Can XRP and Polkadot (DOT) rise faster than Bitcoin (BTC) for a while?

Bulls are trying to seize the initiative by the end of the week, as some coins have come back to the green zone.

Top coins by CoinMarketCap

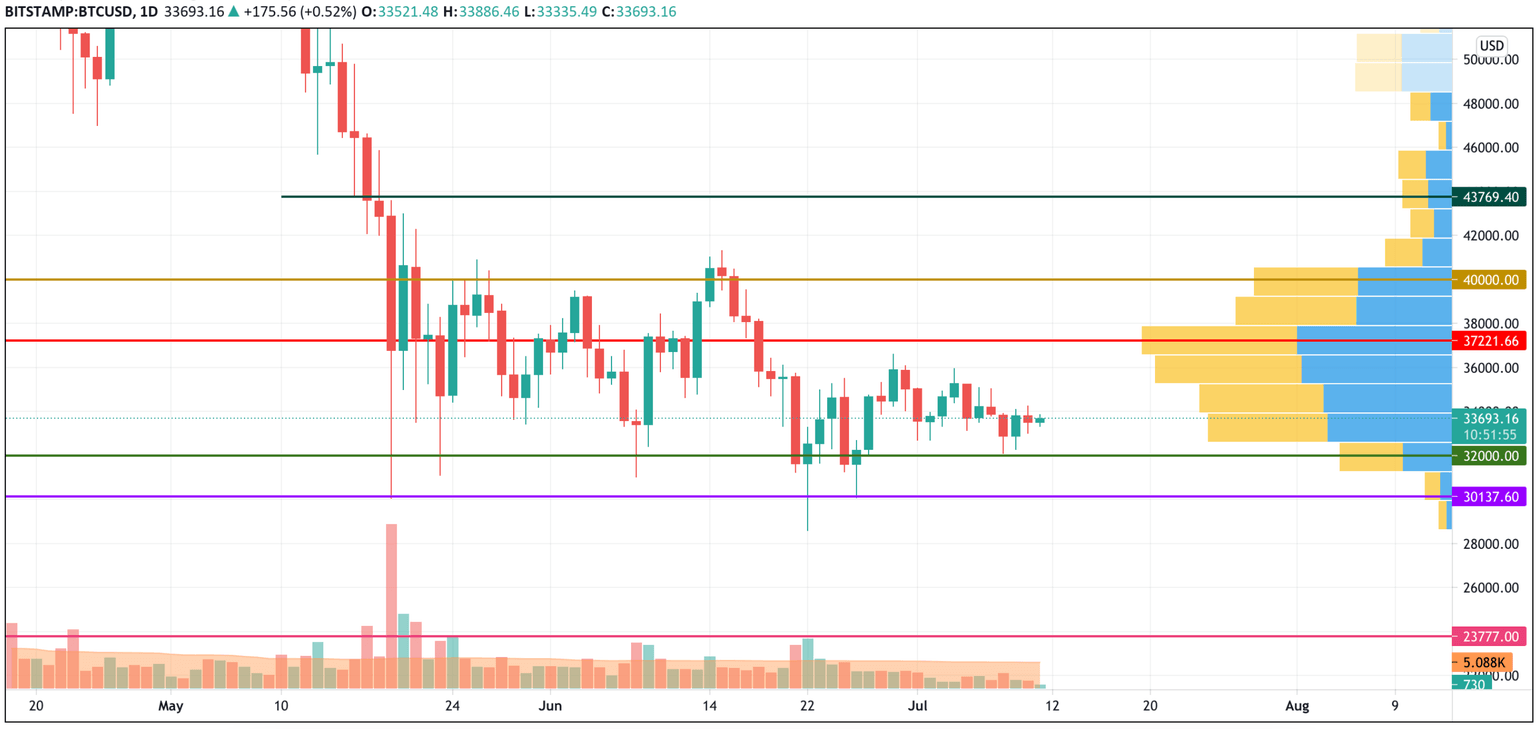

BTC/USD

The rate of Bitcoin (BTC) has fallen by 4.40% over the past seven days.

BTC/USD chart by TradingView

Bitcoin (BTC) is still locating in the sideways trend even though its rate has declined by 0.12% since yesterday. At the moment, a rise is more likely than a decrease as the main crypto remains trading above the support at $32,000.

In this case, there are chances to get to the zone of the most liquidity at $37,200 next week.

Bitcoin is trading at $33,710 at press time.

