Cardano price gains 5% with more to come as whales make a swirl of large acquisitions

- Cardano price is up 5% after a swirl of whale acquisitions on May 22.

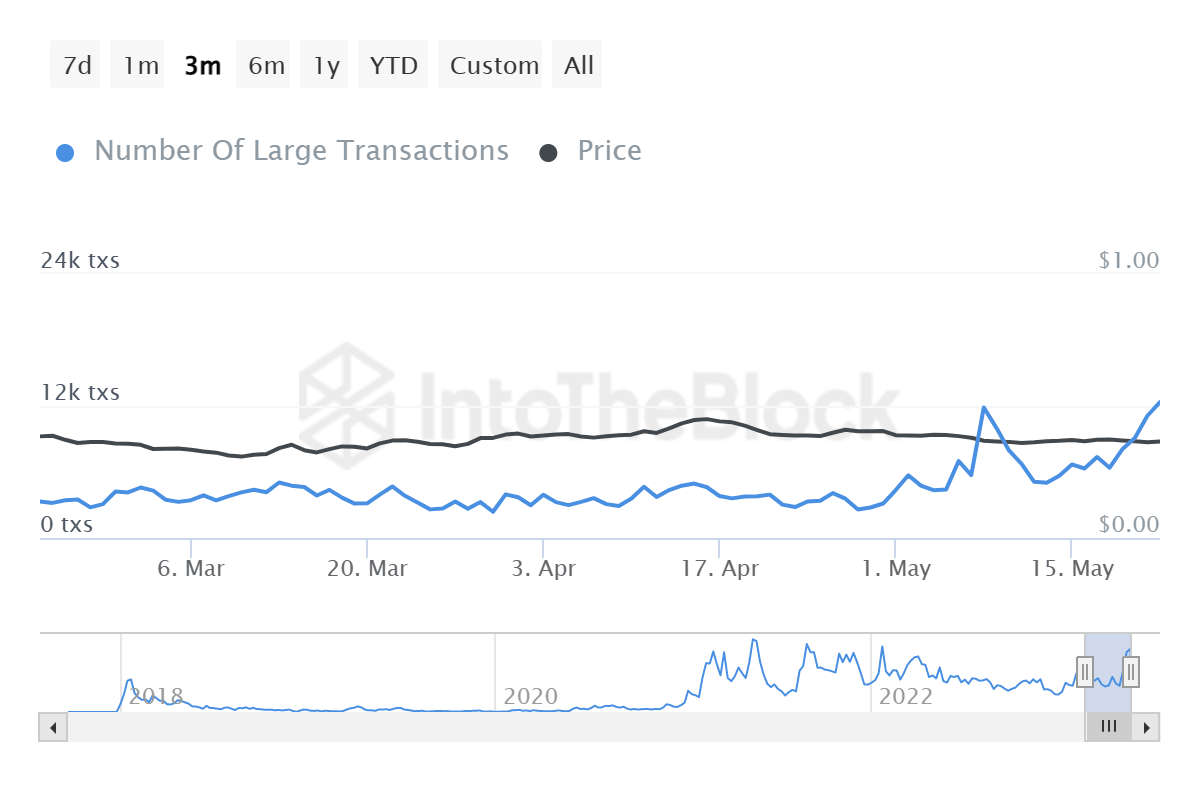

- ADA Large Transactions soared to 12,360 on May 22, a 146% increase from the May 13 low of 5,020 whale transactions.

- Whale transactions exceeded 12,000 for the first time since May 2021.

- Despite the leap, the MVRV data shows that most Cardano investors still hold sizeable losses.

Cardano (ADA) price has recorded a daily rise of 5% to the current price of $0.371 after ADA whales performed a swirl of large transactions on May 22. The optimism has turned on-chain data in favor of ADA, showing that more bullish activity may manifest in the coming days, with Bitcoin (BTC) price action hinting at a positive short-term outlook.

Cardano whales spotted recording massive transactions

Cardano (ADA) whales were spotted conducting massive transactions on Monday, a move that has earned ADA a place among the best-performing Layer-1 (L1) tokens this week. Based on the chart below, the number of ADA-related transactions went as high as 12,360 on May 22, representing a 146% spike from the 5,020 whale transactions recorded on May 13.

IntoTheBlock's large transactions metric determines the daily number of transactions exceeding $100,000, with the above chart showing that the last time Cardano recorded such an enormous whale activity was around May 2021.

Considering previous Cardano price rallies have been preceded with increased activity among whales, ADA investors should expect more gains in the next few days.

Most ADA holders still recording net losses

Nevertheless, while Cardano price leaped, Santiment's Market Value to Realized Value (MVRV) metric indicates that most ADA investors still hold significant losses.

The MVRV metric determines investors' net financial position by comparing their purchase prices to the asset's current market value. From the chart above, with Cardano price at $0.371, investors who acquired ADA in the last 30 days are holding 5.331% in losses.

Typically, as investors avoid selling until the asset's price approaches its break-even point, ADA traders will likely continue consolidating their Cardano holdings over the next few days as they wait for the cost to equal revenue.

Cardano price could rally an additional 5%

Cardano (ADA) price could record more gains amid buyers' described level of bullishness. An increase in buyer momentum above the current price could see ADA break above the hurdles presented by the 100-, 50-, and 200-day Exponential Moving Averages (EMA) at $0.375, $0.378, and $0.393, respectively, before an extended rally to the $0.427 hurdle. In a highly bullish case, the altcoin could tag the $0.462 resistance level, denoting a 25% uptick from the current level.

ADA/USDT 1-Day Chart

Based on IntoTheBlock's Break-Even Price Distribution data, ADA could soon reclaim the $0.50 level last tested around September. Nevertheless, this would not be as easy as it seems, considering the formidable $0.423 to $0.695 zone where around 594,380 addresses that bought 6.71 billion ADA could sell once they break even at $0.50, unwittingly provoking a pullback.

Accordingly, the bullish outlook for Cardano price could be short-lived if ADA drops below $0.342. However, the 371,400 investors that bought 3.12 billion ADA at the minimum price of $0.316 can offer some support.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.

%2520%5B23.38.09%2C%252023%2520May%2C%25202023%5D-638204745104532709.png&w=1536&q=95)