Chainlink attracts big investors interest while ambassador advocates for broader vision

- Chainlink drew investor interest during an accumulation phase lasting more than 500 days.

- Analyst Altcoin Sherpa recommends investment strategy in Chainlink within the $5 to $7 range.

- Chainlink ambassador advocates for a more comprehensive understanding of its decentralized network.

Chainlink (LINK) has garnered investor interest during a lengthy accumulation phase but its revenue and fees have lately taken a hit. Crypto market educator Altcoin Sherpa suggests a Dollar-Cost Averaging strategy for investment, while ChainLinkGod advocates for a broader understanding of Chainlink's capabilities.

Chainlink witnesses prolonged accumulation

Chainlink, a smart contract system built on the Ethereum blockchain, has been amassing investor interest during a prolonged accumulation phase. Analyst Altcoin Sherpa noted on X that the LINK accumulation has spanned more than 500 days and might soon give way to an upward surge in price.

Altcoin Sherpa advised investors to consider Dollar-Cost Averaging (DCA) in their investment in Chainlink, particularly in the price range of $5 to $7. At the time of writing, LINK is slightly outside the range at a price of $7.5 after minor daily gains.

$LINK: 500+ days in accumulation and chop, this will fly 1 day. I think the best way to play this (for most investors) is to:

— Altcoin Sherpa (@AltcoinSherpa) October 13, 2023

-DCA from $5-$7 (I know it's a huge range).

-Sit on this for as long as it takes and wait for the breakout of the range

-First bids could be $6.80ish pic.twitter.com/kQMS63m2Z5

The crypto influencer also calls it a waiting game for the anticipated breakout, which could materialize around $6.80.

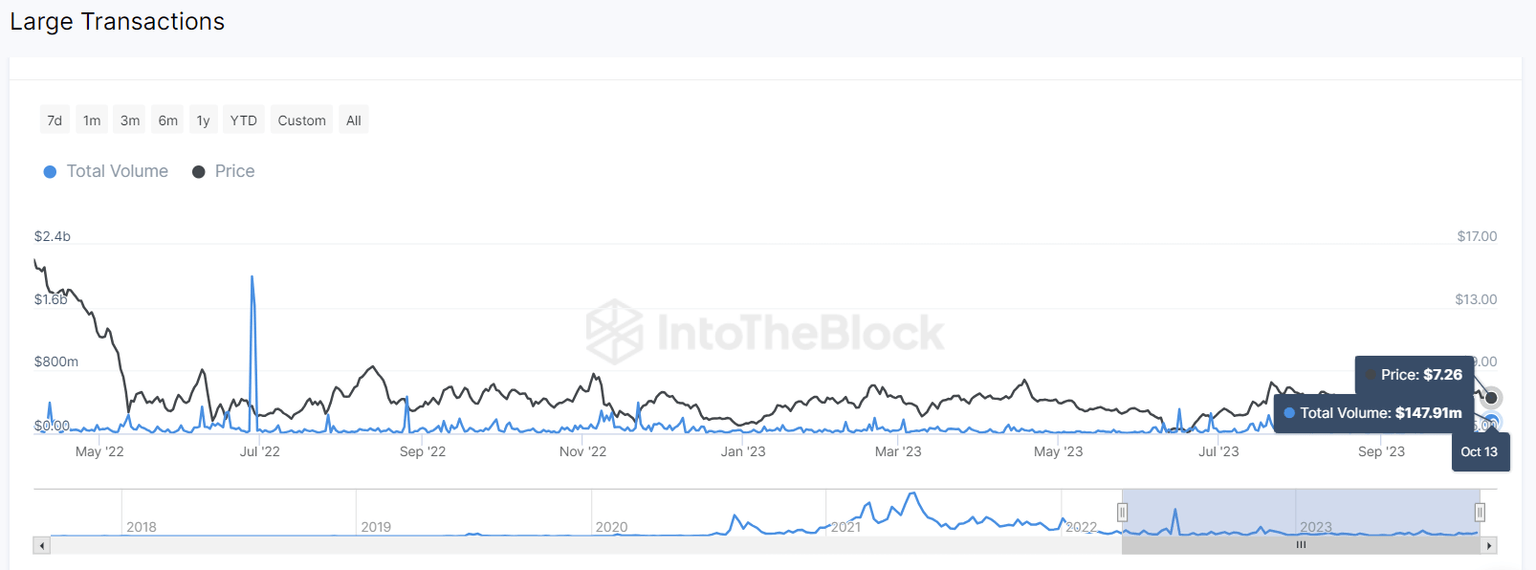

Crypto analyst Ali Martinez highlights that the total transaction volume by whales and institutional players has been on the rise. According to IntoTheBlock data, a combined 69% is held by large holders, including whales. Meanwhile, large LINK transactions worth $100,000 or more approached $150 million on Friday.

