Chiliz Price Prediction: CHZ to blast off 42% as accumulation gains traction

- Chiliz price hints at a 42% upswing as it nears the end of descending triangle consolidation

- Massive exchange outflows hint at an accumulation of CHZ from interested investors.

- A decisive close above $0.61 will create a higher high and confirm a new uptrend’s start.

The Chiliz price could be coming close to restarting its massive bull run as on-chain metrics point to accumulation.

Chiliz price shows strong fundamental growth

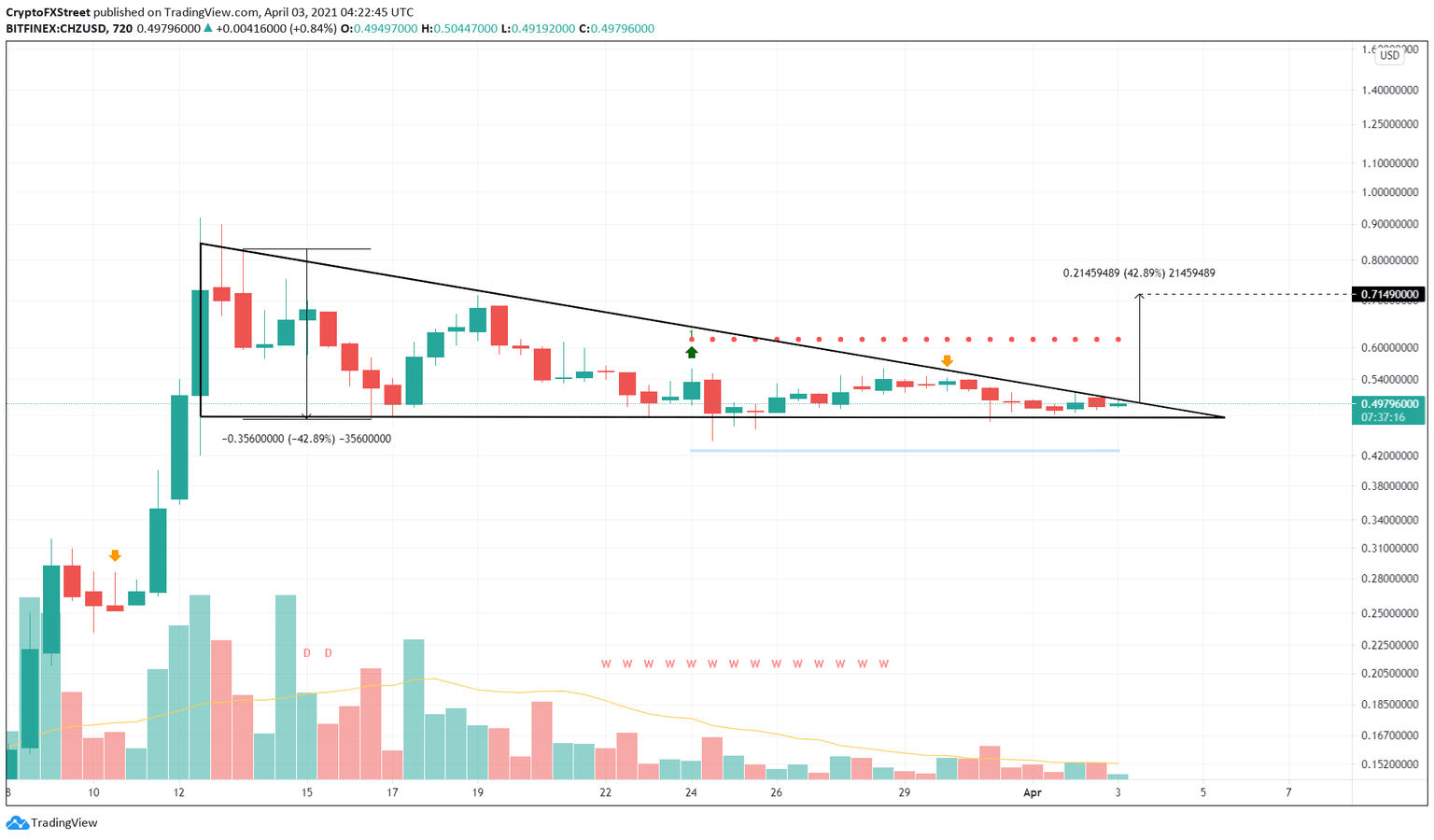

On the 12-hour chart, the Chiliz price has formed a series of lower highs that have bounced off a flat support barrier at $0.47. By drawing trend lines connecting the swing points, an ascending triangle pattern seems to evolve.

