Chainlink price breaches 17-month-long downtrend as whales accrue 5 million LINK in a week

- Chainlink price is holding above $7.50 after rising by 40% in the second half of September.

- Addresses holding between 10k to 100k LINK have purchased over $37 million worth of tokens in the past seven days.

- Whale activity has seen a bump in the last few days, with transactions hitting a three-month high.

Chainlink price rise pushed LINK far above the rest of the major altcoins in less than a month. The cryptocurrency has come closer to recovering its losses since July. Interestingly, a particular cohort had a lot to do in calling the shots of the altcoin’s movement since November 2022.

Chainlink price bounceback is on the cards

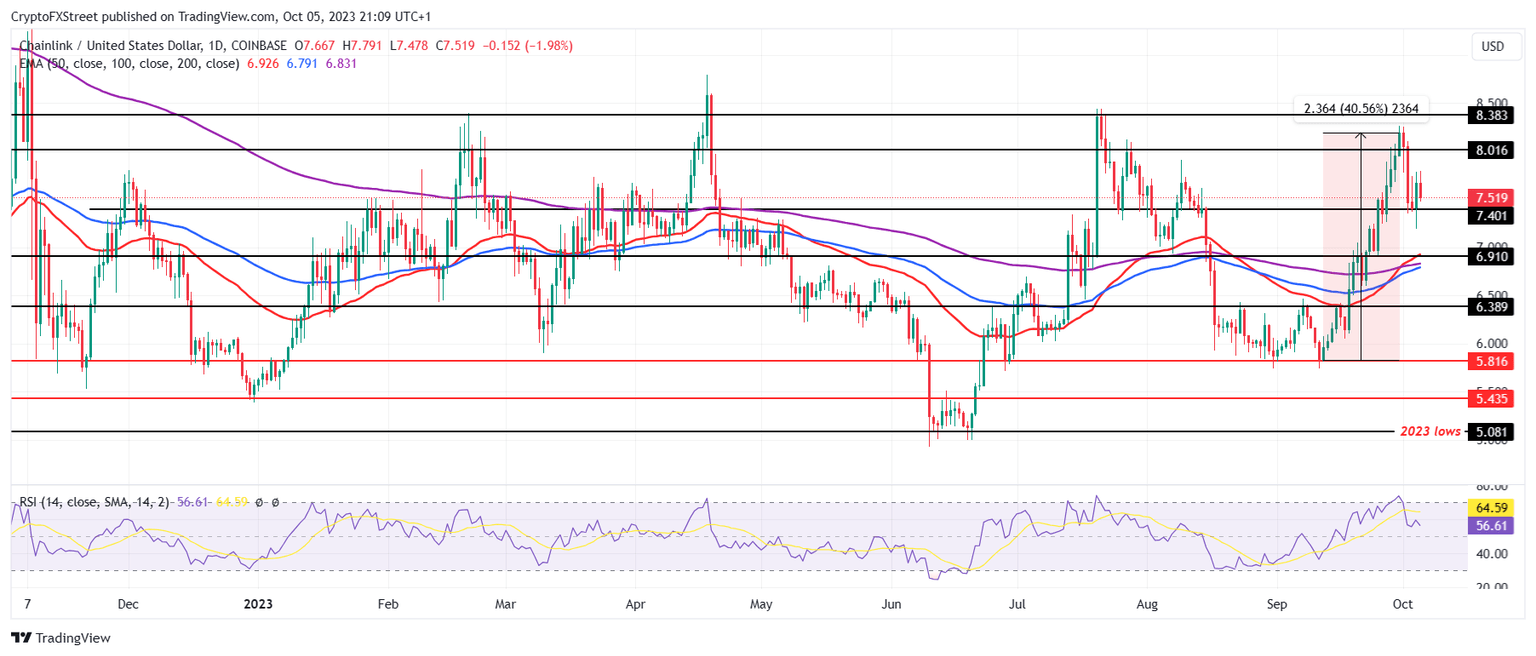

Chainlink price trading at $7.50 is dealing with the cooldown noted by the altcoin in the past few days. The 40.5% rally noted in the second half of September resulted in the market being overheated, which resulted in minor corrections being observed. At the moment, LINK stands only 14% away from its year-to-date high, and the chances of hitting it are not too bleak either.

$LINK

— Rekt Capital (@rektcapital) October 5, 2023

Let's not forget that Chainlink has broken its Macro Downtrend#LINK #Crypto #ChainLink pic.twitter.com/2ivDtTOlJT

Looking at the Relative Strength Index (RSI), it is evident that the altcoin is still bullish as the indicator is above the neutral line at 50.0. Thus, a bounce back from the support line at $7.40 would enable a recovery towards $8.01 flipping, which would allow Chainlink price to rise further towards the 2023 high of $8.58.

LINK/USD 1-day chart

However, on the off chance that LINK breaks down from $7.40, it could slip to $6.90, which also marks the confluence of the 50-day Exponential Moving Average (EMA). Losing this support line would invalidate the bullish thesis and send Chainlink price to $6.38.

Whales could support a recovery

The reason why there is a bleak chance of a decline going forward is the activity noted among certain cohorts of investors. Addresses holding 10,000 to 100,000 LINK have recently begun accumulating, adding nearly 5 million LINK to their wallets in the past seven days. Holding 86 million LINK, these addresses have been consistently dictating Chainlink price action since November 2022.

Chainlink whale holding

Their accumulation has been followed by a price increase, and selling has usually resulted in a decline. Thus, given their current stance of accumulation despite the past week’s correction, it is a signal that Chainlink price still has some steam left in it to carry on its uptrend.

Furthermore, the whale activity since the beginning of October has also seen a spike. The transactions worth more than $100,000 have risen to mark a three-month high these last few days following the increase in price.

Chainlink whale activity

Since over 51% of the entire circulating LINK supply sits in the hands of the whales, their increased activity is a bullish sign. This might fuel Chainlink price to inch closer to its year-to-date high.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B01.47.53%2C%252006%2520Oct%2C%25202023%5D-638321340253871131.png&w=1536&q=95)

%2520%5B01.47.47%2C%252006%2520Oct%2C%25202023%5D-638321340534394810.png&w=1536&q=95)