Chainlink projects broader long-term vision

As the investor interest grows, a prominent Chainlink Community Ambassador, ChainLinkGod, took to X to advocate for a broader understanding of Chainlink's capabilities.

He contended that referring to Chainlink simply as a "decentralized oracle network" is suboptimal as it limits its utility and falsely promotes it as a monolithic network. ChainLinkGod emphasized on Chainlink's decentralized network with a distributed architecture rather than it being a single large network.

"So really, it’s more accurate to say that Chainlink is a platform for creating Web3 services powered by decentralized oracle network infrastructure, which can provide secure access to external data, trust-minimized off-chain computation, cross-chain interoperability, and bidirectional connectivity to external systems," he added.

On Monday, Chainlink updated new platform integrations across seven chains that include Avalanche, Polygon and Ethereum.

⬡ Chainlink Adoption Update ⬡

— Chainlink (@chainlink) October 15, 2023

This week, there were 9 integrations of 5 #Chainlink services across 7 different chains: @arbitrum, @avax, @BuildOnBase, @BNBCHAIN, @ethereum, @optimismFND, and @0xPolygon.

New integrations include @ArchlyFinance, @ArkhamIntel, @bullionlabs,… pic.twitter.com/jvlri54eI7

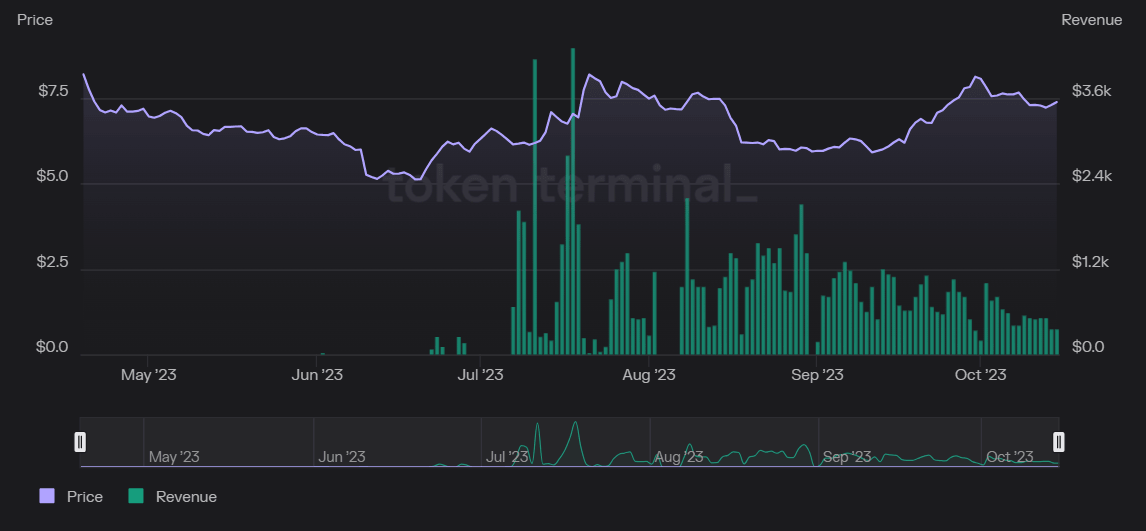

Over the past 30 days, LINK has seen a price growth of 20%, based on Token Terminal data. However, the coin seems to be facing challenges in the longer term after achieving an all-time high at $52.70 in May 2021.

While Chainlink's price is far from the record high, the revenue figures and fees also don't paint an optimistic picture, giving a mixed near-term outlook.

Author

Shraddha Sharma

FXStreet

With an educational background in Investment Banking and Finance, Shraddha has about four years of experience as a financial journalist, covering business, markets, and cryptocurrencies.