Chainlink price rises to new all-time highs while Band Protocol wants to catches up

- Chainlink price has hit a new all-time high at $21.45.

- It seems that Band Protocol price has been somewhat correlated with Chainlink for the past few months.

-637336005550289133_XtraLarge.jpg)

Chainlink has finally established a new all-time high at $21.45 before a brief pullback below $20. The digital asset has been trading inside an uptrend since December 25, 2020. Band Protocol price action has been similar to Chainlink in the past few months and seems to be trying to catch up.

Can Band Protocol also explode to a new all-time high?

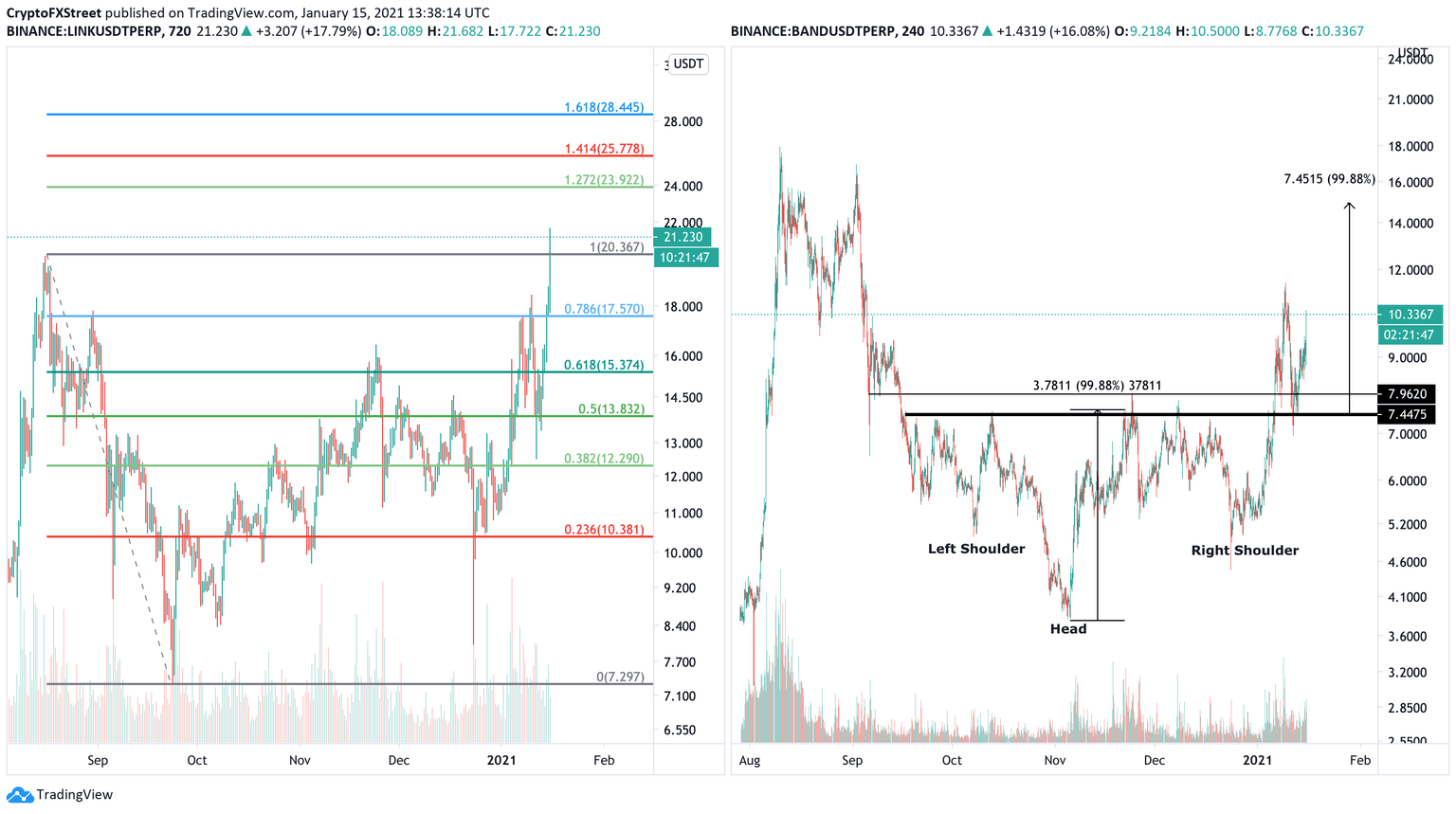

On the 12-hour chart of Chainlink, we can see a breakout towards the 100% Fibonacci Level at $20.367 and the next potential price target at $24, which is the 127% level. On the 4-hour chart, Band Protocol price saw a breakout above an inverse head and shoulders pattern with a price target of $15.