XRP/USD

XRP is the biggest loser today in terms of the weekly price change as its rate has gone down by 9%.

XRP/USD chart by TradingView

Despite the fall, XRP is also bullish as bears are weakening, taking into account the falling selling trading volume. If bulls keep XRP above $0.60, the nearest resistance at $0.70 might be attained shortly.

XRP is trading at $0.6251 at press time.

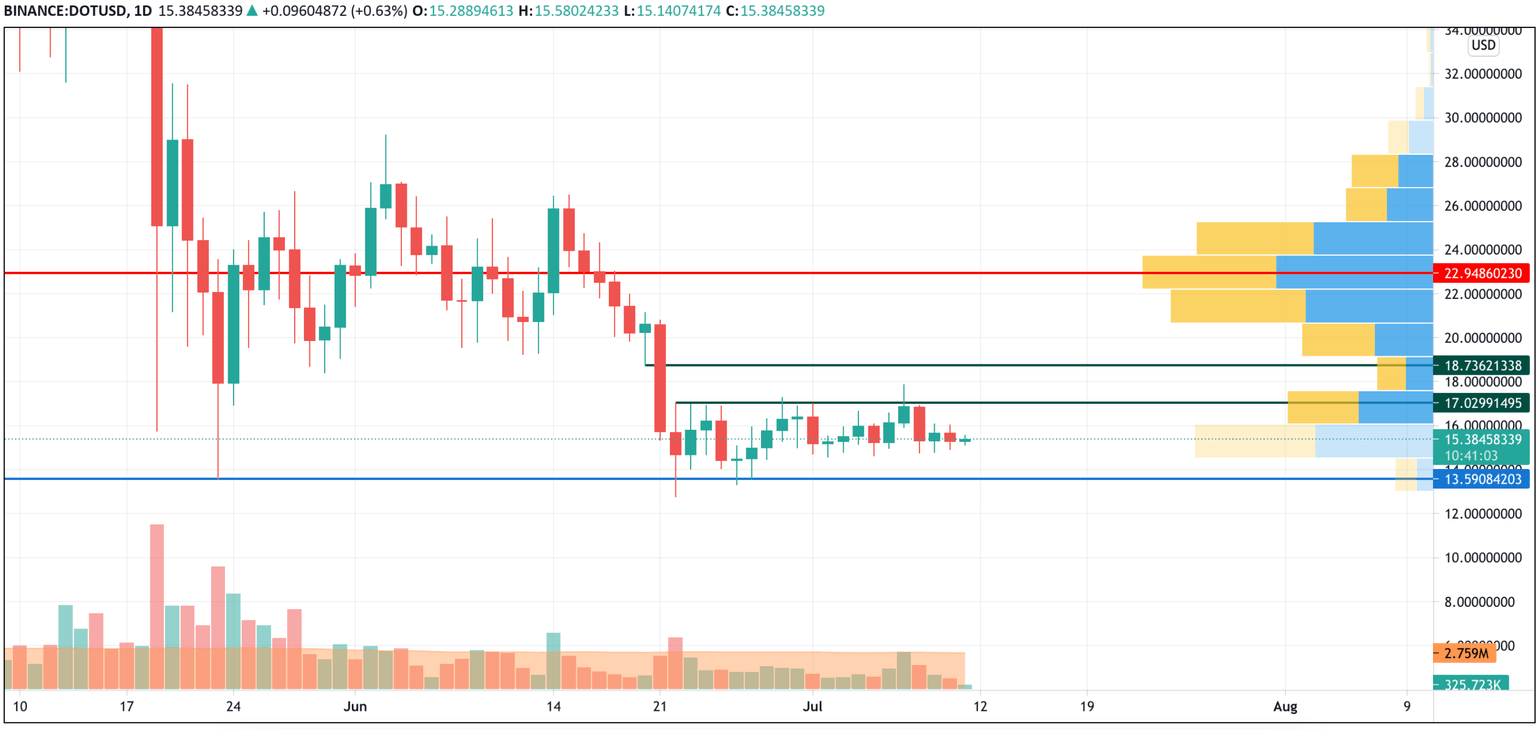

DOT/USD

The rate of Polkadot (DOT) has remained the same over the past 24 hours.

DOT/USD chart byTradingView

Polkadot (DOT) remains neutral as it remains trading in a narrow range. The bullish scenario becomes relevant if buyers break the resistance at $17 and fix above it.

DOT is trading at $15.38 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.