Can Bitcoin (BTC) push the rates of other altcoins deeper?

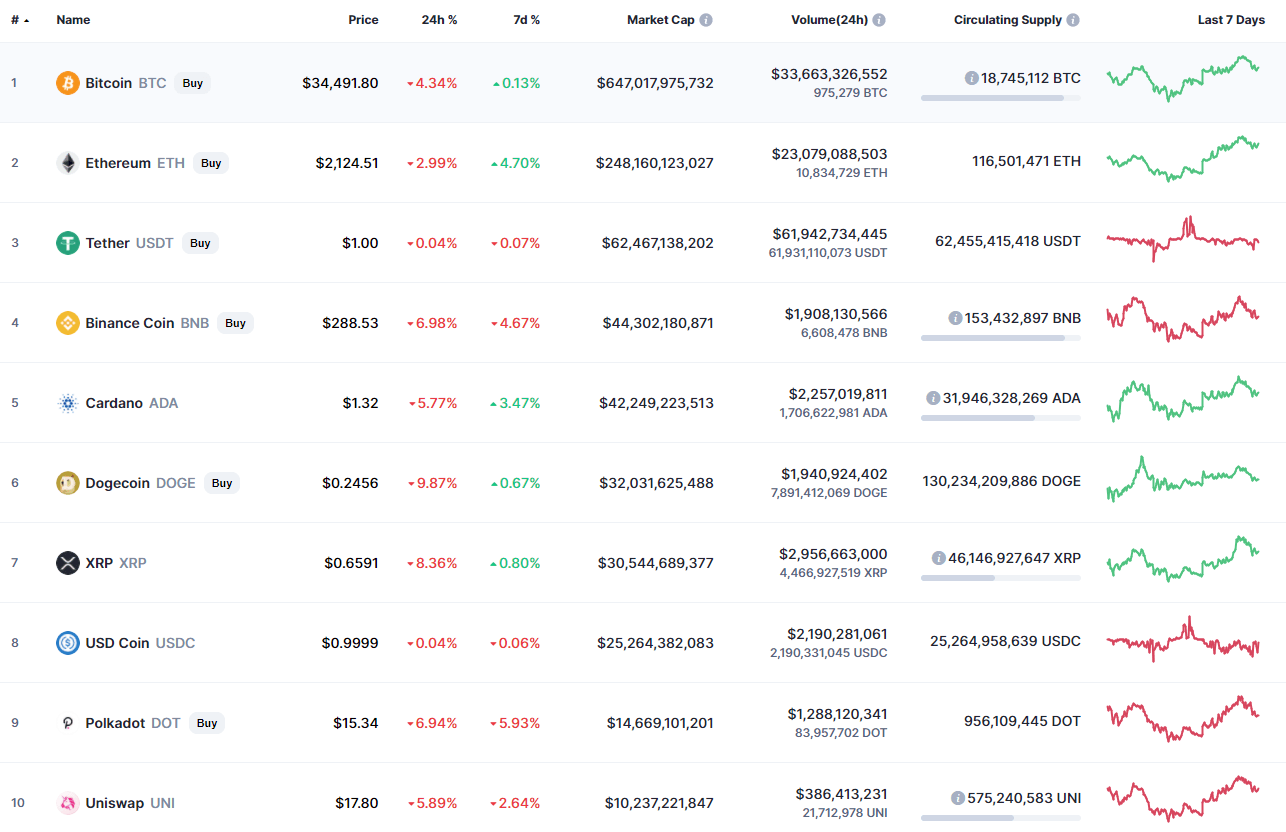

Bulls could not keep the growth and bears seized the initiative. Respectively, all top 10 coins are in the red zone.

