Can the altcoins rise against the sharp growth of Bitcoin (BTC)?

The new week has begun with the continued rise of the market as most of the assets remain green. Solana (SOL) is the exception to the rule, decreasing by 4%.

Top coins by CoinMarketCap

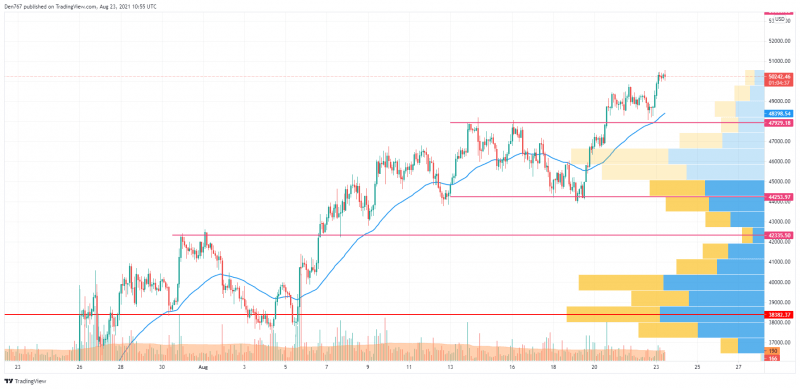

BTC/USD

At the end of last week, the Bitcoin price consolidated in a sideways range with the support at $48,500. On Sunday, the bears managed to pierce this support level several times. But the Bitcoin (BTC) price did not fall below $48,000, immediately returning to the sideways corridor.

BTC/USD chart by TradingView

Buyers formed a bullish impulse tonight, which broke through the psychological level of $50,000 and, in the morning, marked a new August high of $50,438.

This summer, the price of BTC returned above $50,000 for the first time. This week, the growth may continue to the area of $51,500. Along with this, an increase in sales is to be expected soon. This might lead to a reversal of the pair in a pullback and a decline in price to the support of $48,000.

Bitcoin is trading at $50,256 at press time.

ADA/USD

Cardano (ADA) is the biggest gainer from today's list, going up by almost 8% since yesterday.

ADA/USD chart by TradingView

Cardano (ADA) keeps rising after setting a new peak on the daily chart. The trading volume is going down, which means that traders are accumulating power for a possible further price rise.

Now, the more likely price action is trading in the range around $2.72 before a rise to the psychological level of $3.

Cardano is trading at $2.82 at press time.

LTC/USD

The rate of Litecoin (LTC) is almost unchanged since yesterday. The price rise has accounted for only +0.53%.

LTC/USD chart by TradingView

Litecoin (LTC) has absorbed the fall from the local low at $162, which confirms the bulls' power. If the daily candle closes near the resistance at $189, one may consider a breakout and rise to the closest level at $200. The low buying trading volume supports this bullish mood.

Litecoin is trading at $189.10 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.