LINK vs BAND comparison

Band Protocol price dropped below the initial breakout to retest the neckline resistance level which turned into a support. BAND rebounded and it’s targeting $15 again in the long-term, trying to mimic LINK’s price action.

BAND Holders Distribution

The number of whales holding between 10,000 and 100,000 BAND coins has increased from 36 on December 19, 2020, to 52 currently, which indicates there is a lot of buying pressure behind Band Protocol despite the rise in value.

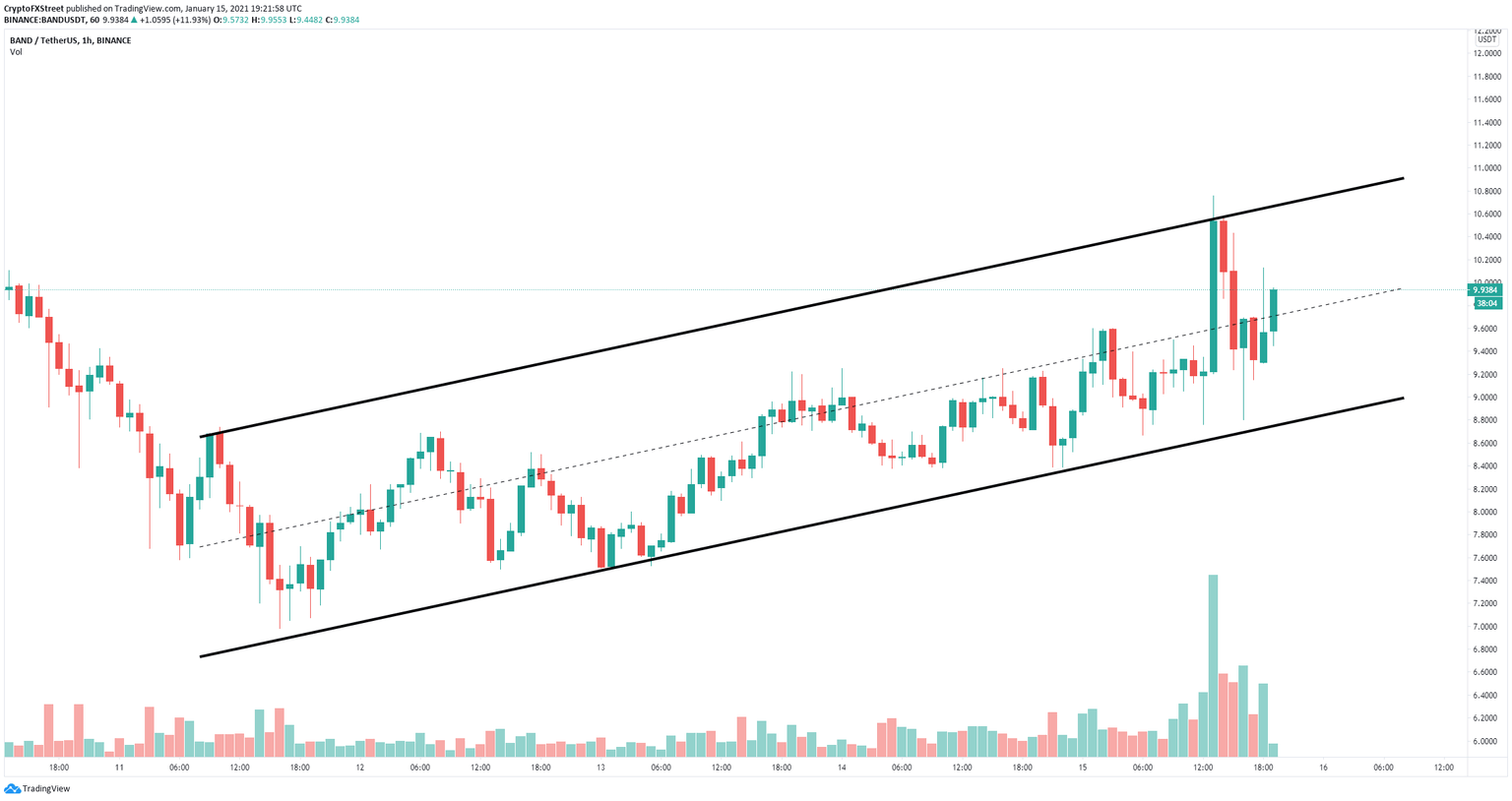

BAND/USD 1-hour chart

On the 1-hour chart, Band Protocol has established an ascending parallel channel and it’s trading right in the middle. A rejection from the psychological level at $10 could quickly push it down to $9.