This technical formation forecasts a 42% move, which is the distance between the pivot high and low. The Chiliz price target of $0.71 is obtained by adding this measure to the breakout point at $0.50.

A secondary confirmation will arrive after the buyers push CHZ above $0.61, which happens to be the State Trend Resistance set up by the Momentum Reversal Indicator (MRI).

CHZ/USDT 12-hour chart

Supporting the Chiliz price’s bullish potential is the accumulation that seems to be underway. The supply on exchanges as a percentage of total supply reduced from 31.8% at its all-time high to 28.17% as of this writing.

This 11% decrease represents that investors have moved their CHZ holdings off exchanges and anticipate a further expansion in its market value.

A similar decreasing trend can be seen in withdrawal transactions, representing market participants moving their investments outside centralized entities. Moreover, such transactions were last seen during the start of the CHZ’s 1000% bull run.

%2520%5B10.21.20%2C%252003%2520Apr%2C%25202021%5D-637530228909634566.png&w=1536&q=95)

Chiliz exchange supply and withdrawal transactions chart

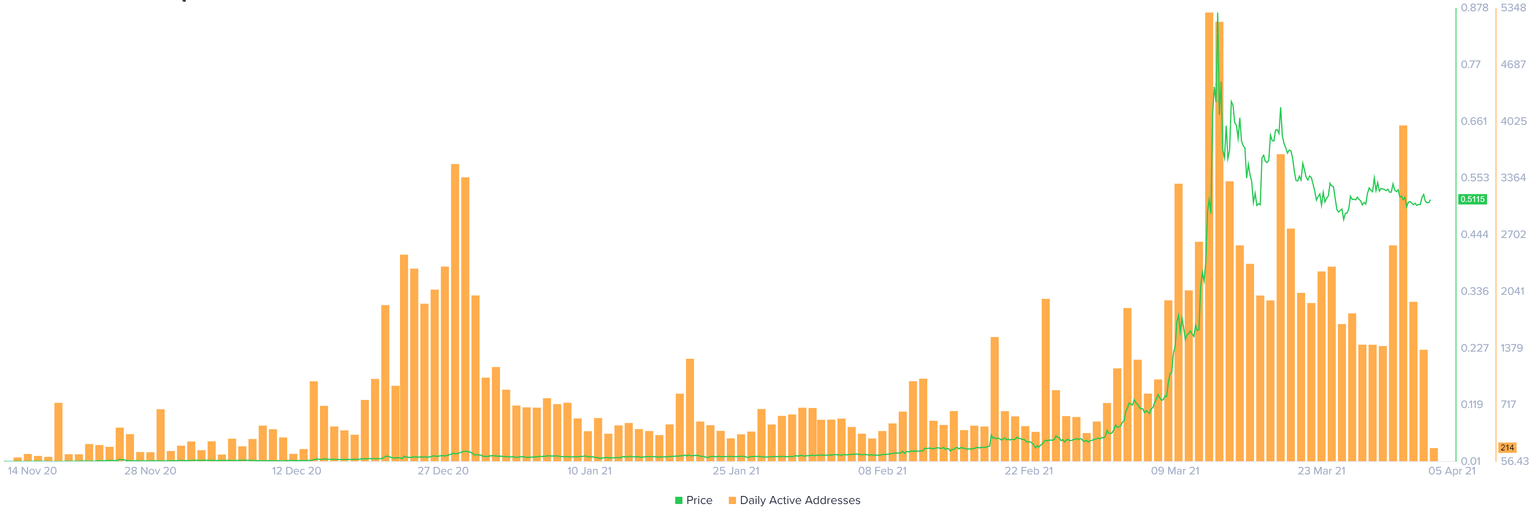

The number of daily active addresses also saw a positive spike, suggesting an increased adoption of the Chiliz network from investors interesting in CHZ at the current price levels.

Chiliz daily active addresses chart

While the on-chain metrics suggest an accumulation for Chiliz, investors should note that descending triangle pattern is a bearish pattern formed due to aggressive sellers. Hence, a sudden spike in bearish momentum that pushes the CHZ price below $0.47 will jeopardize the upswing.

However, if the Chiliz price slices through the MRI’s breakout line at $0.42, it will invalidate the bullish outlook and trigger a bearish one. In such a scenario, CHZ could slide 17% to the immediate support at $0.35.

Another 16% drop to $0.30 seems likely if $0.35 fails to contain the bears.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.