Cardano Price Prediction: ADA regains crucial support but its network activity raises red flags

- Cardano sits on top of strong support that starts at $0.104.

- On-chain metrics cast doubt that the price will be able to break from the range.

Cardano (ADA), the 10th largest digital asset with the current market capitalization of $3.4 billion, has been doing well recently. The coin has gained over 3% in the recent 24 hours and managed to settle above a critical support area. At the time of writing, ADA/USD is changing hands at $0.10, off the intra-week high reached at $0.11 on November 11.

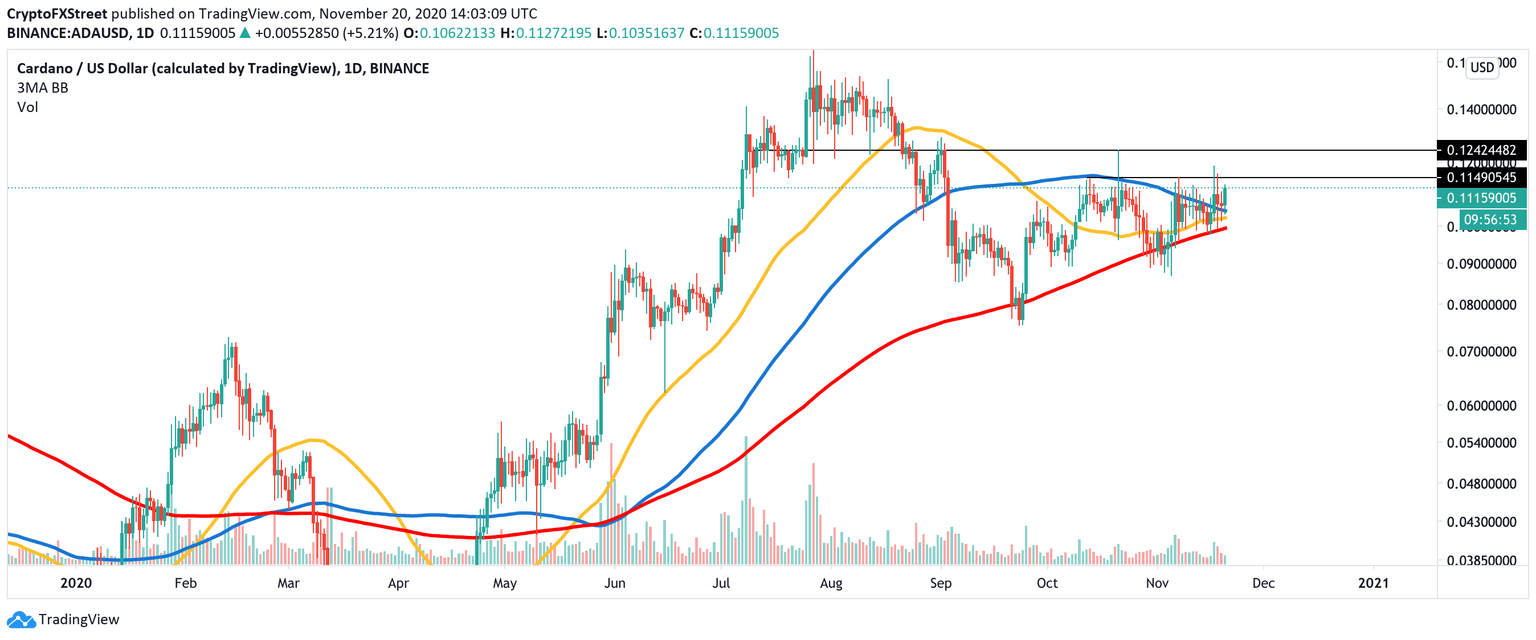

Cardano technical picture is supportive

ADA bottomed at $0.08 on September 23 and has been moving within a bullish channel ever since. The upside momentum seems to have vanished. The price failed to clear a local resistance on approach to $0.11. However, the technicals and on-chain metrics imply that the price might have regained support and now is ready to resume the recovery.

On a daily chart, ADA/USD has settled above the bunch of EMAs, including 50, 100 and 200 EMAs, which is a positive signal as it means that the price may bounce from the support created by the 100 EMA at $0.104. The next barrier is formed by the EMA200 that serves as a backstop for the coin since the end of April. Currently, it sits at $0.09.

ADA/USD daily chart

The first local resistance sits at $0.11. This area has been tested by the price on numerous occasions since the end of October but to no avail. Once it is out of the way, the upside is likely to gain traction with the next focus on the significant barrier located on the approach to $0.124.

On-chain metrics are less reassuring

This idea is supported by the In/Out of the Money Around Price (IOMAP) model, which shows that there is little to no resistance ahead until $0.124. Meanwhile, on the downside, the price sits on top of a strong support area that goes from the current price all the way down to $0.095.

ADA's IOMAP data

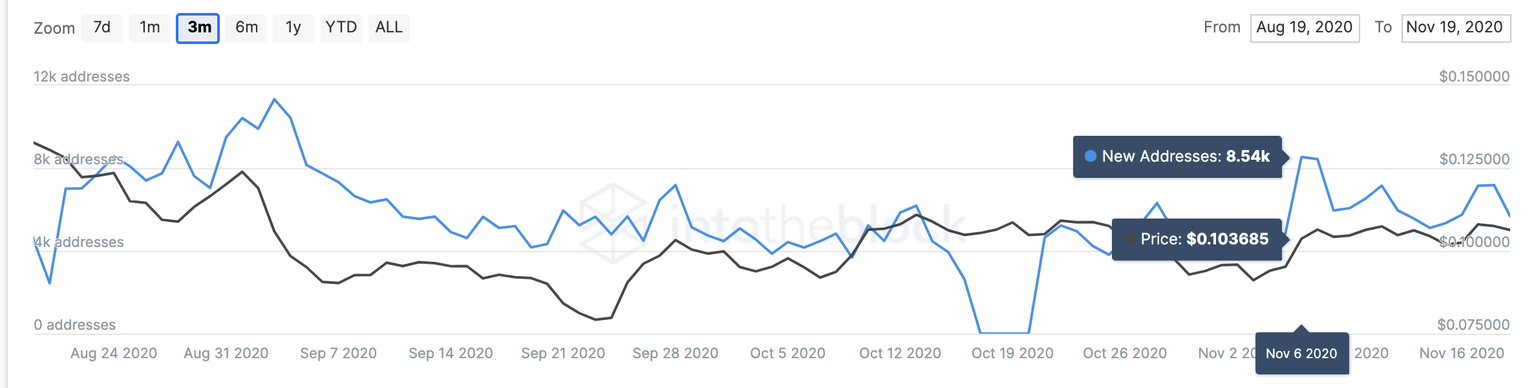

Meanwhile, the network growth seems to have peaked on November 6 as the number of new addresses created daily decreased from 8,540 to 7,180 by the time of writing. This is an alarming signal meaning that the network has been shrinking recently.

ADA New Addresses

Key levels to watch

From the technical perspective, ADA/USD is well-positioned to rebound from $0.099 and retest the support created by $0.124. Nevertheless, a sustainable move below $0.104 will invalidate the immediate bullish scenario and bring $0.095 into focus.

Author

Tanya Abrosimova

Independent Analyst

%20Analytics%20and%20Charts%20(1)-637414780389181287.png&w=1536&q=95)