Cardano founder intensifies rivalry with Ethereum amid ADA's bearish streak

- Charles Hoskinson promotes Cardano over Ethereum in a surprise AMA session on Sunday.

- Cardano’s ADA token extends the downtrend for the fourth consecutive day, risking a drop below $0.80.

- The on-chain data reflects Ethereum’s superiority over Cardano.

Charles Hoskinson, founder of Cardano (ADA), has intensified the rivalry with Ethereum (ETH) and made other key comments in his recent Ask Me Anything (AMA) session on Sunday. Ethereum, the largest altcoin by market capitalization of $532 billion, outpaces Cardano by a huge margin, which has a valuation of $28 billion. Furthermore, the on-chain data puts Ethereum on a pedestal far higher than Cardano, reflecting its larger adoption.

Key comments of Charles Hoskinson

Charles Hoskinson, one of the co-founders of Ethereum, has picked sides with his brainchild, Cardano. In an AMA session on Sunday, Hoskinson responded with “I want Cardano to win” against Ethereum, while urging developers to build more on the Cardano blockchain.

The founder also tapped into the Glacier update, which will introduce Hydra protocol, Cardano smart contracts, and the Midnight token. This will likely increase the decentralized finance (DeFi) share of Cardano.

Furthermore, Hoskinson shared an experience with Sergey Nazarov, the founder of Chainlink (LINK), who asked him for too high a price for integration. As per Hoskinson, “Segey is an extremely smart man that sees the future and knows he’s sitting on a golden egg.”

Cardano’s uphill battle with Ethereum

Ethereum, a well-established smart contract and DeFi powerhouse, holds a Total Value Locked (TVL) of $91.64 billion, representing the total on-chain asset value. This is significantly higher than Cardano’s total on-chain assets, worth $362 million, as the blockchain struggles to implement smart contract functionalities and decentralized Applications (dApps).

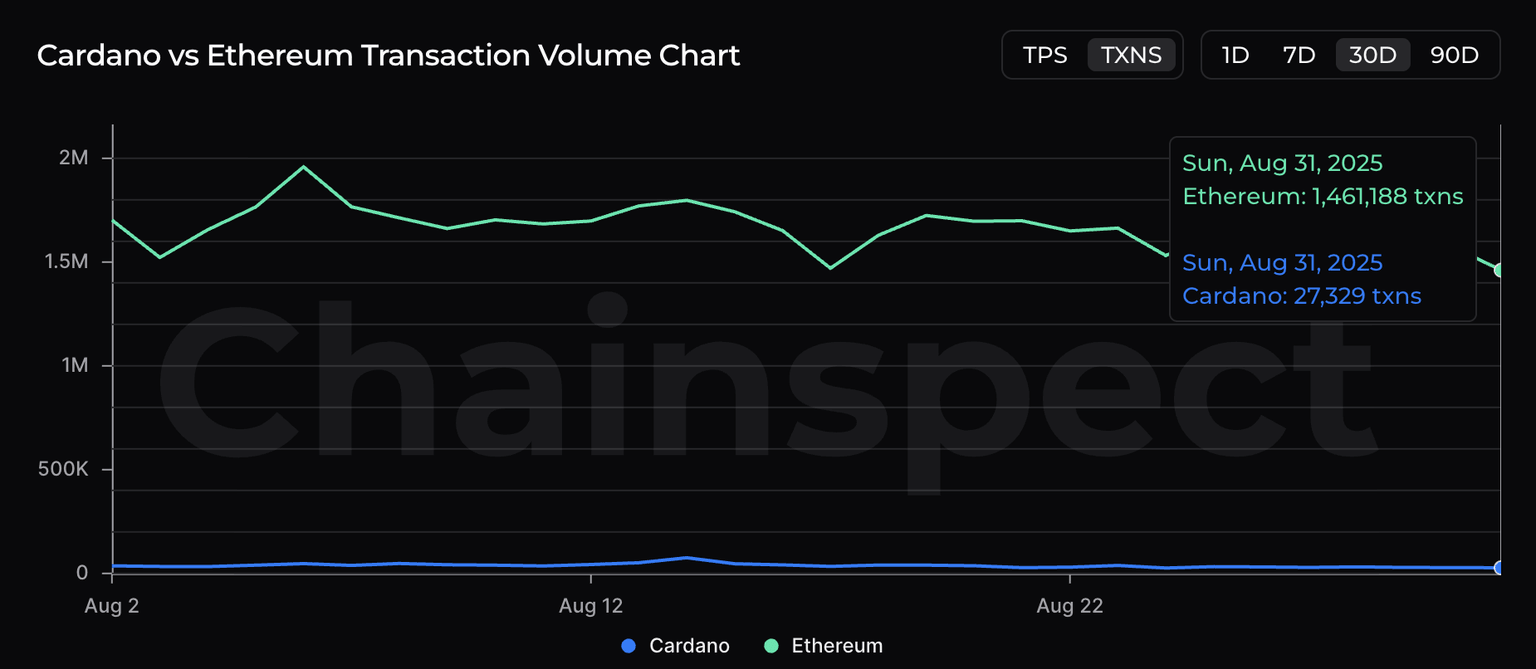

Furthermore, the transaction over the two blockchains highlights the huge difference in user adoption. Chainspect data shows 1.46 million daily transactions on Ethereum compared to 27,329 transactions on Cardano.