Top coins by CoinMarketCap

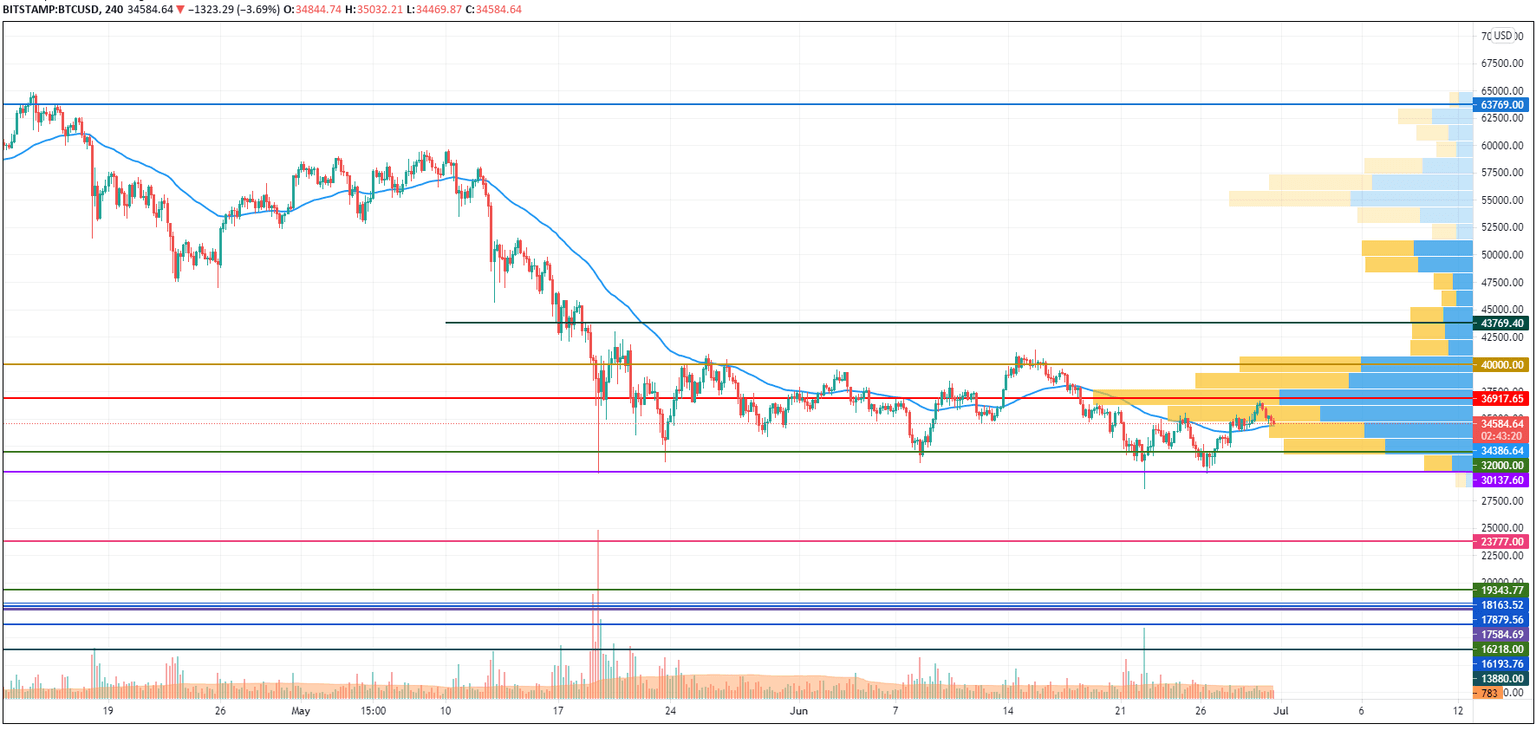

BTC/USD

Yesterday morning, the four-hour EMA55 kept the price from falling and allowed buyers to break through the upper border of the short sideways corridor at $35,000.

BTC/USD chart by TradingView

In the afternoon, the bulls overcame the lilac resistance of $36,000 and tried to gain a foothold above it. At the end of the day, the price marked a daily high around the $36,624mark, and at night sellers returned the Bitcoin (BTC) price below $36,000.

Bears' pressure increased this morning and the pair pulled back even deeper. In the near future, the BTC price might return to the upper side of the range at around 35,000. One believes that today, it will be able to play the role of support and stop today's rollback, and at the end of the day the bulls can try to test the target level of $37,150.

Bitcoin is trading at $34,624 at press time.

