Cardano price prepares for an explosive take-off

- Cardano price fractal is yielding good returns as bulls continue to move the markets.

- A quick run-up to $0.550 could result in an extensive rally to $0.628 if there is sufficient momentum

- A daily candlestick close below $0.435 will invalidate the bullish thesis.

Cardano price seems to be faring well after triggering the same bullish fractal for the fourth time. The ongoing rally is likely to continue on its path to the next hurdle. However, ADA holders should be careful of the shifting winds that could sway the bias favoring bears.

Cardano price fractal strikes again

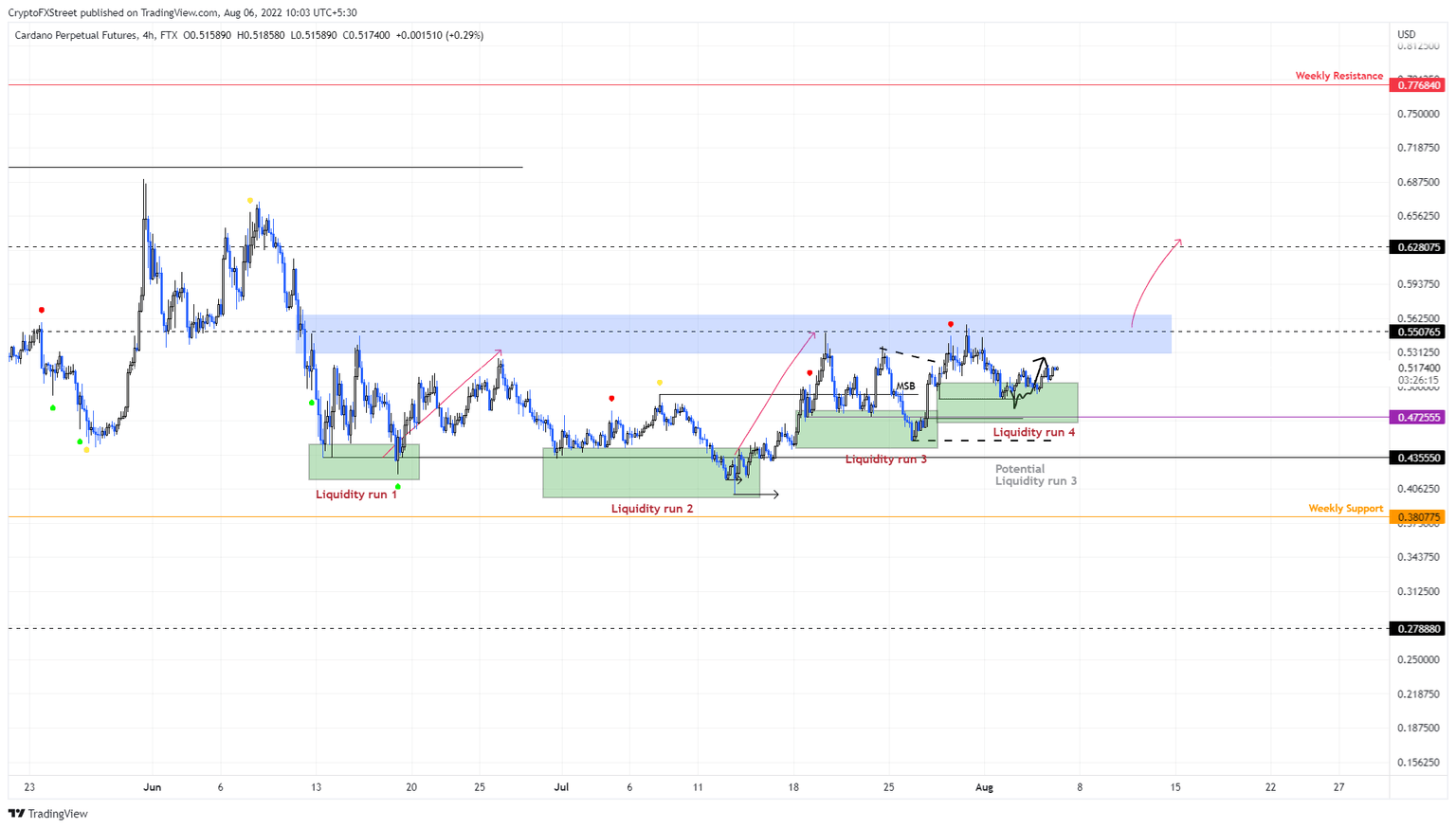

Cardano price fractal is a liquidity-based pattern triggered after a lower low formed recovers. The first time this pattern formed was when the June 13 swing low at $0.435 was swept by June 19 swing low at $0.419 on June 19.

After producing a lower low, ADA recovered quickly and kick-started a 25% run-up to $0.550 in the next week.

Similar setups formed over the course of next month. The latest liquidity run was on the July 28 swing low at $0.488. The sweep of this level has so far netted a 6% ascent, and going forward, investors can expect this move to continue until ADA reaches the $0.550 resistance level.

Although unlikely, a flip of this level could result in an extension of this rally to $0.628, constituting a 22% gain.

ADA/USDT 4-hour chart

However, if Cardano price fails to stick to the fractal’s characteristics, things go quickly go awry. If ADA retraces lower, to sweep the $0.450 support level, buyers have another chance at recreating the said fractal.

A failure to do so, however, coupled with a daily candlestick close below $0.435, will invalidate the bullish thesis for ADA. In such a case, Cardano price could revisit the $0.380 support level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.