Chainlink price squeezes shorts out in bear trap

- Chainlink price action under pressure from bulls as price jumps 10% on the day.

- LINK price action surfs on tailwinds from positive developments in talks between Russia and Ukraine

- Expect more upside in the coming days from tailwinds and fewer bears presenting after being squeezed out of their position.

-637336005550289133_XtraLarge.jpg)

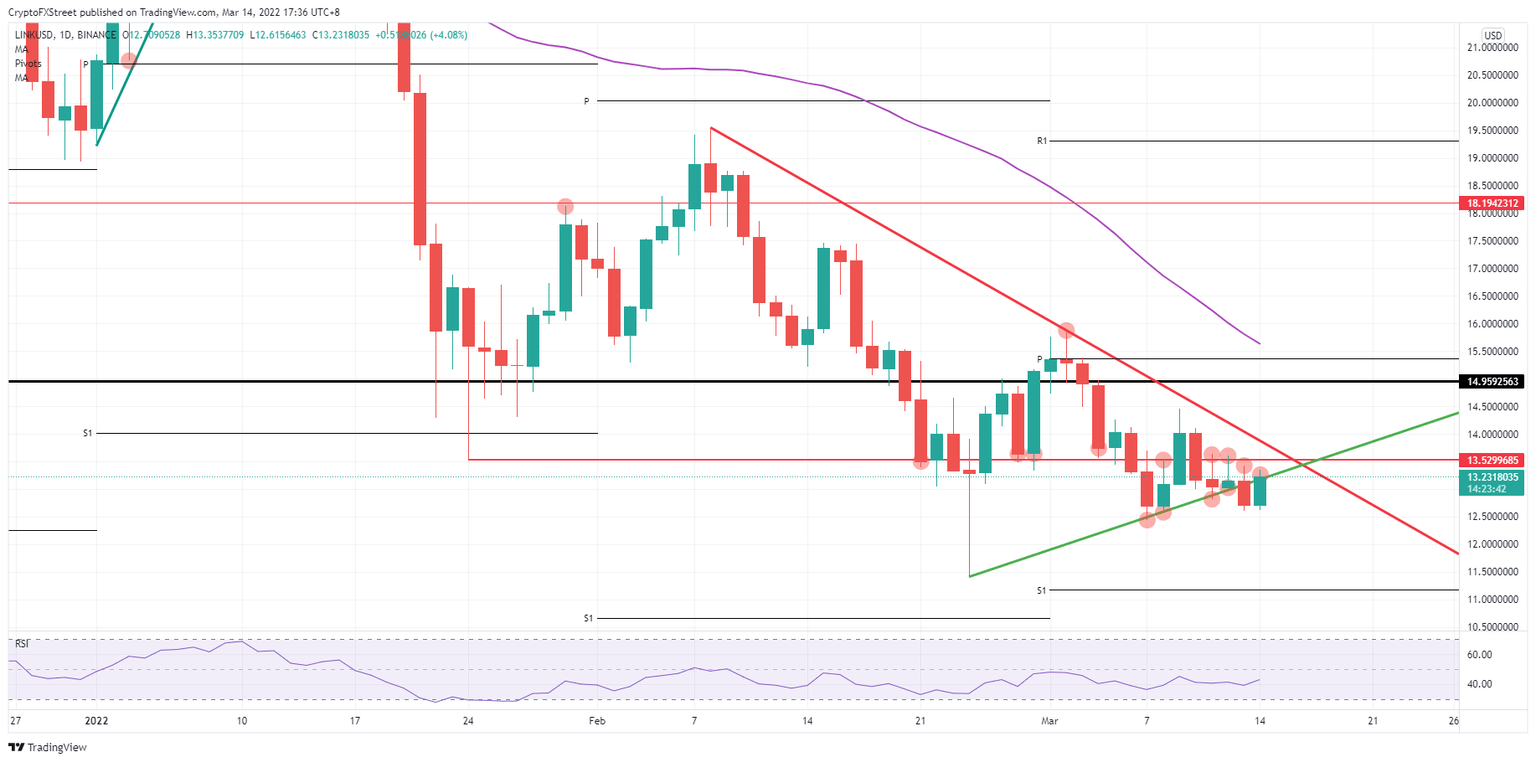

Chainlink (LINK) price action is on a rampage this morning as bulls are performing a breakout trade that pushes bears out of their positions. Over the weekend, price action dropped to lower levels but did not make new lows for the month. Expect to see a possible return to near $15 if current tailwinds persist and bulls build enough momentum to break the red descending trend line to the upside.

Chainlink price action set for 21% gains in the coming week

Chainlink price action saw bulls storming out of the gate on Monday morning during the ASIA PAC and European sessions as markets overall jumped on positive signals out of talks between both Russia and Ukraine. Global markets moved onto the front foot and cryptocurrencies received renewed interest with ask prices going higher. Technically the break below the green ascending trend line on Sunday has now turned into a bear trap with bears being squeezed out of their positions as prices revert higher.

LINK price action looks set to hit $13.5299 intraday and possibly break above that once the U.S. session kicks off. From there price action would be in a good place to start building momentum in order to break above the red descending trend line as that triangle becomes very small with $13.5299 providing the base for a bounce. As long as positive tailwinds persist, expect to see a break above the red descending trend line and for LINK price to cover ground up to $15.50 with the monthly pivot and 55-day Simple Moving Average (SMA) as a double cap against further gains.

LINK/USD daily chart

If the situation still sees no solution or some ceasefires by this weekend, expect to see a fade during the week as markets will start to focus back on the longer-term effect as the Ukraine situation will add to more price pressure, pushing up food and energy price inflation. Price action will then likely slip below the red descending red line and print a new low for the week at $12.50. At that rate, $11.00 could be on the cards by Friday, with the low of February 24 and the monthly S1 Support coming in next.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.