Cardano Price Forecast: ADA targets 900% bull rally, but it must clear $0.33 first

- Cardano price seems to be on the verge of a massive breakout after cracking a long-term trendline resistance.

- After a brief consolidation period, it seems that Cardano is ready to resume its uptrend.

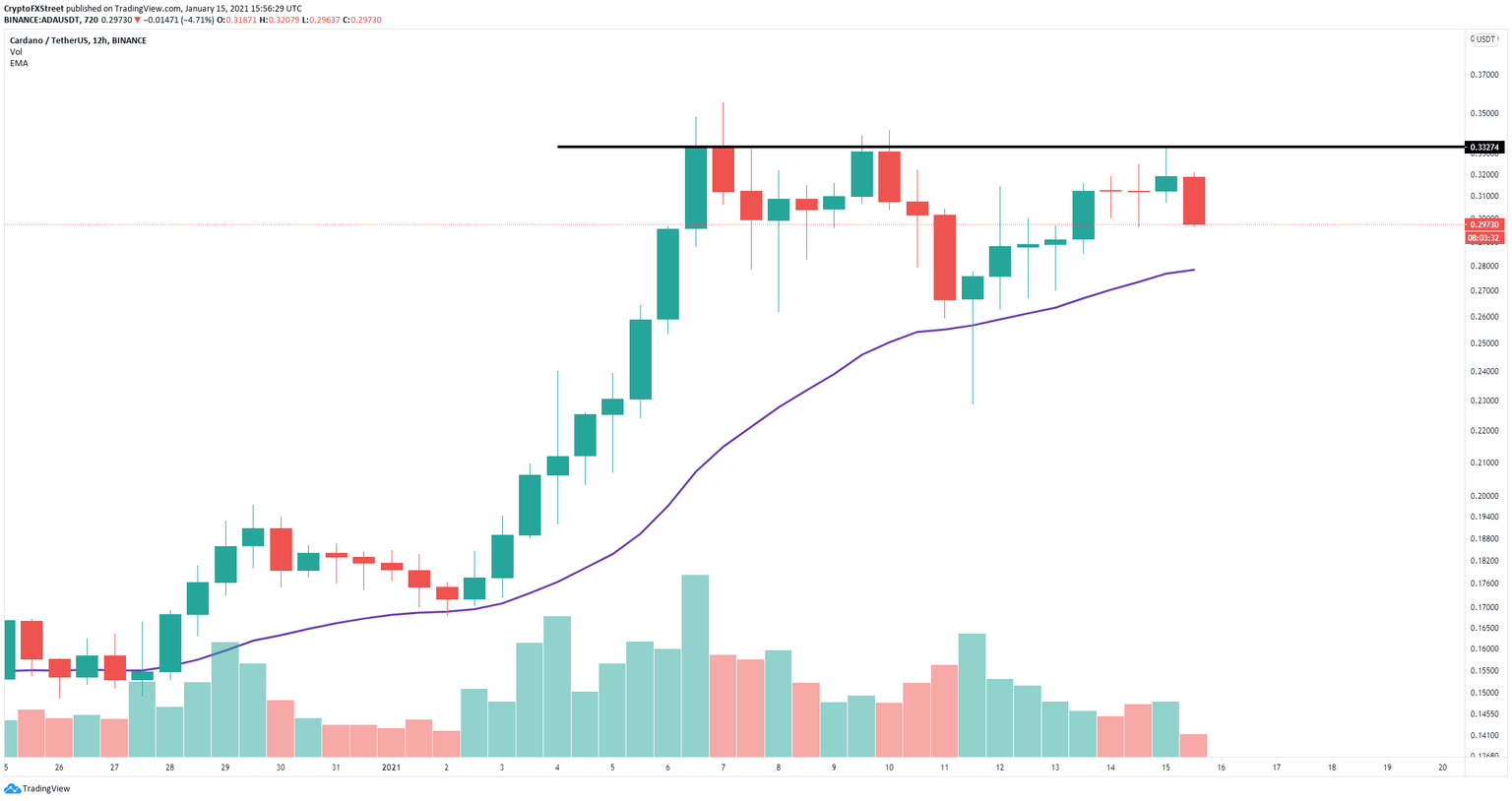

Cardano had a significant rally towards $0.355 at the beginning of 2021. After a notable dip to $0.228, bulls bought it and managed to push Cardano price to $0.33 again before a small rejection.