Cardano vs Ethereum transaction volume. Source: Chainspect

Transactions occurring per second (TPS) in Ethereum are at 17.78 transactions, outpacing Cardano's 0.27 TPS. Fundamentally, Ethereum holds the ground with the maximum theoretical TPS of 119 compared to Cardano’s 18 TPS.

Cardano vs Ethereum scalability. Source: Chainspect

To compete with Ethereum, the upcoming Glacier update in Cardano could provide the initial boost to reshape its DeFi space and increase its adoption.

Cardano risks further losses

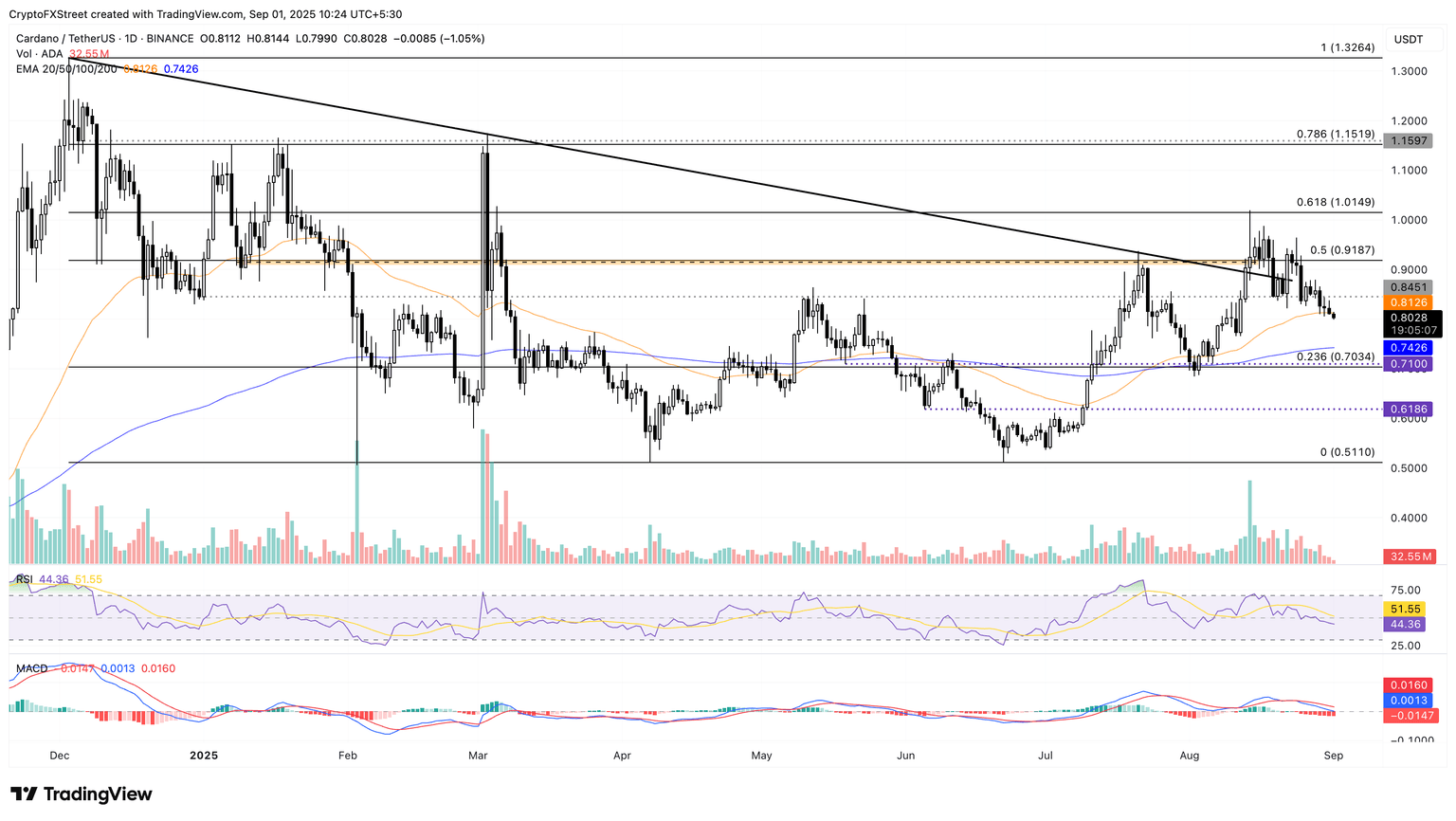

Cardano edges lower by 1% at press time on Monday, extending the losses for the fourth consecutive day. The downtrend in ADA steeply falls below the 50-day Exponential Moving Average (EMA) at $0.8126, targeting the 200-day EMA at $0.7426.

The momentum indicators on the daily chart indicate a bearish tilt as overhead pressure intensifies. A declining trend in the Relative Strength Index (RSI) crosses below the halfway line, reaching 44, indicating a steady decline in buying pressure.

The Moving Average Convergence Divergence (MACD) and its signal line inch closer towards the zero line, indicating a rise in selling pressure.

ADA/USDT daily price chart.

Looking up, to reinforce a recovery run, Cardano should reclaim the 50-day EMA at $0.8126.

Author

Vishal Dixit

FXStreet

Vishal Dixit holds a B.Sc. in Chemistry from Wilson College but found his true calling in the world of crypto.