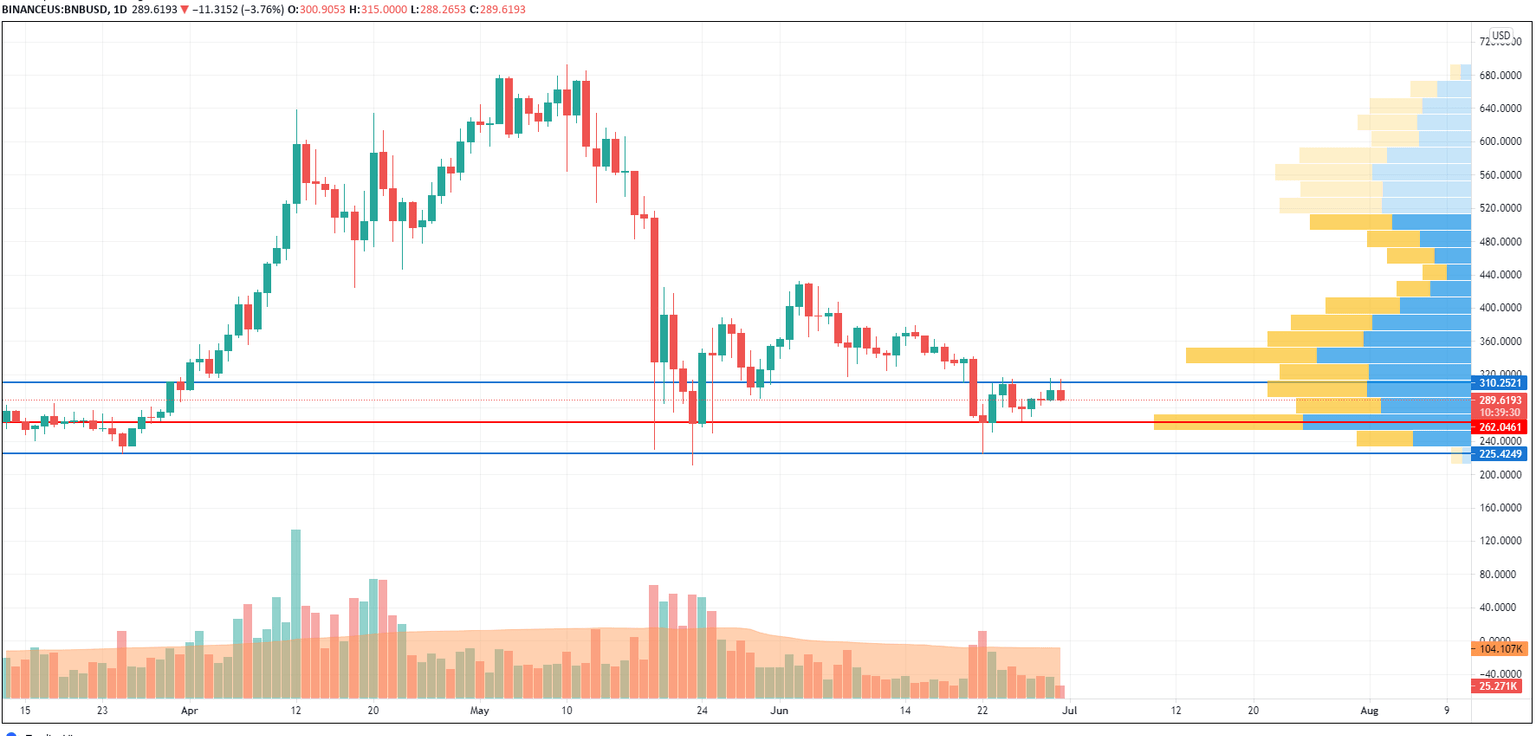

BNB/USD

Binance Coin (BNB) could not keep the growth, having gone down by almost 7%.

BNB/USD chart byTradingView

Binance Coin (BNB) made a false breakout of the resistance at $310 which means that bears are not giving up and keep pushing the rate of the native exchange coin deeper. In this case, the more likely price action is the test of the liquidity zone around $260 until the end of the week.

BNB is trading at $289 at press time.

