Chainlink Price Forecast: LINK looks poised to rebound towards $18 if this crucial support level holds

- Chainlink sits on top of strong support that may become jumping ground of a new bullish trend.

- On-chain metrics support the LINK bullish view.

-637336005550289133_XtraLarge.jpg)

Chainlink (LINK) is hovering at $13. It is the seventh-largest digital asset with a current market capitalization of $5.1 billion. The coin has gained 1.5% in the recent 24 hours and lost nearly 5% on a week-to-week basis. LINK hit bottom at $11.28 on November 26 and attempted recovery. However, the upside momentum stopped short of $15, while the price entered another consolidation phase.

While the technical picture reflects a state of uncertainty, several on-chain metrics imply that the coin has a potential to retest $18 if bullish momentum gains traction.

Chainlink on-chain metrics are bullish

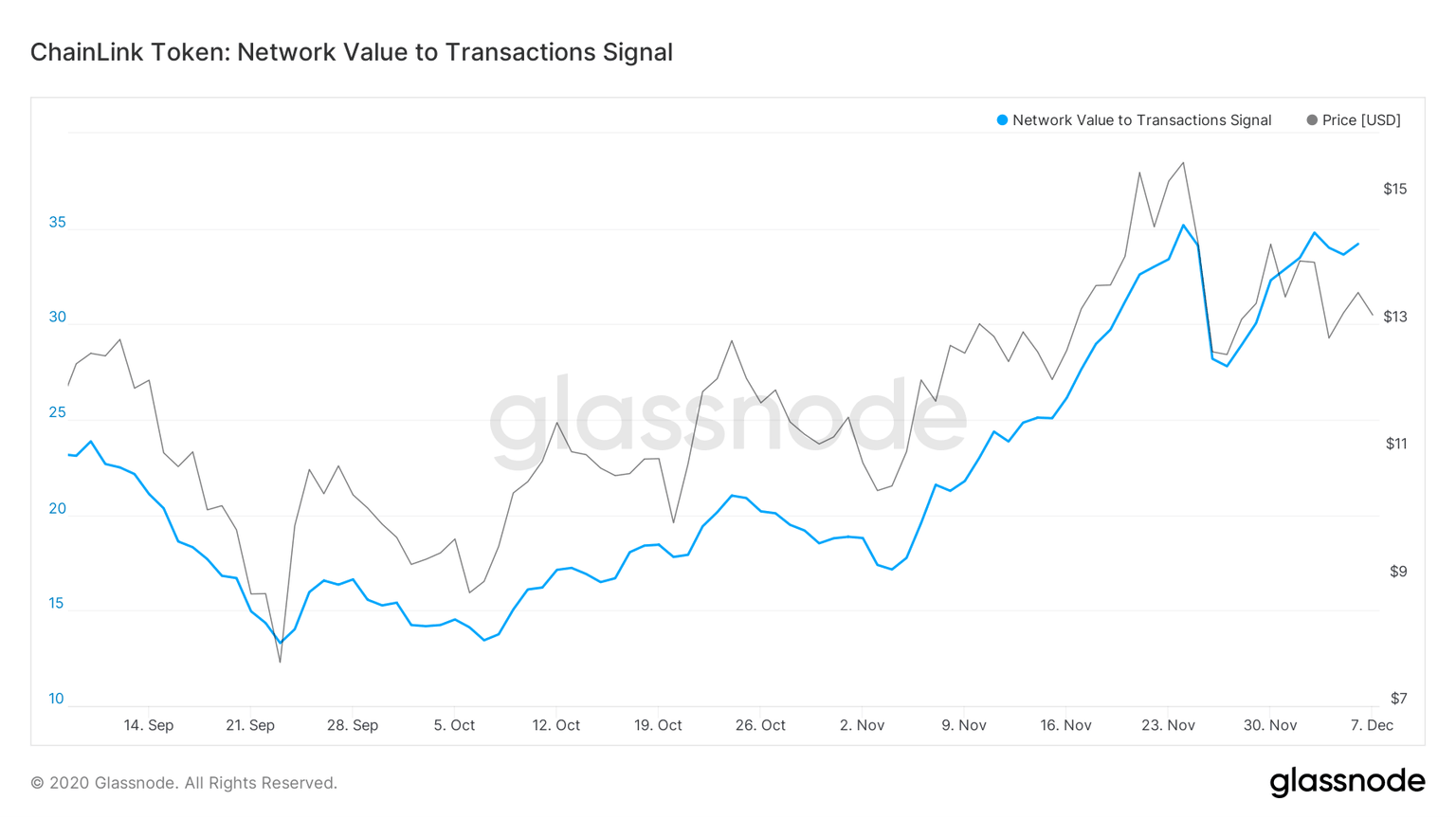

LINK's Network Value for Transactions signal has created a bullish divergence against price, which is a strong positive signal. It implies that the price may be ready for a bullish breakthrough. Network Value for Transactions (NVT) shows whether a certain cryptocurrency is overvalued or undervalued. It is calculated as a ratio between the network value of a crypto asset and the value of its transaction activity. When the indicator goes up, the price tends to follow shortly.

