Cardano price squeezes with breakout offering a whopping 65% upside potential

- Cardano price sees both bid and ask sides caught in a tight range between two technical forces.

- ADA price set for a bullish breakout as positive sentiment is gaining momentum in global markets.

- A daily close above $1.00 sets the scene for a 65% upswing, making new highs for 2022.

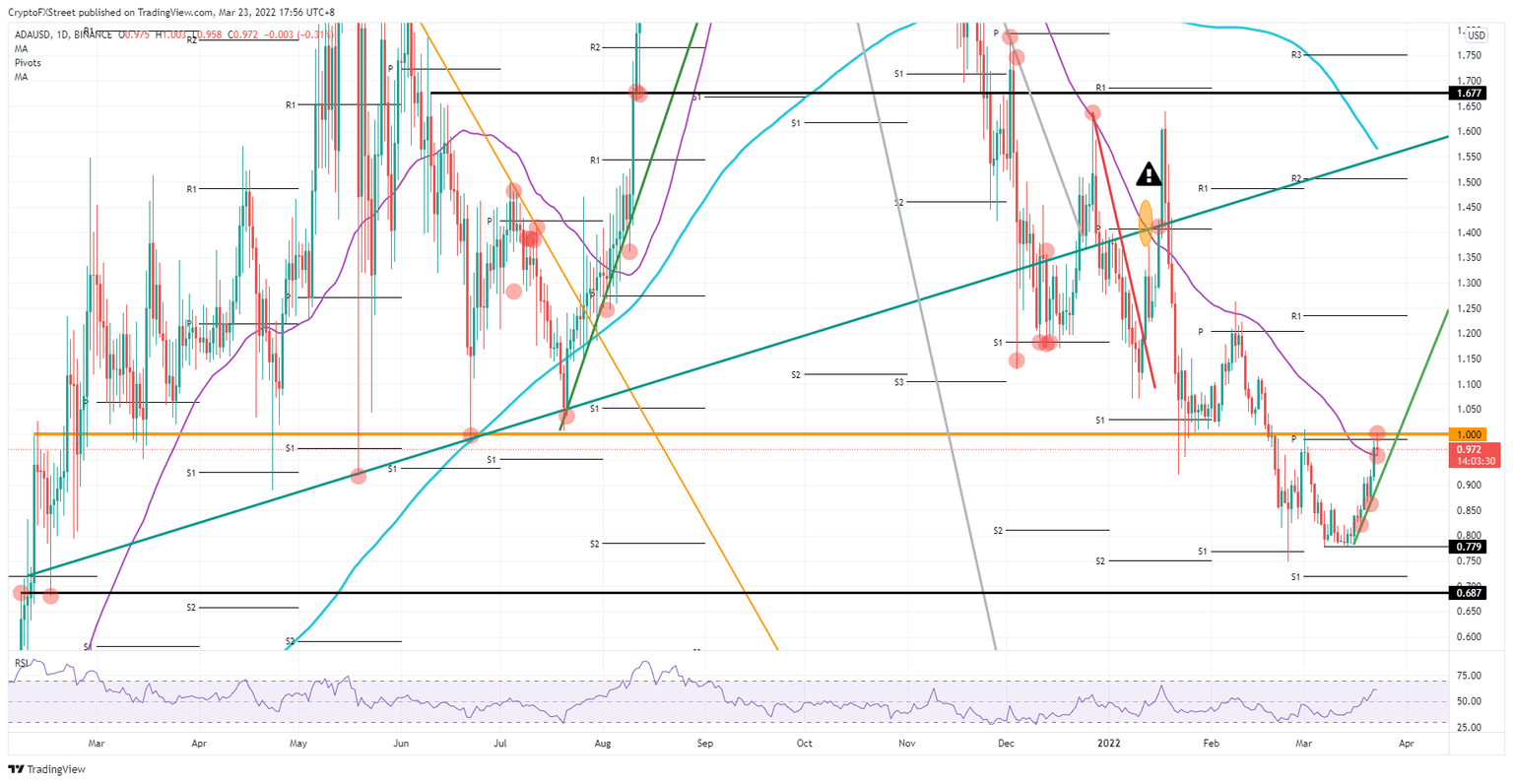

Cardano (ADA) price sees bears and bulls getting squeezed toward each other since the latter were able to break above the 55-day Simple Moving Average on Tuesday at $0.957. From the topside, the significant $1.00 barrier is doing its part to refrain bulls from entering above with short-sellers selling massively to maintain price action subdued. With the current tailwinds and technical setup, the coin is set to flip in favor of the bulls with a breakout above $1.00, which will open the door to a big area that could hold 65% gains, with ADA price hitting $1.677.

Cardano price set for a swing trade towards $1.677

Cardano price has hurt many bears on Tuesday by covering a lot of ground to the upside, as a rally is picking up speed. Help came from global tailwinds that are pushing equities and cryptocurrencies higher. Although bulls hit a curb at $1.00, expect to see a breakthrough anytime soon as momentum is building for a bullish breakout with tailwinds overpowering bearish price action.

ADA price could be thus in for some solid gains that could mount up to 65%, towards $1.677 in what would be a perfect swing trade and possibly even print new highs for 2022. That is a more longer-term trade as, in the near-term, the Relative Strength Index (RSI) is still offering some room for upside but is starting to look topish, near overbought. Expect this week for bulls to focus on $1.25 with the monthly R1 just below as the anchor point.

ADA/USD daily chart

Risk to the downside comes with bulls unable to break above $1.00, and that failed test becomes an actual rejection to the upside. That would trigger the green light for bears to go in and fill every buy-order present to evaporate the demand and push price action back to the green ascending trend line that has already held on two previous occasions. Expect either a bounce off the trend line around $0.90, and with a break a full completion of the descent back to $0.779.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.