Cardano price grabs liquidity, next stop is $0.505

- Cardano price collected liquidity resting below the September 13 swing low at $0.460, triggering a reversal.

- Investors can expect ADA to continue this recovery rally until it retests the $0.505 hurdle.

- A daily candlestick close below $$0.0.450 will create a lower low and invalidate the bullish outlook for ADA.

Cardano price triggers its liquidity fractal pattern again after the recent sell-off in Bitcoin and Ethereum. The collection of sell-stop liquidity has also caused ADA to catalyze a run-up. Interested traders can capitalize on this rally by jumping on this trend at the right time.

Cardano price signals buy

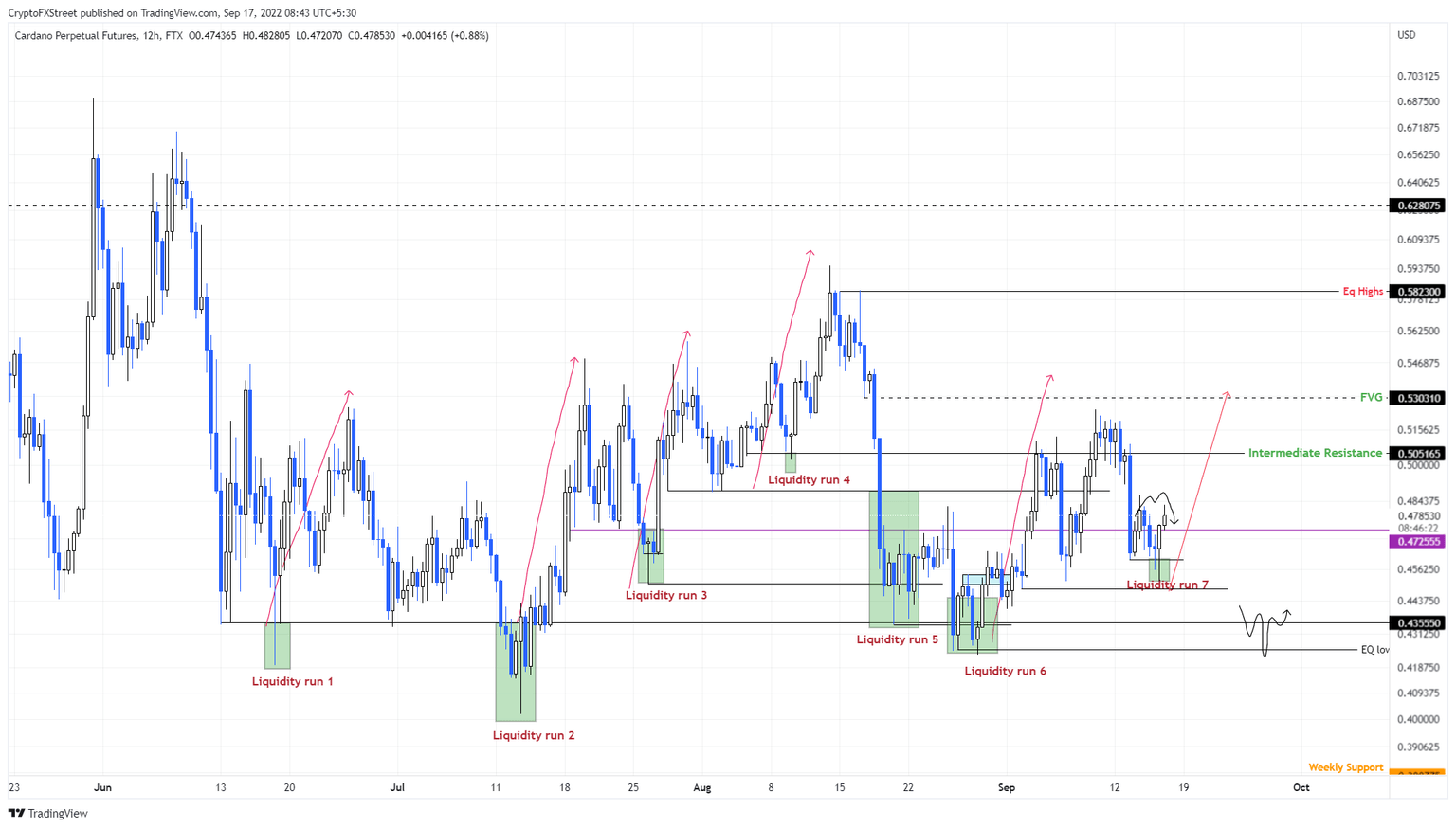

Cardano price created the seventh liquidity run on a twelve-hour chart as it swept the September 13 swing low at $0.460 and created a double bottom at $0.450. This development kick-started a reversal that has pushed ADA up by 5.82% so far.

The bounce in ADA could easily retest the immediate hurdle at $0.505. Since Cardano price produced a higher high at $0.521 relative to the September 6 swing high at $0.512, the trend seems to be favoring bulls. Hence, the ongoing recovery rally could aim for the $0.530 resistance level.

If ADA retests $0.530, it will have rallied 17% and is likely where the upside will be capped for the so-called “Ethereum-killer.” Additionally, this move would have produced a higher high relative to the last higher high at $0.524 formed on September 10.

ADA/USDT 12-hour chart

On the other hand, if Cardano price produces a lower low below the $0.450 level, it will invalidate the bullish thesis for ADA. This development could see Cardano price crash to the $.435 stable support level.

Note:

The video attached below talks about Bitcoin price and its potential outlook, which could influence Cardano price.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.