LINK's Network Value for Transactions

Santiment's holders' distribution data confirms the bullish forecast as whales seem to be accumulating LINKs. Over 20 addresses holding between 100,000 and $1,000,000 LINK tokens joined the network in less than a month. The number of super big whales having from 1 million to 10 million coins increased from 48 to 51 in a matter of ten days. While the number may seem insignificant, it is worth noting that each whale controls LINKs worth between $153,000 and $1.5 million.

LINK's Holders' Distribution

LINK price forecast: Massive support around $12

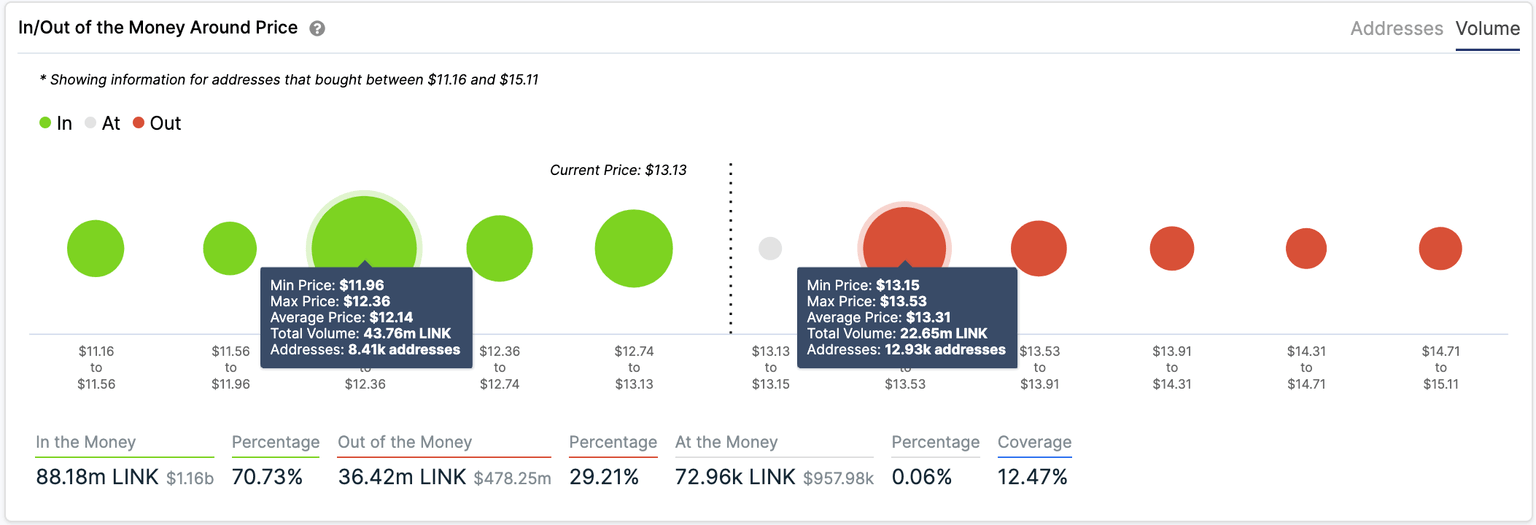

However, based on IntoTheBlock's "In/Out of the Money Around Price" model, LINK sits on top of a significant support area. Over 8,400 addresses previously purchased over 43 million LINK tokens between $11.96 and $12.36, meaning that this barrier has the potential to slow down the downside momentum and trigger a new bullish wave.

LINK In/Out of the Money Around Price

On the other hand, the recovery is capped by the local resistance on approach to $14.50. It is created by nearly 13,00 addresses that bought over 22 million LINK tokens around that level. However, even if this barrier is cleared, the bulls won't face stiff resistance until $18.

Author

Tanya Abrosimova

Independent Analyst

%2520%5B12.19.34%2C%252007%2520Dec%2C%25202020%5D-637429456222561716.png&w=1536&q=95)