Cardano price hints at a 25% rally as ADA retests stable support level

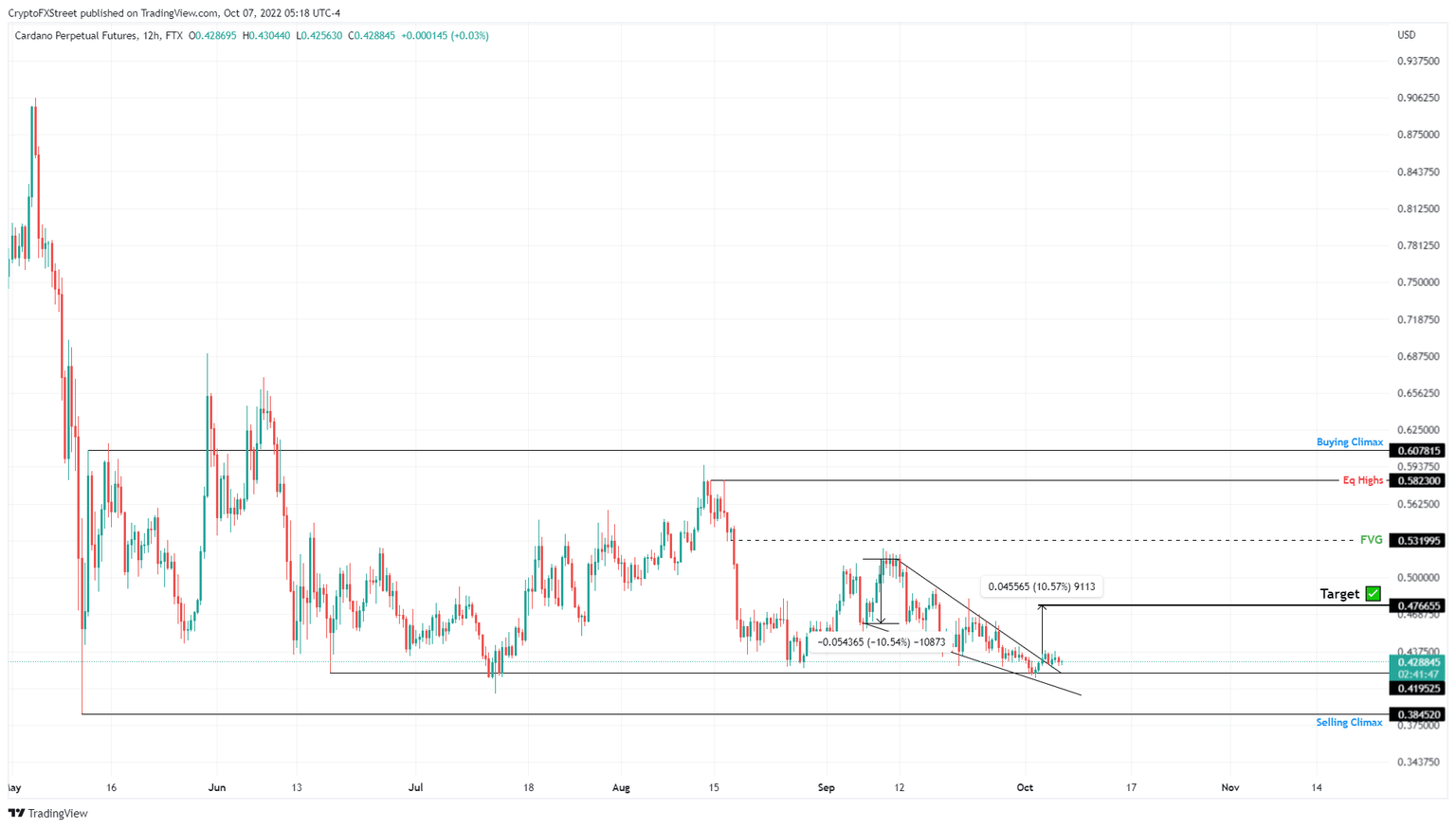

- Cardano price has broken out of a falling wedge pattern that forecasts a 10% upswing to $0.476.

- Investors can expect ADA to clear the FVG at $0.531, bringing the total gain to 25%.

- A daily candlestick close below $0.419 will invalidate the bullish thesis for the so-called “Ethereum-killer.”

Cardano price has arrived at an inflection point that has triggered not one but three reversals over the last two months. The recent retest does provide a similar opportunity for investors but with a higher risk.

Cardano price ready to make a volatile move

Cardano price has set up a falling wedge pattern that contains four lower highs and three lower lows, connected using trend lines.

This technical formation forecasts a 10% upswing to $0.476, obtained by measuring the distance between the first swing high and swing low to the breakout point at $0.430 and extrapolating it higher. Investors should prepare for an extension of this rally, especially if the market conditions improve.

In such a case, the Cardano price could propel higher and rebalance the inefficiency formed at $0.531 where ADA once crashed 8% in a twelve-hour period. This whole breakout move would constitute a 25% upswing from the current position.

ADA/USDT 1-day chart

On the other hand, if Bitcoin price continues to nosedive, Cardano price will follow suit. In such a case, if ADA produces a daily candlestick close below the $0.419 level, touched on multiple occasions before, it will invalidate the bullish thesis.

Such a development could see Cardano price revisit the immediate support level at $0.384.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.