Cardano price is on the verge of a 8% breadown if it slices through this barrier

- Cardano price is at risk of a significant correction if bulls can’t defend $0.35.

- The digital asset has been trading inside a tightening range for the past 24 hours.

- ADA could also see a massive breakout but it is less likely.

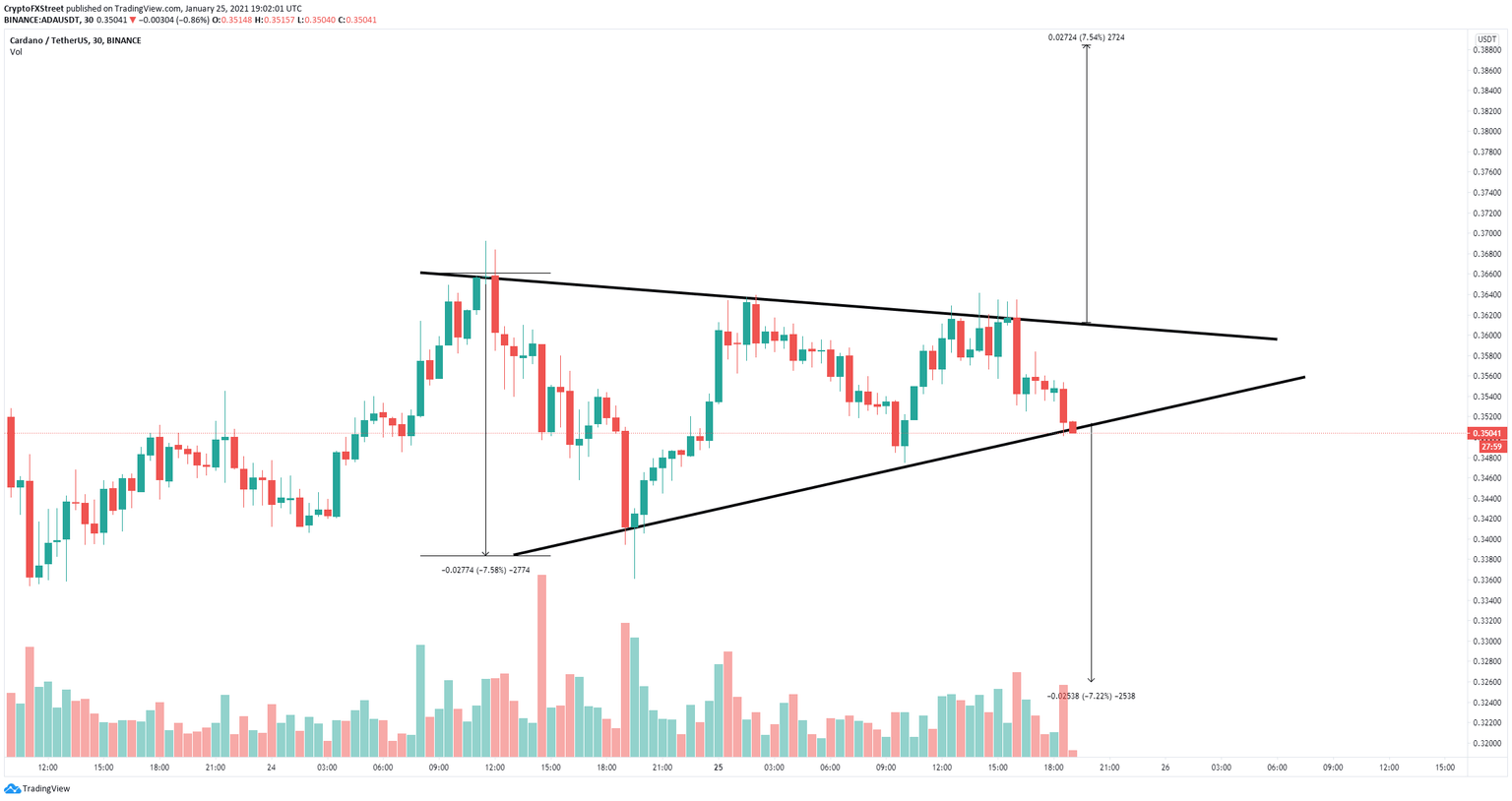

Cardano has been trading inside a tightening range on the 30-minutes chart and seems to be on the verge of a potential breakdown. The most crucial support level is located at $0.35 and it’s the key for the bears to a 8% fall.

Cardano price has to stay above $0.35 to avoid a massive drop

On the 30-minutes chart, Cardano has established a symmetrical triangle pattern which is really close to a breakdown. The support level at $0.35 must be defended at all costs by the bulls to avoid another pullback.

ADA/USD 30-minutes chart

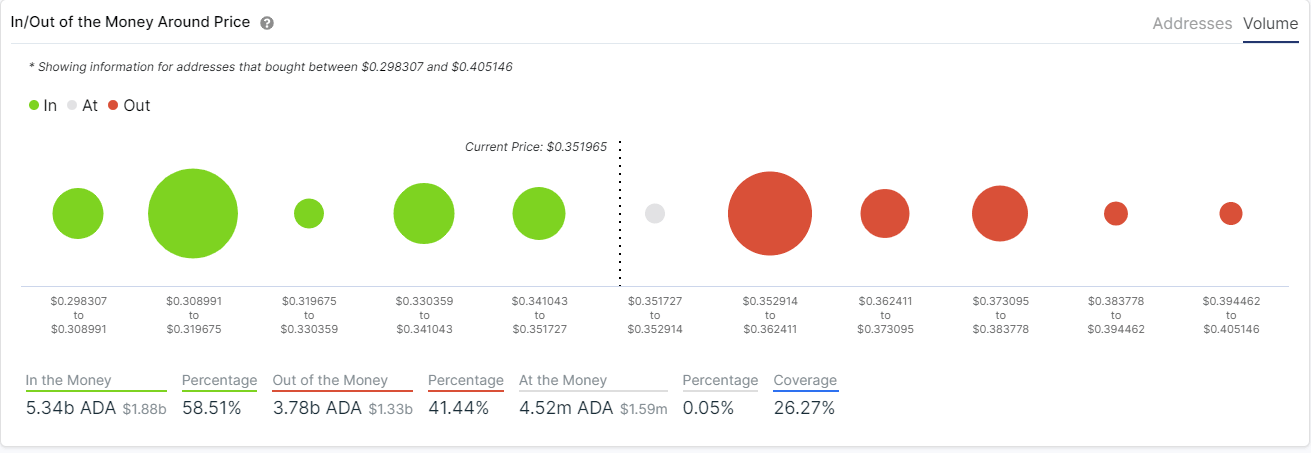

Losing $0.35 would quickly push Cardano price down to $0.32 as the In/Out of the Money Around Price (IOMAP) model indicates that the area between $0.308 and $0.319 is the most significant support range where 42,140 addresses purchased a total of 3.03 billion ADA coins.

ADA IOMAP chart

However, the IOMAP chart also indicates that only one resistance barrier between $0.35 and $0.36 separates from a potential 8% breakout. The $0.36 hurdle coincides with the upper trendline of the symmetrical triangle pattern on the 30-minutes chart. A breakout would push Cardano by up to 8%. This number is calculated using the maximum height of the pattern as a reference point.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.