Cardano price awaits another trailblazing 30% liftoff supported by robust on-chain metrics

- Cardano flies the bull flag high, rising to the fourth position in the cryptocurrency market.

- ADA primed for another 30% upswing to $0.86, which will bring it closer to $1.

- The breakout may fail to come to life if Cardano does not rise above symmetrical triangle's upper trendline.

Cardano's consistent breakout continues to impress many in the crypto community. Besides, the aspiring smart contract token has displaced Ripple (XRP), becoming the fourth-largest digital asset in the market. The token has a market value of $20 billion compared to XRP's $19 billion.

Cardano bullish picture remains intact

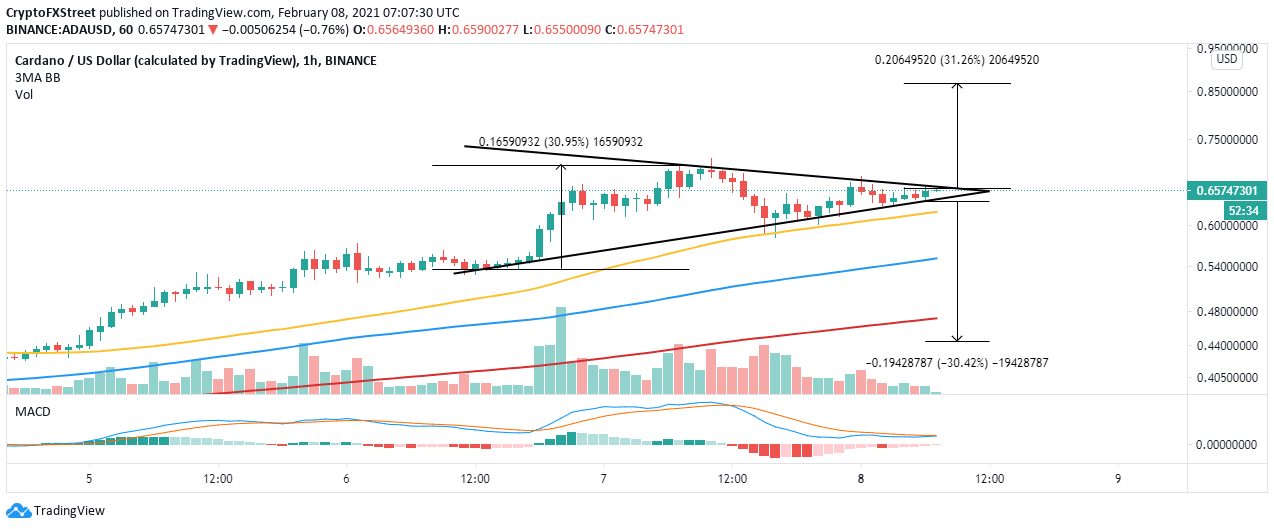

ADA is dancing at the apex of a symmetrical triangle on the 4-hour chart. The pattern forms amid a consolidating market, especially after a massive price action. Either a breakdown or a breakout is expected from the pattern.

A breakout occurs as the price steps above the upper trendline, while a breakdown happens on crossing below the lower trendline. As for ADA, we are anticipating a 30% breakout to $0.86. Note that the price usually breaks out before the trendlines converge.

ADA/USD 1-hour chart

In just seven days, Cardano increased in value by over 75%. The surge in price took place in tandem with an outpouring number of traders within the ADA ecosystem.

IntoTheBlock (ITB) highlighted that addresses that have held ADA for at least 30 days hit a multi-year high. Intriguingly, this category's value stands at 11.93 billion ADA, representing 34% of the current circulating supply.

Cardano traders by ITB

The IOMAP model by ITB slows that Cardano could rally to $0.86 very quickly with a little push from the bulls. The minor resistance zone ahead of ADA would be easy to tackle, especially with fewer people selling.

The only implied area of centration is between $0.678 and $0.697. Here, 928 addresses had previously bought nearly 16 million ADA.

It is worth mentioning that Cardano has built immense support, helping to keep the momentum upwards. The most robust buyer congestion zone runs from $0.58 to $0.6.

Here, roughly 22,200 addresses had previously bought approximately 778 million ADA. It is doubtful that bears will slice through this zone to force a breakdown toward $0.5.

Cardano IOMAP model

Looking at the other side of the picture

The massive upswing to $0.86 will fail to occur if the triangle resistance remains unshaken. Moreover, $0.7 is a former resistance zone, which may delay the uptrend. A 30% downswing may come into the picture if ADA slices through the lower trendline on the downside.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

-637483675070585225.png&w=1536&q=95)

-637483674926151070.png&w=1536&q=95)