Coinbase says value of AI tokens may be overstated due to lack of demand drivers

- Artificial Intelligence tokens may lack sustainable demand side drivers in the medium to short term, according to Coinbase.

- The exchange’s recent market intelligence report states that value potential for most AI tokens is likely overstated.

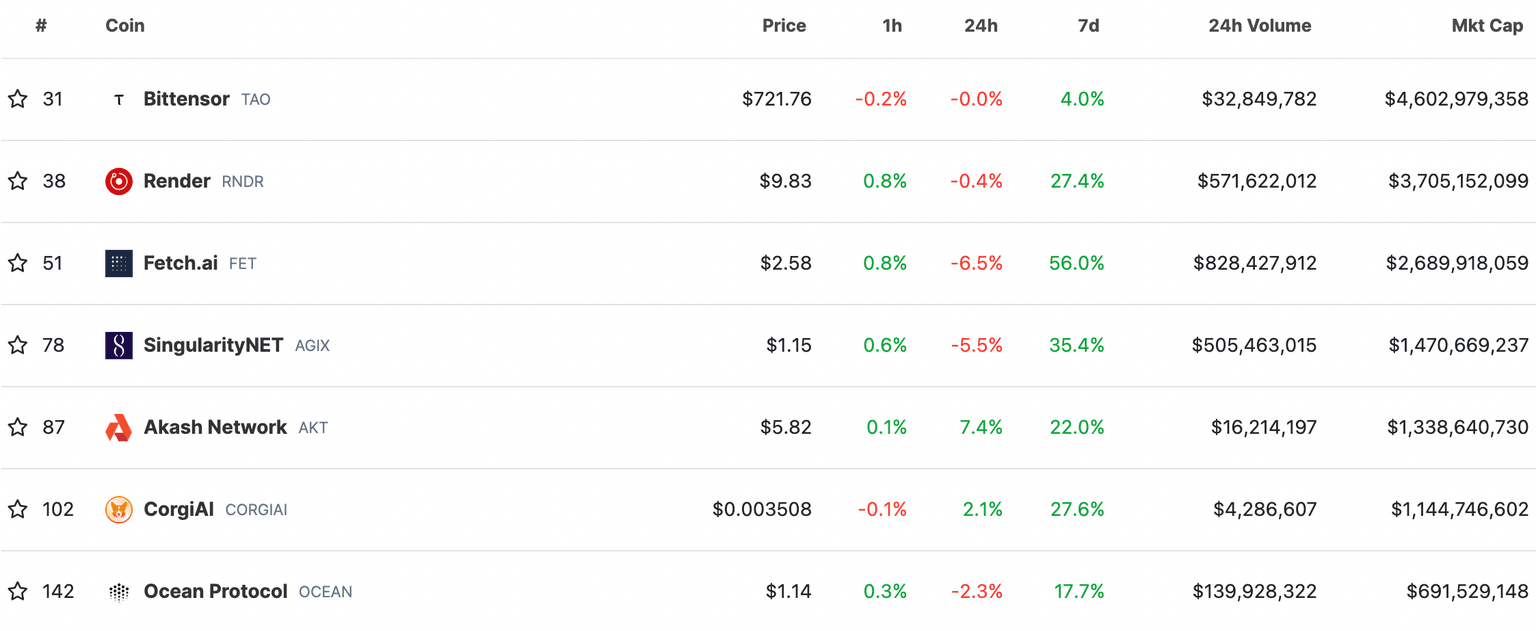

- TAO, AKT, RNDR, WLD find mention in Coinbase’s report, prices decline slightly on Friday.

Coinbase, one of the largest crypto exchanges in the world, published a market intelligence report that addresses the recent gains in Artificial Intelligence (AI) tokens like Bittensor (TAO), Akash Network (AKT), Render (RNDR), and Worldcoin (WLD).

These AI tokens have rallied in the past two weeks as the AI narrative made a comeback among crypto market participants, catalyzed by OpenAI’s text-to-video generator tool, NVIDIA Q4 2023 earnings report and the upcoming AI conference by the technology company.

Also read: OCEAN, GRT, FET: Artificial Intelligence projects with high developer activity

Artificial Intelligence tokens are likely overvalued for this reason

Coinbase’s market intelligence report, published on March 6, addresses the recent rally in AI tokens like RNDR, AKT, TAO and WLD. The analysts believe that the value potential of AI tokens has been overstated since their research reveals that there are no significant drivers of value for these tokens in the medium to short term.

The exchange’s analysts believe that the rally in AI tokens is likely catalyzed by the attention that the industry received recently, but this may not be sufficient to drive consistent gains in the native tokens of AI protocols like Bittensor, Akash Network, Render and Worldcoin.