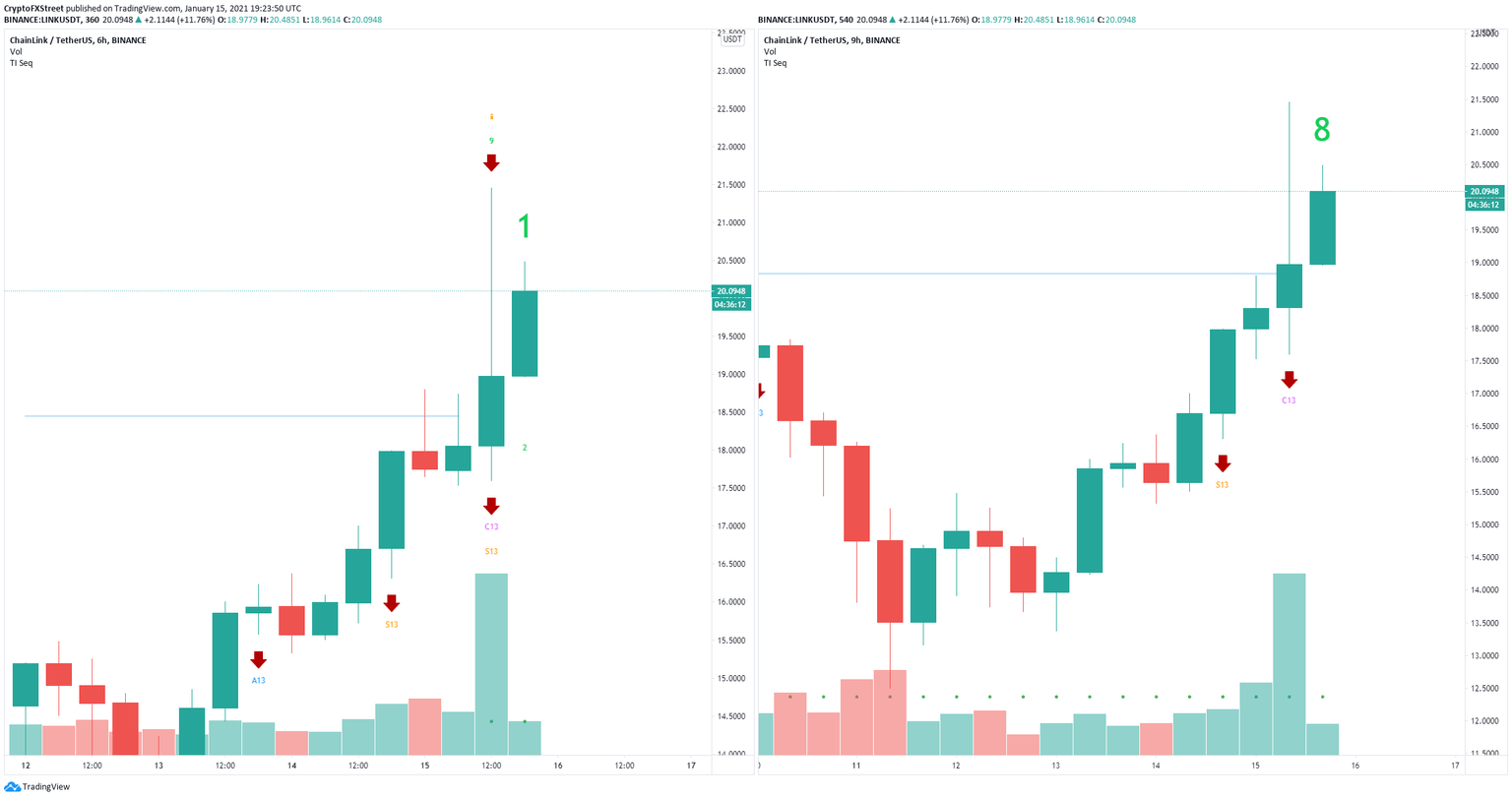

Chainlink sell signals

After a massive breakout above $20, the TD Sequential has presented a sell signal on the 6-hour chart and it’s on the verge of doing the same on the 9-hour chart. Validation of both calls could push Chainlink price down to $19 in the short-term.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B20.29.39%2C%252015%2520Jan%2C%25202021%5D-637463357817137498.png&w=1536&q=95)