Cardano price prediction: ADA is looking at an 11% rally if it can reclaim this level

- Cardano price rose by almost 6% in the last 24 hours, bringing the price to $0.266.

- ADA could rise to $0.300 if buyers sustain the bullish momentum.

- If Cardano price fails to note growth and declines below $0.248, it would invalidate the bullish thesis.

Cardano price managed to revive itself after forming two-year lows towards the end of 2022, registering a good start to 2023. The third-generation cryptocurrency still has a shot at initiating recovery, provided it can breach through its almost month-long resistance level.

Cardano price onset for recovery

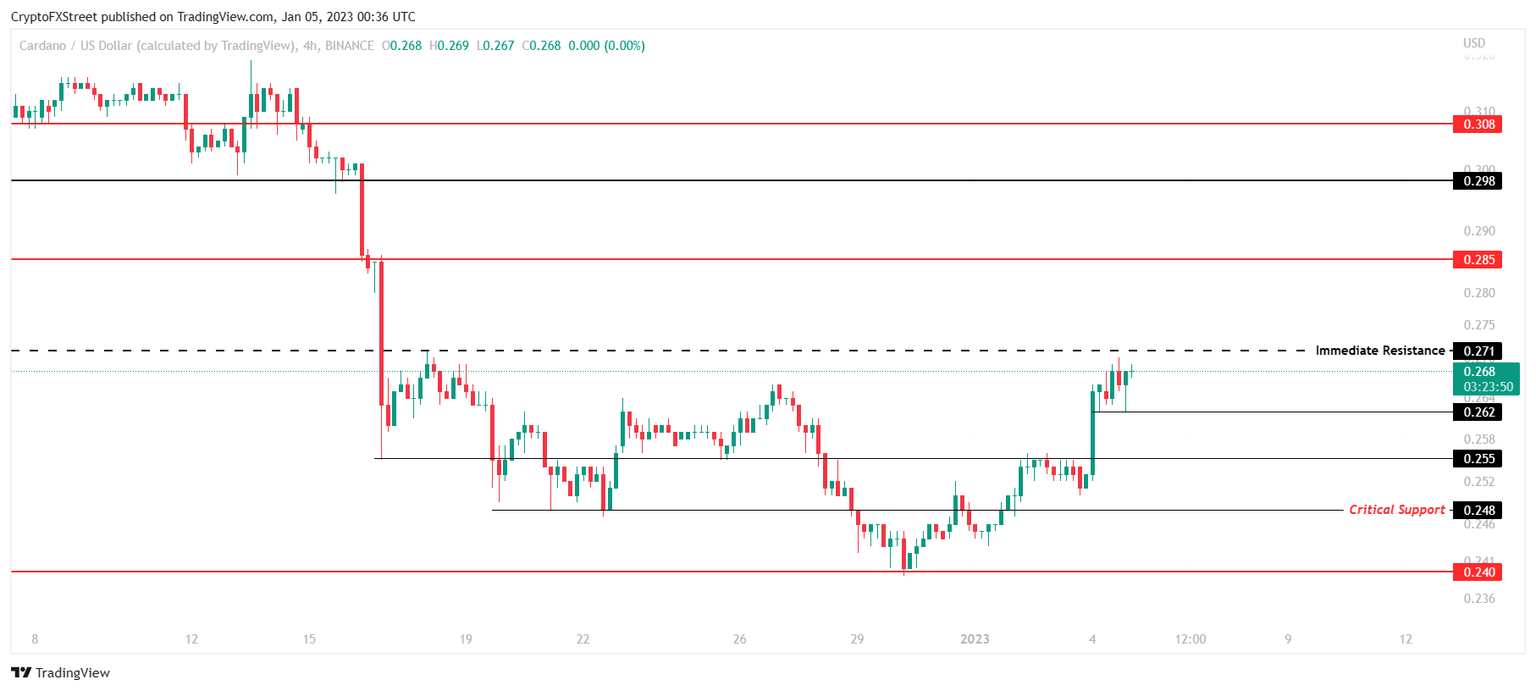

Cardano price slipped to $0.240 before the beginning of the new year after falling by more than 16% mid-December. Since then, ADA has managed to recover slightly, bringing the trading price of the altcoin to $0.266 after a 5.93% rise noted in the last 24 hours.

If this momentum continues, Cardano price might be able to reclaim its December losses, which began after ADA fell below $0.300. Should the bullish behavior noted at the hand of buyers persist, the cryptocurrency will be able to breach the immediate resistance at $0.271.

This would allow for the altcoin to rise toward $0.285 and flip it into a support floor. From here, if the third-gen cryptocurrency breaches $0.298, it would achieve an 11% rally.

ADA/USD 4-hour chart

However, if the bullish outlook does not pan out, investors must be wary of a possible 11% crash as well. Trading at $0.266, Cardano price is treading very close to its immediate support level at $0.262. Losing this support would initiate a downfall that could result in ADA falling below $0.255.

If this decline continues, Cardano price could end up tagging the critical support level at $0.248. A daily candlestick close below this level would invalidate the bullish thesis, potentially pushing ADA toward two-year lows of $0.240.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.