Cardano Price Prediction: ADA remains indecisive, but a 30% move is underway

- Cardano price has been under consolidation since January 7.

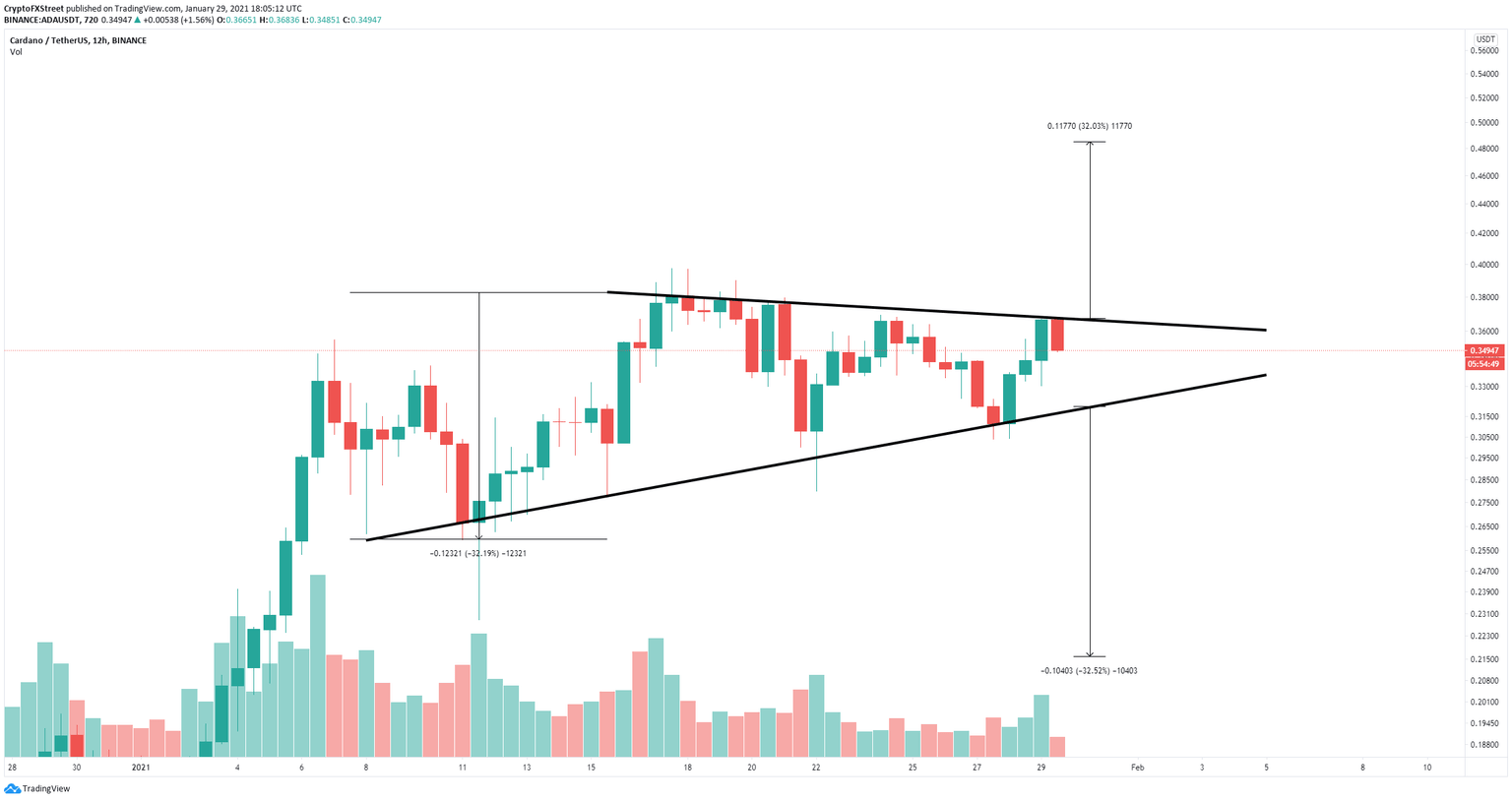

- The digital asset has formed a 12-hour symmetrical triangle pattern.

- A breakout or breakdown in the next week will most likely drive ADA price by 30%.

Cardano price hasn’t benefited much from the recent Bitcoin pump. The digital asset has been trading in a tightening range and it’s close to bursting. A clear breakout or breakdown can quickly push the digital asset by more than 30%.

Cardano price needs to crack this level to jump towards $0.50

On the 12-hour chart, the symmetrical triangle pattern has formed a resistance trendline at $0.37. A breakout above this point would drive Cardano price by 32% towards a high of $0.50.

ADA/USD 12-hour chart

The In/Out of the Money Around Price (IOMAP) chart shows that the range between $0.35 and $0.36 is the strongest barrier with 2.2 billion ADA in volume. Climbing above this area will easily push Cardano above $0.40.

ADA IOMAP chart

On the other hand, the support trendline at $0.32 must be defended at all costs by the bulls to avoid a massive dive towards $0.21. The IOMAP model suggests that the biggest support area is established between $0.308 and $0.319, coinciding with that support trendline.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

-637475405163454335.png&w=1536&q=95)