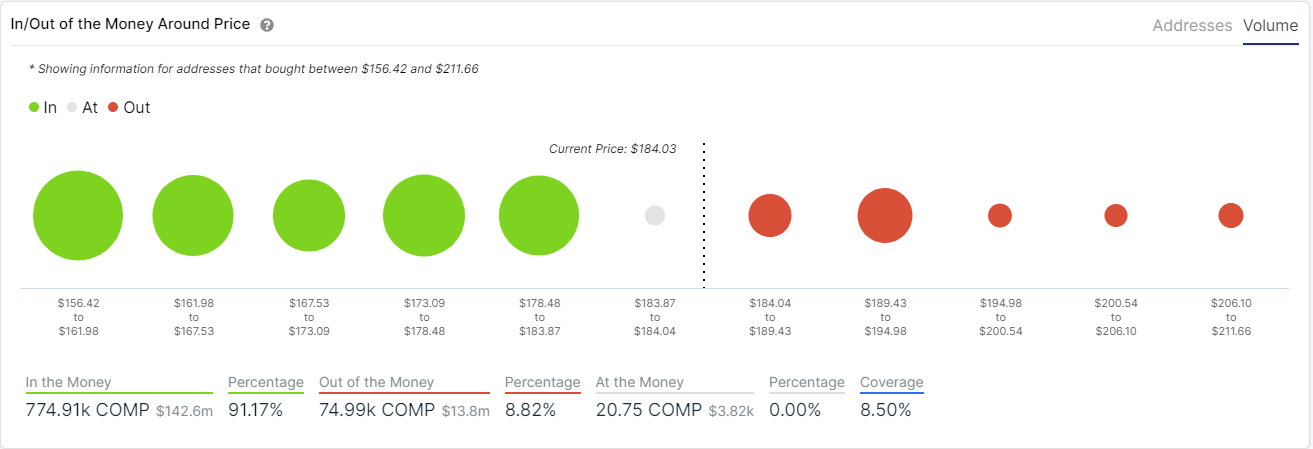

COMP IOMAP chart

The In/Out of the Money Around Price (IOMAP) chart showed the strongest resistance area to be located between $189 and $194. Above that point there seems to be almost no opposition.

COMP Holders Distribution chart

Additionally, the number of whales holding between 10,000 and 100,000 COMP has been increasing significantly since December 2020 from a low of 55 to 62 currently. This indicates that large holders are extremely interested in buying the digital asset despite the rise in price in the same time period.

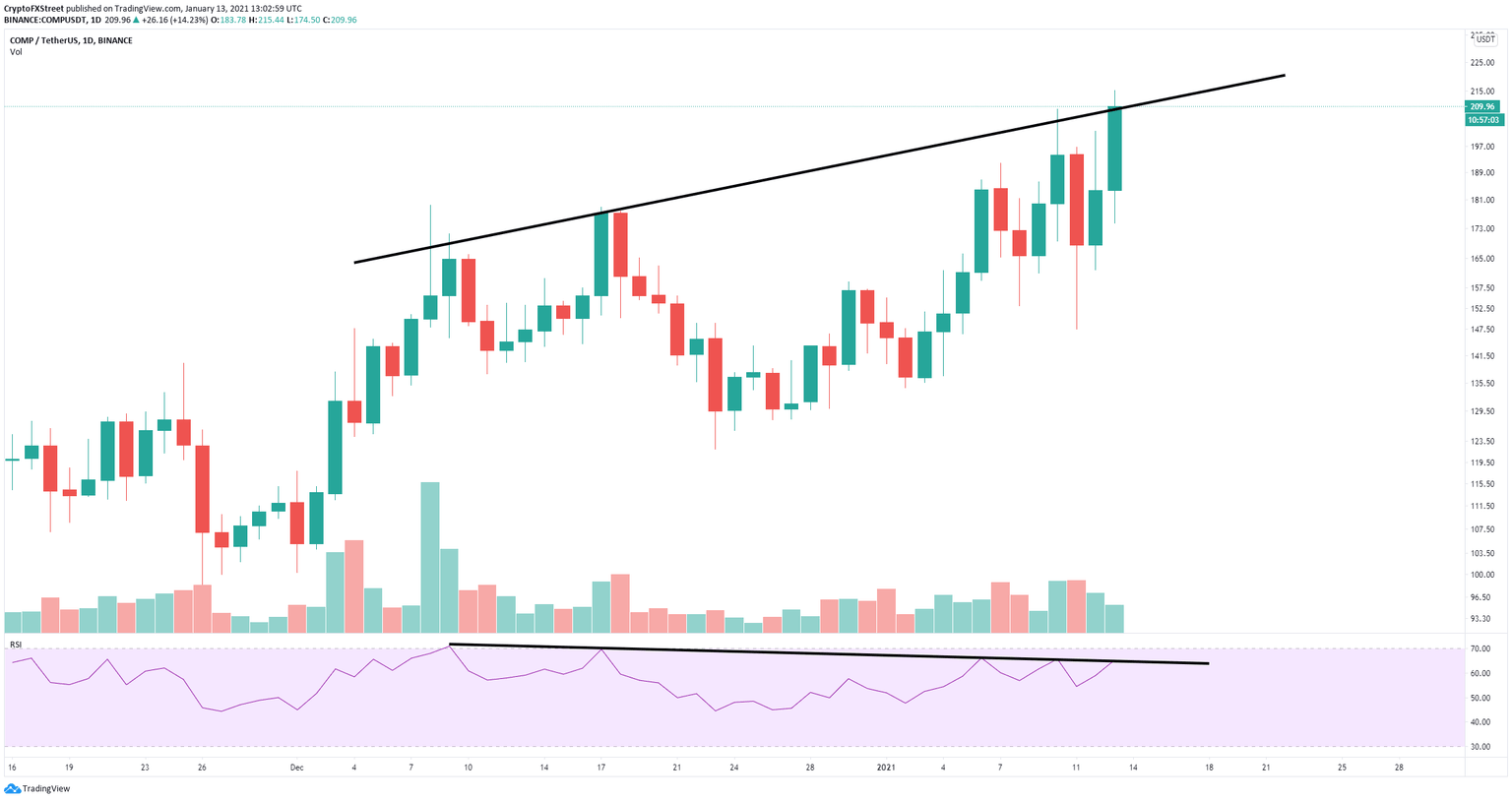

COMP/USD daily chart

However, on the daily chart, the RSI and the price of COMP have formed a bearish divergence. Compound price has established higher highs while the RSI formed lower highs. Additionally, every time the RSI is close to overextended, COMP suffers a pullback.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B13.56.22%2C%252013%2520Jan%2C%25202021%5D-637461398862921134.png&w=1536&q=95)