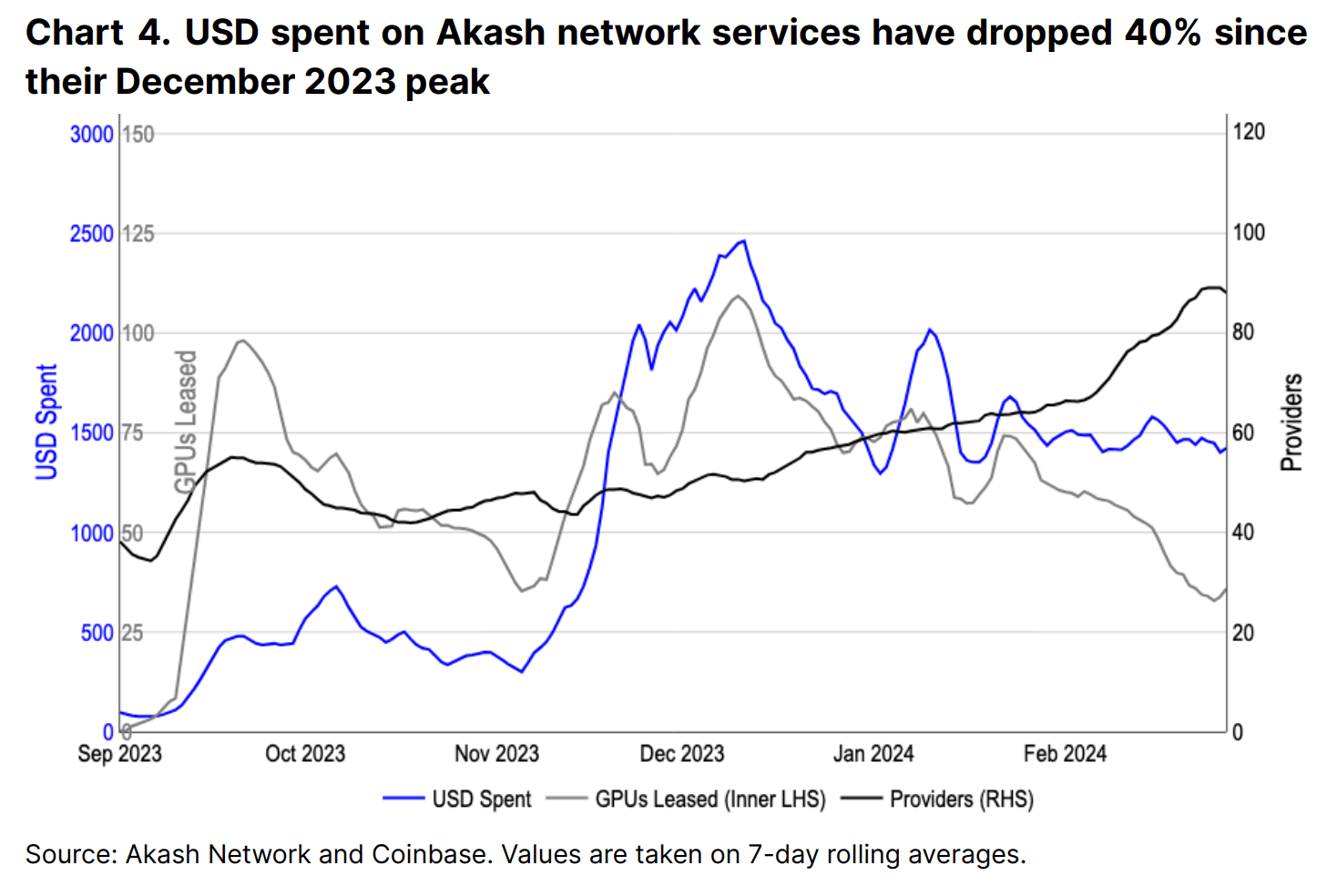

The report reveals that while there was an initial uptick in Akash Network in number of users year-to-date, this was largely driven by increased usage of their storage and compute resources. Coinbase analysts point out that this increase is unsustainable since more providers have joined the network.

Akash Network Usage and Coinbase. Source: Coinbase report

The report adds that there is a growing concern over the output quality and biases of AI models. Certain crypto projects like Bittensor are focused on finding a decentralized, market-based solution to this problem. However, there are a number of technical challenges that could stand in the way of the adoption of this project.

Native tokens of these projects are, therefore, likely overvalued and could be hit by a correction in the medium to short term.

The AI token rally in the past two weeks was riding on the popularity of OpenAI’s latest offerings and NVIDIA’s upcoming AI conference. At the time of writing, AI tokens have noted a slight decline in their price.

AI token prices. Source: CoinGecko

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.