Cardano price positions itself for a steep correction as ADA bulls disappear

- Cardano price is traversing a descending triangle, hinting at a 17% crash if it breaches crucial support.

- Transaction data shows that a bullish move for ADA is not possible as its path is riddled with underwater investors.

- A decisive close above $1.30 will create a higher high and invalidate the bullish thesis.

Cardano price is consolidating inside a bearish setup that is due for a breakdown soon. If the bears shatter one crucial level, it will trigger a crash that will knock ADA down to levels last seen six months ago.

Cardano price on a delicate footing

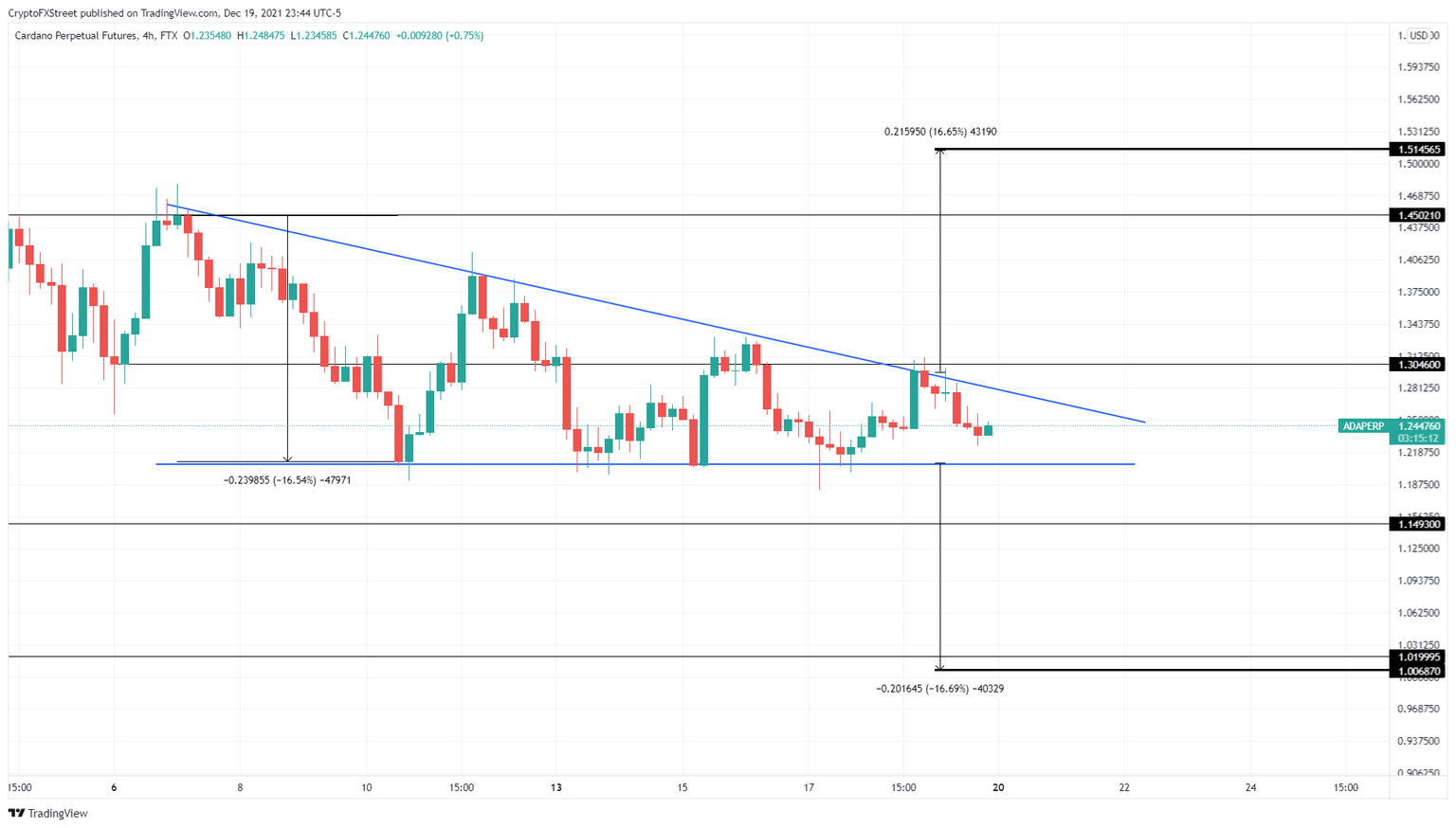

Cardano price has set up four lower highs and four equal lows since December 7. Connecting these swing points using trend lines reveals a descending triangle setup in play. This technical formation forecasts a 17% downswing, obtained by adding the distance between the first swing high and swing low to the breakout point at $1.20.