Cardano price needs to clear the $0.33 level to see a massive breakout

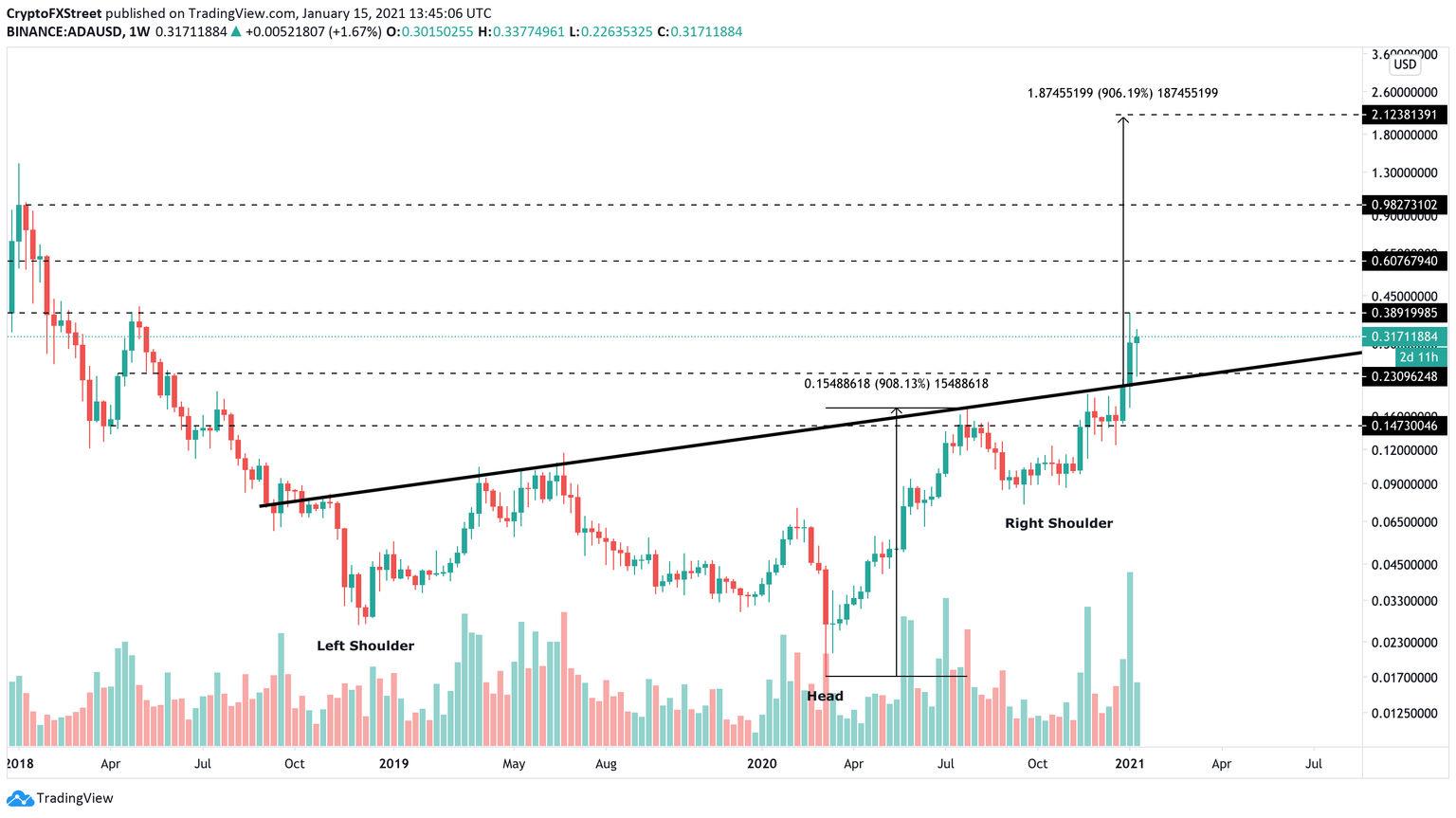

On the weekly chart, Cardano broke out from a reverse head and shoulders pattern and seems to have retested the neckline resistance trendline. This breakout had a price target of $2.12 which represents a 900% increase. The target was determined using the height from the neckline trendline to the head.

ADA/USD weekly chart

On the 12-hour chart, Cardano price has established a critical resistance level at $0.33 in the short-term. A breakout above this point can quickly start to push the digital asset towards the $2.12 long-term price target.

ADA/USD 12-hour chart

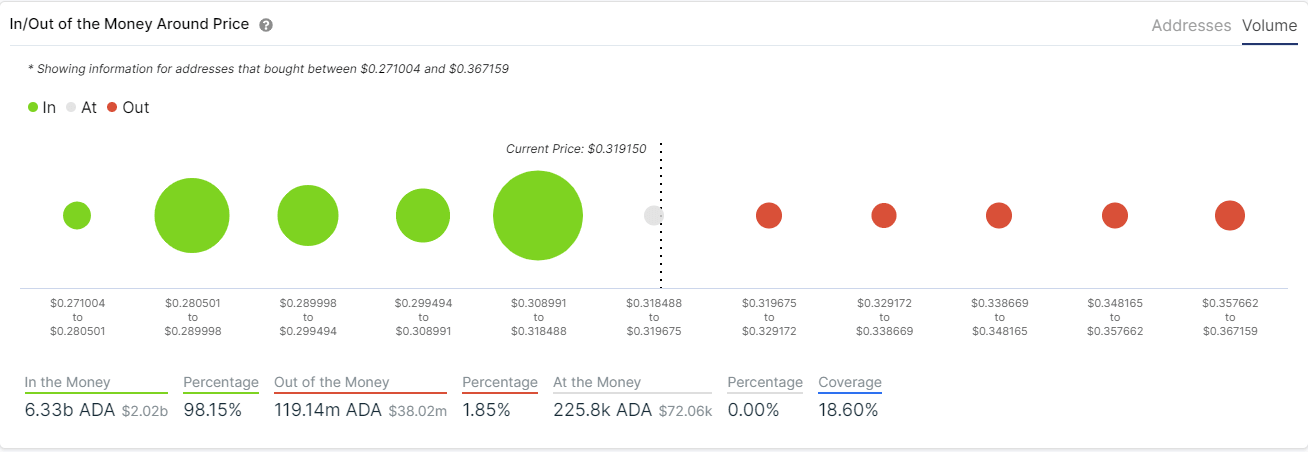

Cardano bulls can find a lot of support at $0.28 which is the 26-EMA. Additionally, the In/Out of the Money Around Price (IOMAP) chart shows a robust support area between $0.318 and $0.30 and another one between $0.28 and $0.29 which coincides with the 26-EMA.

ADA IOMAP chart

However, losing this crucial support level would be a notable bearish sign capable of sending the digital asset down to $0.20, the next psychological support level.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.