Cardano gains dominance in DeFi as ADA price heads to $1

- Cardano price is on track for a major move to $1 as the altcoin’s dominance in DeFi is on the rise.

- Cardano network witnessed the largest single month increase in total value locked in staking on its blockchain.

- The Ethereum-killer’s DeFi dominance is now at 0.2%, neck and neck with Optimism, a layer-2 solution.

Cardano price is recovering from a recent drop on the back of rising dominance in the DeFi ecosystem. The Ethereum-killer is in direct competition with Optimism in the DeFi ecosystem sphere.

Cardano price is set to recover with spike in DeFi supremacy

Cardano price has posted double-digit gains over the past week on a rise in the altcoin’s pre-eminence. Analysts argue that the Ethereum-killer blockchain is on track to hit the $1 target as it makes major moves.

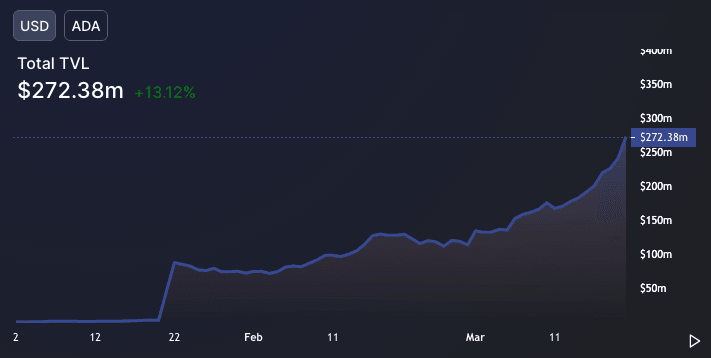

In March 2022, the capital inflow to DeFi applications on the Cardano network increased through staking and other mechanisms. Based on data from community-driven crypto intelligence account @cardano_whale, the Cardano network’s total value locked, including staking, has witnessed the most significant one-month increase.

Across all DeFi protocols on the Cardano network, the total value locked has increased by $10 million. Based on data from crypto tracker DeFi Llama, Aggregated TVL of the Cardano network is $277 million. This spike in TVL has pushed DeFi dominance higher, on a par with Ethereum’s layer-2 protocol Optimism, at 0.2%.

TVL of the Cardano network

Analysts have evaluated the Cardano price trend and predicted a trend reversal after a month-long bearish movement. FXStreet analysts believe Cardano price is on track to make a major move to $1.

Analysts argue that the 61.8% Fibonacci retracement is providing firm support in the $0.70 to $0.80 range. Analysts have identified an opportunity for a drop to $0.35 based on volume profile. The weekly chart reveals that time cycle-wise, Cardano price is poised to break into an uptrend and eye $1 target.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.