The threat of a crash builds up as Cardano price trades around the apex of the triangle at $1.24. A four-hour candlestick close below $1.20 will indicate a breakdown and trigger a 17% downswing to $1. However, investors need to note that the support level at $1.15 will play a vital role in defending the incoming crash. If the selling pressure overwhelms, ADA will head straight to the next support floor at $1.02, present in the proximity of the theoretical target at $1.

ADA/USDT 4-hour chart

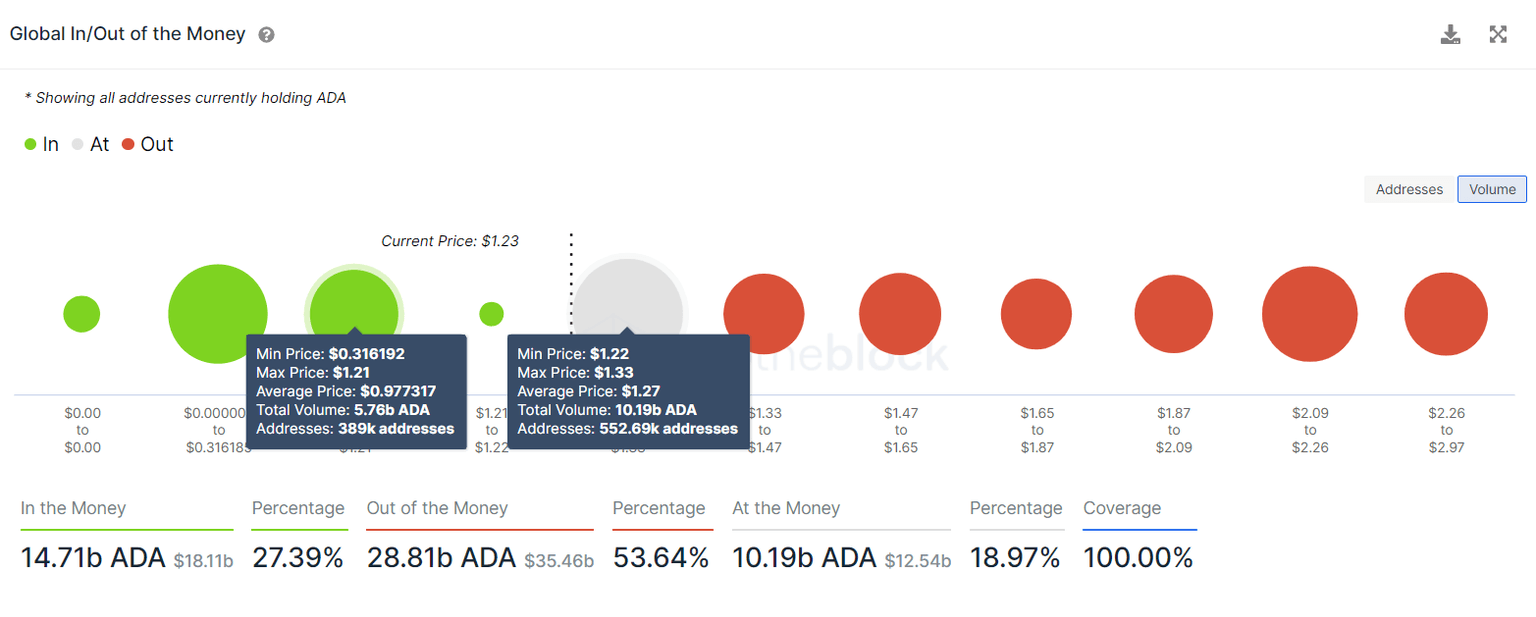

Supporting this crash for Cardano price is IntoTheBlock’s Global In/Out of the Money (GIOM) model, which shows that a strong support level is present at around $0.977. Here, roughly 3890,000 addresses that purchased roughly 5.76 billion ADA are “In the Money” and are likely to buy more if ADA heads lower.

Moreover, the 552,690 addresses that purchased 10.19 billion ADA at an average price of $1.27 are “Out of the Money.” These holders might offload their holdings and serve as a source of selling pressure if ADA rises higher.

ADA GIOM

Lastly, the number of large transactions worth $100,000 or more has dropped from 8,870 to 2,880 over the past month. This 67.5% decline suggests waning interests from high networth or whale investors.

ADA large transactions

While things are going against Cardano price, a decisive four-hour candlestick close above $1.30 will alleviate any short-term selling pressure and create a higher high, invalidating the bearish thesis.

In such a case, investors can expect ADA to rally to retest $1.45 before tagging the $1.51 hurdle.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.