Can Ethereum (ETH) and XRP show the same growth as Bitcoin (BTC)?

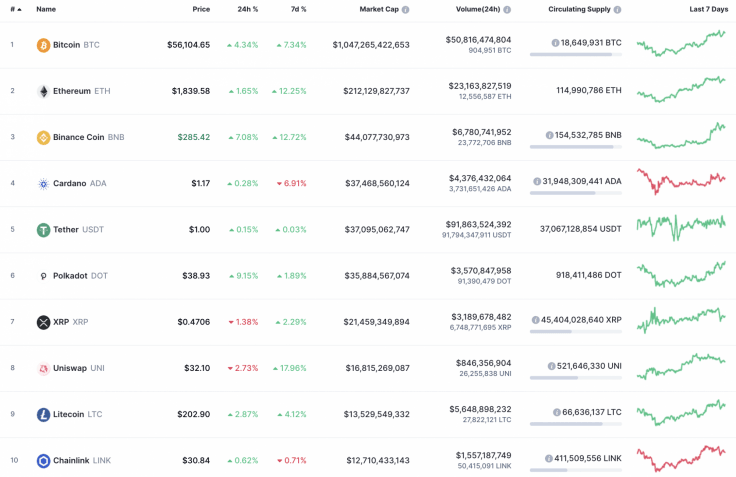

Bulls keep dominating the market as most of the top 10 coins are in the green zone. XRP and Uniswap (UNI) are the only exceptions to the rule, falling by 1.38% and 2.73%, respectively.

Top 10 coins by CoinMarketCap

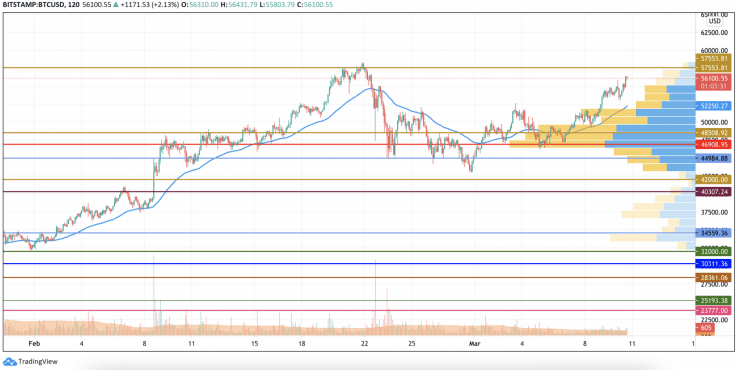

BTC/USD

Yesterday morning, buyers continued the recovery of the BTC/USD pair, but during the day the bulls repeatedly ran into bearish impulses, which brought the price down to the support around the $53,300 mark.

BTC/USD chart by TradingView

By the end of the day, the pair came close to the target level of $55,000. However, it was possible to break through this resistance only this evening. The March high was set at $55,855 and, in the morning, the Bitcoin price returned to the support of $53,300. If sellers' efforts are limited today by this support, then buyers will try to restore the price to the zone of the monthly maximum.

If the bears push below the $53,300 mark, then the price may retrace to the two-hour EMA55 area.

Bitcoin is trading at $56,256 at press time.

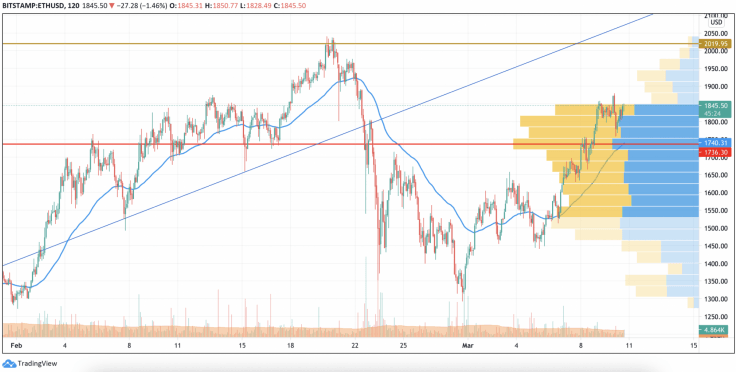

ETH/USD

Yesterday, after the morning high around the $1,860 mark, trading volumes decreased and sellers pressed the Ether price to the support of $1,800.

ETH/USD chart by TradingView

Tonight there was a weak attempt by the bulls to test the level of $1,900, but the growth was not supported by large enough volumes. After a local maximum of around $1,880, the price rolled back to the POC line ($1,768). If the bears push through this Volume Profile indicator line, then the pair will test the two-hour moving average EMA55.

If the point of control line stops the onslaught of sellers, then in small volumes the price will resume the sideways consolidation with support at $1,800.

Ethereum is trading at $1,846 at press time.

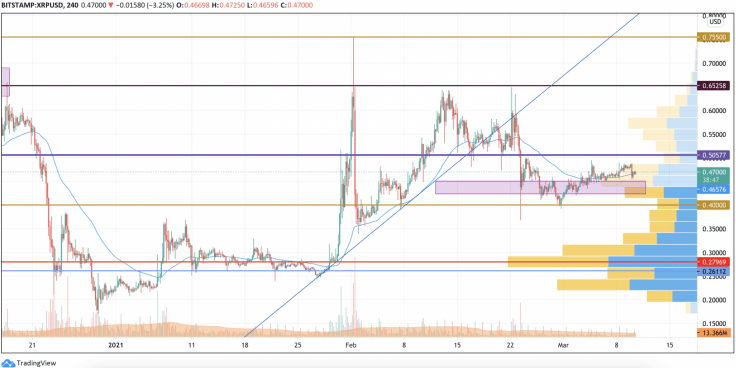

XRP/USD

XRP was trading at low volumes yesterday, and buyers were unsuccessful in the price recovery.

XRP/USD chart by TradingView

The bears broke through the four-hour EMA55 tonight and are trying to test the support of $0.450. If the upper border of the channel cannot withstand the onslaught of sellers, the pair will return to a narrow sideways trend with support at $0.430. At the same time, low selling volumes will help ease the bearish onslaught and restore the pair above average prices.

XRP is trading at $0.47 at press time.

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.