Chainlink price correction imminent after 35% rally liquidates $12 million worth of LINK in 72 hours

- Chainlink price rallied to breach the $10.00 mark over the weekend, posting a 35% increase.

- The rise in price led to about $12.3 million worth of short positions being liquidated in three days.

- The MVRV ratio noted the largest spike since August 2021, reaching into the opportunity zone and suggesting an imminent correction.

-637336005550289133_XtraLarge.jpg)

Chainlink price observed a massive rally in the past few days, which brought profits to a significant chunk of LINK holders. However, the altcoin seems to have found its top around the $10 mark, as LINK is most likely preparing for a major crash soon.

Chainlink price to see downfall

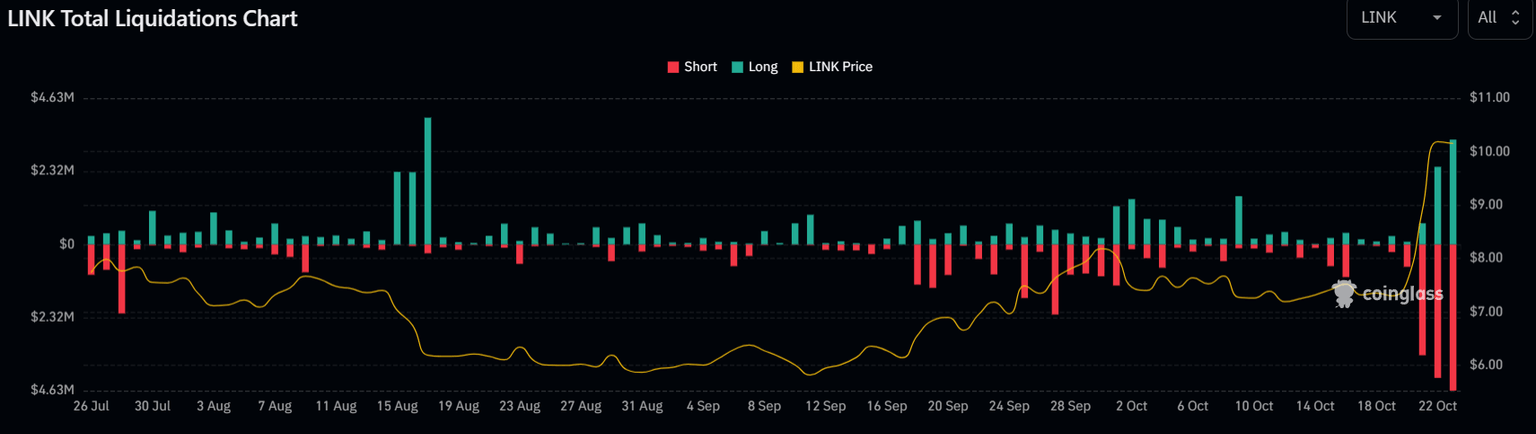

Chainlink price trading at $10.15 has managed to rise by about 35% in the past three days. The rally, which almost even continued on Monday, has pulled the altcoin up from $7.57, noting another 8% rise during the intra-day trading hours before correcting to the trading price.

Consequently, Chainlink price has successfully established the 50-, 100- and 200-day Exponential Moving Averages (EMA) into support. However, the Relative Strength Index (RSI) suggests a different story. This is because the recent rally resulted in Chainlink's price shooting up, which drove the indicator to the point where it was overbought.

LINK/USD 1-day chart

But that did not stop the investors. However, that may not be the case for soon. The red candle noted at the time of writing suggests a pause is likely, which could result in a cool-down. Plus, as long as the market is overheated, price correction is highly possible.

Presently, $10.00 stands as the first line of defense; losing this would bring Chainlink's price to test $9.00 as the critical support level. If the bearishness still persists, further decline cannot be ruled out.

But on the off chance that Chainlink price manages to bounce back from $10.00, it could see some rise, potentially even to the $11 mark, invalidating the bearish thesis.

The future of Chainlink price is likely to decline

Apart from the price indicators, there are other factors in the market that suggest a slip in Chainlink price is the next likely outcome. Firstly, the MVRV ratio is indicating an imminent decline in price.

The Market Value to Realized Value (MVRV) ratio is an indicator that is used to assess the average profit/loss of investors who purchase an asset. The 30-day MVRV ratio measures the average profit/loss of investors who purchased an asset in the past month.

