Cardano price to revisit $1.20 after ADA bulls' strong comeback

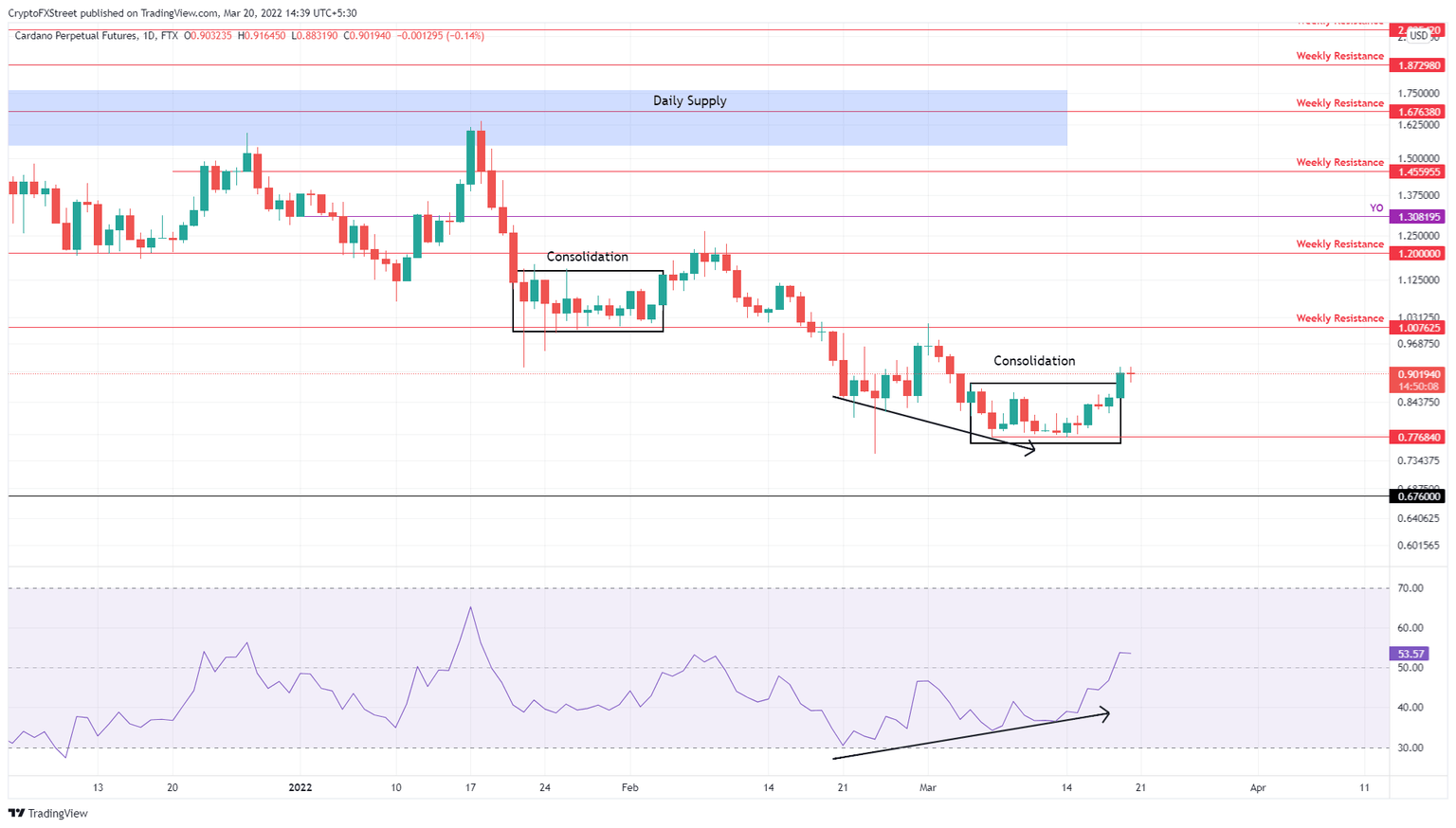

- Cardano price breached its two-week consolidation on March 18, signaling a breakout.

- Investors can expect ADA to continue its ascent to $1.20 if it can flip the $1 psychological level.

- A daily candlestick below $0.776 will invalidate the bullish thesis for ADA.

Cardano price is out of its rangebound movement as it breached the upper limit on March 18. This uptrend signals that ADA is bound for more gains in the near future.

Cardano price recovery in progress

Cardano price slid into a consolidation on March 5 and continued doing so for nearly two weeks. This range-bound movement ended on March 19 as ADA rallied 6%, producing a higher high relative to the March 9 swing high at $0.863.

This development came as ADA produced lower lows while the Relative Strength Index (RSI) formed higher lows, suggesting a palpable bullish divergence. As a result, ADA has breached its rangebound movement and is on a path to recover losses.

Investors can expect Cardano price to retest the $1 psychological level after a 12% ascent from the current position at $0.901. A resurgence of buying pressure around this level is necessary for ADA to flip the $1 hurdle in a support level and make its way to the next target at $1.20.

In total, this run-un would constitute a 33% gain and is likely where a local top will form.

ADA/USDT 1-day chart

While Cardano price looks bullish, its outlook relies on how the big crypto performs. A flash crash could void the optimism and trigger a crash.

If ADA produces a daily candlestick below $0.776, it will invalidate the bullish thesis for ADA and open the path for further descent. In this case, Cardano price could crash lower to look for a stable support level at $0.676. Here, buyers can regroup and attempt another recovery.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.