Can BTC grow faster than Ethereum (ETH) or XRP in the short-term view?

The last day of the week has turned out to be bearish for most of the coins. Binance Coin (BNB) is the only exception to the rule, rising by 1.12% since yesterday.

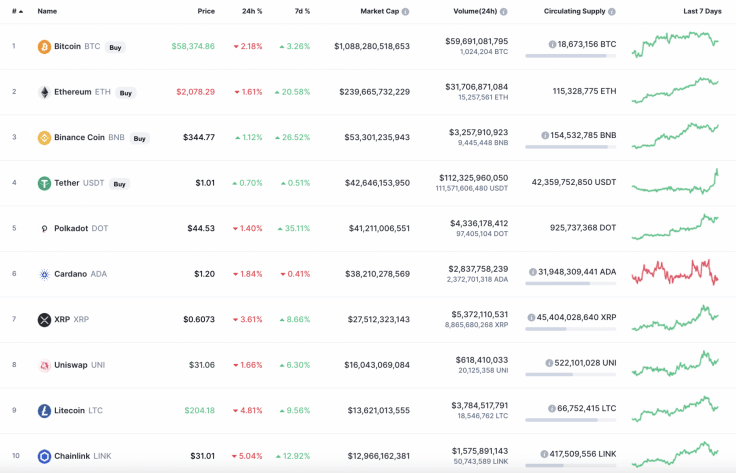

Top 10 coins by CoinMarketCap

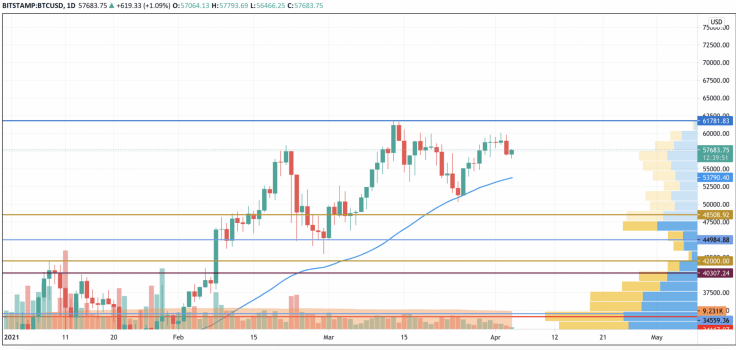

BTC/USD

Bitcoin (BTC) has shown a price decrease since yesterday. It declined by 2.54%.

BTC/USD chart by TradingView

On the daily chart, Bitcoin (BTC) has bounced off, confirming the fact that yesterday's decline was just a drop to gain liquidity for the ongoing rise.

In this case, the leading crypto now has the chance to test the level of $58,500 shortly.

Bitcoin is trading at $57,660 at press time.

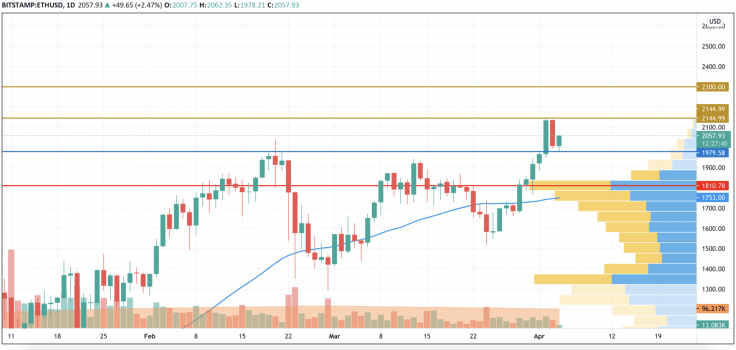

ETH/USD

The rate of Ethereum (ETH) has not decreased as much as that of Bitcoin (BTC).

ETH/USD chart by TradingView

From the technical point of view, Ethereum (ETH) is ready to keep the growth going after yesterday's decline, as one can consider the drop a retest of the mirror level but not the start of a bearish trend. Respectively, the potential short-term target is $2,300.

Ethereum is trading at $2,055 at press time.

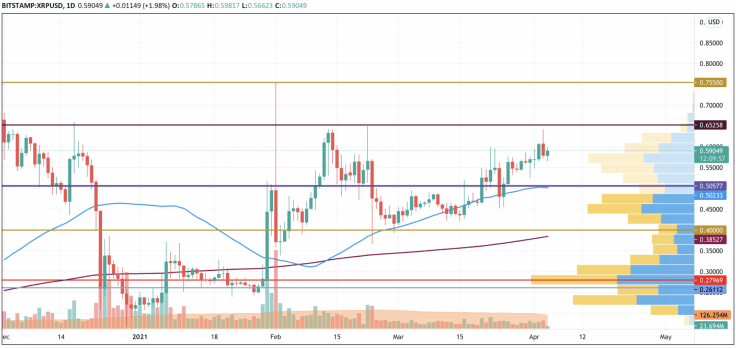

XRP/USD

XRP is the top loser today as its rate has gone down by 4.37%.

XRP/USD chart by TradingView

Despite the decline, the long-term trend remains bullish. Buyers' dominance will become more visible when XRP fixes above $0.652. In this case, the next level of $0.75 may be attained within the next few days.

XRP is trading at $0.5892 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.