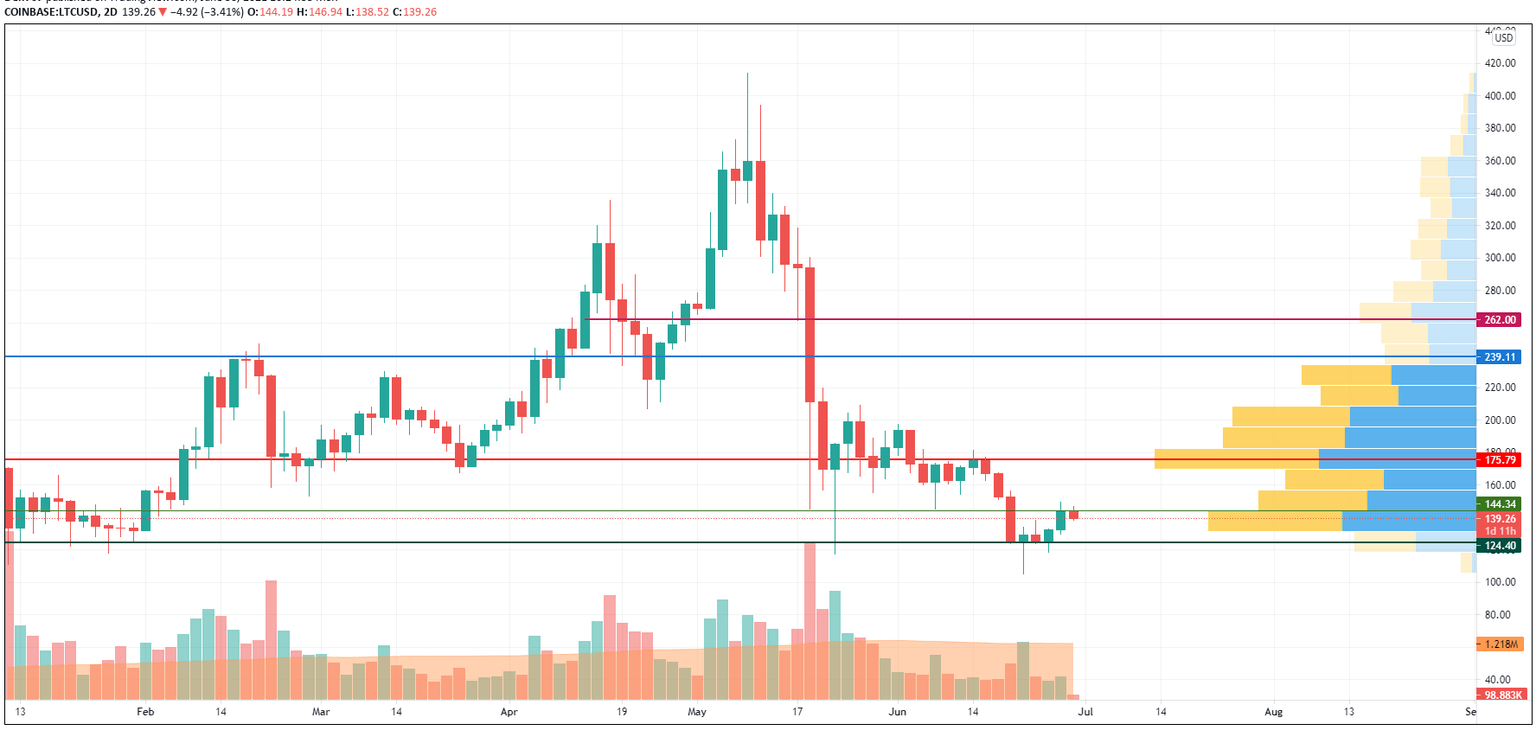

LTC/USD

Litecoin (BTC) is less bearish than Binance Coin (BNB) as its rate has declined by 4% over the last day.

LTC/USD chart by TradingView

Despite the decline, Litecoin (LTC) is trying to fix near the resistance at $144. If bulls manage to do it and the daily candle closes around the $140 mark, the 'digital silver' may get to the next vital zone at $175 soon.

Litecoin is trading at $139.37 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.