In the case of Chainlink, the MVRV ratio is sitting at 25.22% Thus, these investors are likely to sell their holdings to realize profits, which could trigger a sell-off. As seen on the chart, when MVRV hits a point beyond 20%, LINK has undergone major corrections, hence, this area is termed a danger zone.

Chainlink MVRV ratio

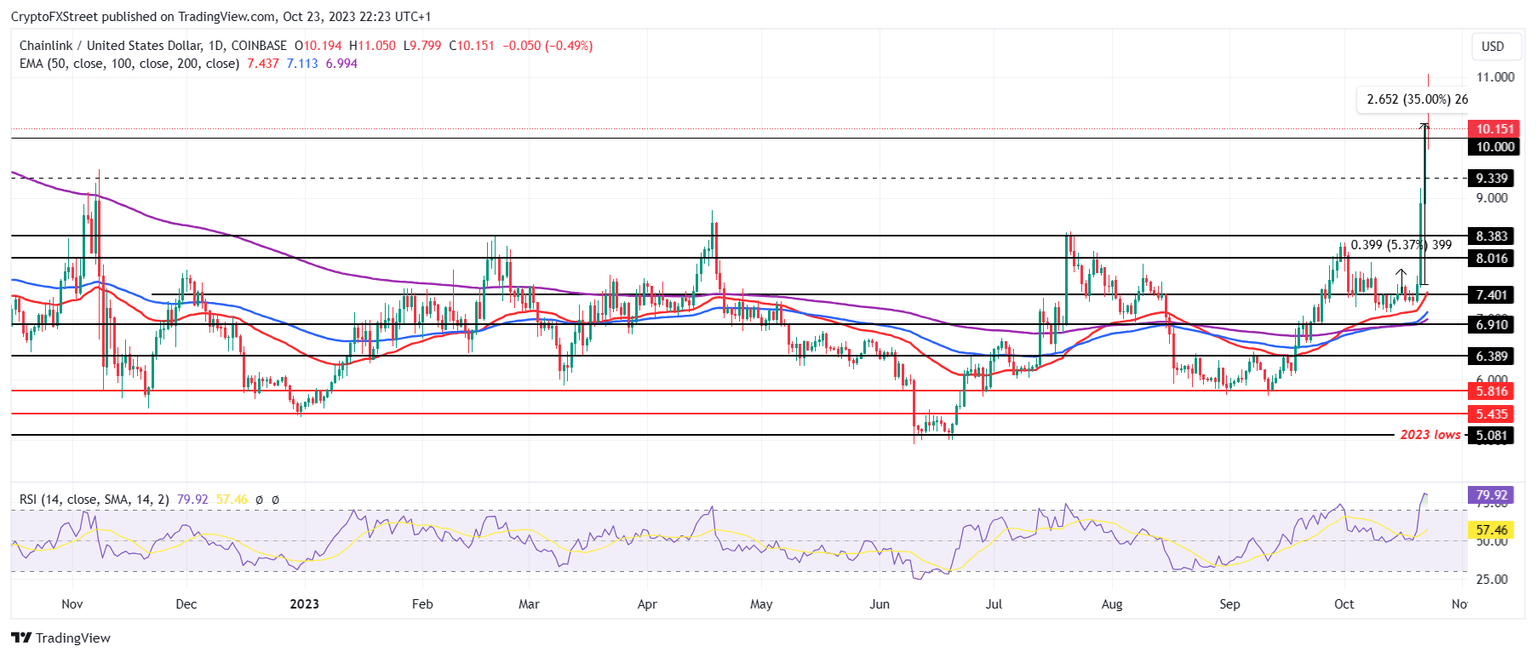

But this would bring profits to the ones who made money during the price rise. The ones that lost money in the same duration - short traders - will also attempt to make their investment back.

The rally led to $12.3 million worth of short liquidations in the last three days, which the traders will attempt to correct.

Chainlink short liquidations

This will increase the bearish pressure on Chainlink, which, when combined with the pressure to sell, could lead to a decrease in price. While a massive drawdown is not expected, it cannot completely be ruled out.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B02.59.00%2C%252024%2520Oct%2C%25202023%5D-638336984894904485.png&w=1536&q=95)